Emerging technologies are redefining the digital universe and are becoming a business imperative for companies worldwide. National Association of Software and Services Companies (NASSCOM) and Boston Consultancy Group (BCG) released a report titled “Sandboxing into the Future: Decoding Technology’s Biggest Bets” on the sidelines of NASTech 2022 in Bengaluru. The report aims to uncover and develop perspectives on big-bet technologies that can potentially disrupt markets in the next 3-5 years.

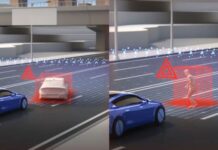

Enterprise Tech spending is estimated to reach $4.2 Tn by 2026 globally, amongst which Tech Services companies represent the largest segment and are expected to become $1.7 Tn by 2026 with a CAGR of 8.1%. As part of the study, 28 emerging technology themes from 11 tech families were identified – across markets and verticals – with the potential to disrupt markets, basis current tech spending, growth potential, innovation maturity, and funding momentum. Amongst these 12 emerging technologies, with high funding momentum and R&D focus, have emerged as the “Biggest Bets,” including, Autonomous analytics, AR & VR, Autonomous Driving, Computer Vision, Deep learning, Distributed Ledger, Edge Computing, Sensor Tech, Smart Robots, Space Tech, Sustainability Tech, and 5G/6G.

As the need for focused use cases emerge and multiple technologies converge to drive disruption, these 12 technologies will unravel in diverse ways, giving way to regional and vertical-specific big bets. While buyers in North America and Europe are betting on technologies such as Autonomous Analytics, APAC is likely to focus more on 5G/6G technologies, Sensor Tech and Smart Robotics. Overall, technology buyers anticipate that investments in emerging technologies will account for 70- 80% of their tech spending by 2030.

Within APAC, India has the highest private tech funding growth at 31% compared to overall APAC at 11%. Healthcare and Transportation have emerged as top funded verticals, followed by Tech, BFSI, and Telecom.

NASSCOM also did a survey of over 120 technology buyers and interviewed over 30 Indian tech providers (CEOs/Leaders from Indian Tech companies) to gauge their priorities across key technologies. As per the survey responses, tech buyers expect the share of emerging tech to grow by 3X in next 4-6 years, driven by higher efficiency, enhanced customer experience, and accelerated product development cycle. Interestingly key technologies such as Autonomous Analytics, Edge Computing, 5G/6G & Deep Learning have emerged as top 5 business priorities for tech buyers. However, for technology providers, supplier priorities differ across technologies and regions. Large firms are diversifying their bets by focusing both on technologies with established use cases(5G/6G), and investing in nascent technologies to gain leadership position (Deep learning and Computer Vision), whereas mid-size firms and digital firms are selective on big bets, either focusing on few emerging areas or going deep in select technologies.

Alignment of tech buyers and providers will create the dynamics in adoption as investments and technologies mature over time. This will also build a spectrum of opportunities for buyers as well as providers across the maturity curve, and in specific regions and verticals. “Emerging technologies have evolved as the nucleus for businesses across segments. It has helped them navigate through the unprecedented challenges of the digital era while allowing them to achieve a competitive advantage”, said Debjani Ghosh, President, NASSCOM. “Going forward, it will be interesting to see how businesses will put their bets on emerging technologies and how they would betaking ahead the tech revolution for the larger good of the society.”

Glimpsing into the new era

To continue to thrive and succeed tech firms need to reassess their current positioning and define a winning strategy. Firms need to act fast as cracking the right strategy can lead to windfall gains, but delayed action can prove detrimental to growth. Focusing on defining where and how to prioritize resources and acquisitions to speed access and close capability gaps, building critical capabilities to support future direction, and debottleneck constraints will ensue firms to realize the largest potential of these technologies in the future.