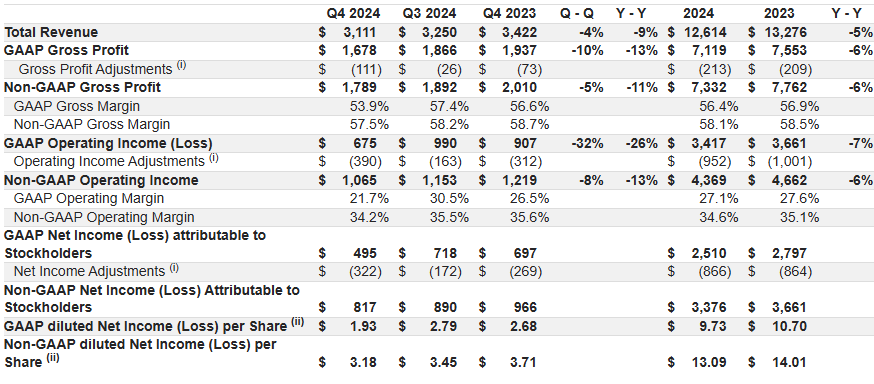

NXP Semiconductors, reported financial results for the fourth quarter and full-year, which ended December 31, 2024. “NXP delivered full-year 2024 revenue of $12.61 billion, a decrease of 5 percent year-on-year. In the fourth quarter, revenue was $3.11 billion, a decrease of 9 percent year-on-year, modestly above the mid-point of our guidance range. In review, NXP delivered resilient results throughout 2024, reflecting solid execution, consistent gross margin, and healthy free cash flow generation despite a challenging market environment. We rigorously focus on managing what is in our control, to navigate a soft landing while executing our growth strategy,” said Kurt Sievers, NXP President and Chief Executive Officer.

Key Highlights for the Fourth Quarter and Full-year 2024:

- Fourth quarter revenue was $3.11 billion, down 9 percent year-on-year. Full-year revenue was 12.61 billion, down 5 percent year-on-year;

- Fourth quarter GAAP gross margin was 53.9 percent, GAAP operating margin was 21.7 percent and GAAP diluted Net Income per Share was $1.93. Full year GAAP gross margin was 56.4 percent, GAAP operating margin was 27.1 percent and GAAP diluted Net Income per Share was $9.73;

- Fourth quarter Non-GAAP gross margin was 57.5 percent, non-GAAP operating margin was 34.2 percent, and non-GAAP diluted Net Income per Share was $3.18. Full-year Non-GAAP gross margin was 58.1 percent, non-GAAP operating margin was 34.6 percent, and non-GAAP diluted Net Income per Share was $13.09;

- Fourth quarter cash flow from operations was $391 million, with net capex investments of $99 million, resulting in non-GAAP free cash flow of $292 million. Full-year cash flow from operations was $2,782 million, with net capex investments of $693 million, resulting in non-GAAP free cash flow of $2,089 million;

- During the fourth quarter of 2024, NXP continued to execute its capital return policy with the payment of $258 million in cash dividends, and the repurchase of $455 million of its common shares. The total capital return of $713 million in the quarter represented 244 percent of fourth quarter non-GAAP free cash flow. On a trailing twelve month basis, capital return to shareholders represented $2.4 billion or 115 percent of non-GAAP free cash flow. The interim dividend for the fourth quarter 2024 was paid in cash on January 8, 2025 to shareholders of record as of December 5, 2024. Subsequent to the end of the fourth quarter, between January 1, 2025 and January 31, 2025, NXP executed via a 10b5-1 program additional share repurchases totaling $101 million;

- On October 15, 2024, NXP introduced the S32J family of high-performance automotive Ethernet switches and network controllers to enable the next generation of software-defined vehicle development (SDV). The S32J family shares a common switch core with the NXP S32 portfolio of automotive processing devices to maximize software re-use and simplify network configuration and integration;

- On October 23, 2024, NXP announced Audi has adopted the Trimension NCJ29Dx Ultra Wide Band (UWB) product family in its advanced UWB platform delivering precise and secure real-time localization to enable hands-free secure car access via smart mobile device and other UWB-based features. Cars featuring NXP’s Trimension UWB devices, including the Audi Q6 e-tron, will hit the road in 2024;

- On November 12, 2024, NXP announced the i.MX 94 family, the newest addition to its i.MX 9 series of applications processors, designed for industrial control, telematics, gateways, and building and energy control. The i.MX94 family includes Ethernet Time Sensitive Networking (TSN) switching capabilities;

- On November 12, 2024, NXP announced industry-first wireless battery management system (BMS) based on Ultra-Wideband (UWB) connectivity, expanding its “FlexCom” family of wired and wireless BMS solutions. The new UWB-based BMS solutions enable increased battery energy density, decoupling the mechanical and electrical development for faster time to market;

- On December 17, 2024, NXP announced it had entered into an definitive agreement to acquire Aviva Links, a provider of Automotive SerDes Alliance (ASA) compliant in-vehicle connectivity solutions in an all-cash transaction valued at $242.5 million. The acquisition of Aviva Links expands NXP’s market leading in-vehicle networking (IVN) portfolio with the industry’s most advanced ASA compliant portfolio, supporting SerDes point-to-point (ASA-ML) and Ethernet-based connectivity (ASA-MLE) with data rates up to 16 Gbps;

- On January 7, 2025, NXP announced it had entered into an definitive agreement to acquire TT Tech Auto, a leader in safety-critical systems and middleware for software-defined vehicles (SDVs). The all-cash transaction is valued at $625 million, and accelerates the NXP CoreRide platform, enabling automakers to reduce complexity, maximize system performance and shorten time to market. TT Tech Auto’s MotionWise middleware platform has a proven industry track record and is designed to manage the interconnected systems in SDVs, prioritizing safety-critical functions while ensuring seamless integration.

Summary of Reported Fourth Quarter and Full-year 2024 ($ millions, unaudited) (1)

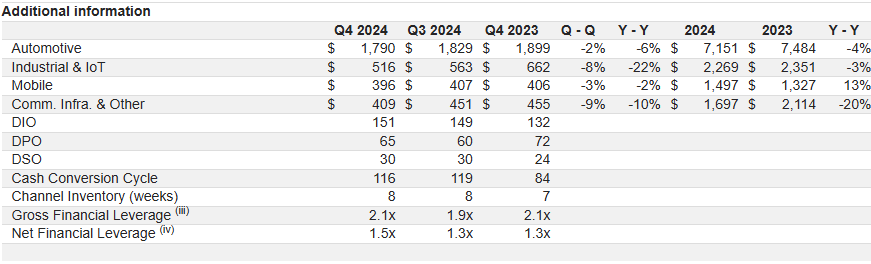

- Additional Information for the Fourth Quarter and Full-year 2024:

- For an explanation of GAAP to non-GAAP adjustments, please see “Non-GAAP Financial Measures”.

- Refer to Table 1 below for the weighted average number of diluted shares for the presented periods.

- Gross financial leverage is defined as gross debt divided by trailing twelve months adjusted EBITDA.

- Net financial leverage is defined as net debt divided by trailing twelve months adjusted EBITDA.

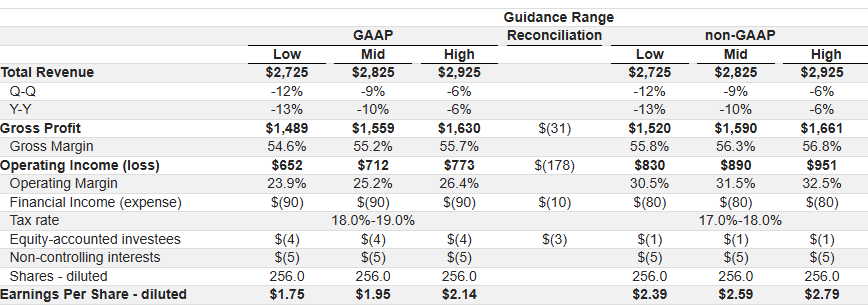

Guidance for the First Quarter 2025: ($ millions, except Per Share data) (1)

Note (1) Additional Information:

- GAAP Gross Profit is expected to include Purchase Price Accounting (“PPA”) effects, $(7) million; Share-based Compensation, $(16) million; Other Incidentals, $(8) million;

- GAAP Operating Income (loss) is expected to include PPA effects, $(35) million; Share-based Compensation, $(128) million; Restructuring and Other Incidentals, $(15) million;

- GAAP Financial Income (expense) is expected to include Other financial expense $(10) million;

- GAAP Results relating to equity-accounted investees is expected to include results relating to non-foundry equity-accounted investees $(3) million;

- GAAP diluted EPS is expected to include the adjustments noted above for PPA effects, Share-based Compensation, Restructuring and Other Incidentals in GAAP Operating Income (loss), the adjustment for Other financial expense, the adjustment for Non-controlling interests & Other and the adjustment on Tax due to the earlier mentioned adjustments.

NXP has based the guidance included in this release on judgments and estimates that management believes are reasonable given its assessment of historical trends and other information reasonably available as of the date of this release. Please note, the guidance included in this release consists of predictions only, and is subject to a wide range of known and unknown risks and uncertainties, many of which are beyond NXP’s control. The guidance included in this release should not be regarded as representations by NXP that the estimated results will be achieved. Actual results may vary materially from the guidance we provide today. In relation to the use of non-GAAP financial information see the note regarding “Non-GAAP Financial Measures” below. For the factors, risks, and uncertainties to which judgments, estimates and forward-looking statements generally are subject see the note regarding “Forward-looking Statements.” We undertake no obligation to publicly update or revise any forward-looking statements, including the guidance set forth herein, to reflect future events or circumstances.

Non-GAAP Financial Measures

In managing NXP’s business on a consolidated basis, management develops an annual operating plan, which is approved by our Board of Directors, using non-GAAP financial measures, that are not in accordance with, nor an alternative to, U.S. generally accepted accounting principles (“GAAP”). In measuring performance against this plan, management considers the actual or potential impacts on these non-GAAP financial measures from actions taken to reduce costs with the goal of increasing our gross margin and operating margin and when assessing appropriate levels of research and development efforts. In addition, management relies upon these non-GAAP financial measures when making decisions about product spending, administrative budgets, and other operating expenses. We believe that these non-GAAP financial measures, when coupled with the GAAP results and the reconciliations to corresponding GAAP financial measures, provide a more complete understanding of the Company’s results of operations and the factors and trends affecting NXP’s business. We believe that they enable investors to perform additional comparisons of our operating results, to assess our liquidity and capital position and to analyze financial performance excluding the effect of expenses unrelated to core operating performance, certain non-cash expenses and share-based compensation expense, which may obscure trends in NXP’s underlying performance. This information also enables investors to compare financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management.

These non-GAAP financial measures are provided in addition to, and not as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. The presentation of these and other similar items in NXP’s non-GAAP financial results should not be interpreted as implying that these items are non-recurring, infrequent, or unusual. Reconciliations of these non-GAAP measures to the most comparable measures calculated in accordance with GAAP are provided in the financial statements portion of this release in a schedule entitled “Financial Reconciliation of GAAP to non-GAAP Results (unaudited).” Please refer to the NXP Historic Financial Model file found on the Financial Information page of the Investor Relations section of our website at https://investors.nxp.com for additional information related to our rationale for using these non-GAAP financial measures, as well as the impact of these measures on the presentation of NXP’s operations.

In addition to providing financial information on a basis consistent with GAAP, NXP also provides the following selected financial measures on a non-GAAP basis: (i) Gross profit, (ii) Gross margin, (iii) Research and development, (iv) Selling, general and administrative, (v) Amortization of acquisition-related intangible assets, (vi) Other income, (vii) Operating income (loss), (viii) Operating margin, (ix) Financial Income (expense), (x) Income tax benefit (provision), (xi) Results relating to non-foundry equity-accounted investees, (xii) Net income (loss) attributable to stockholders, (xiii) Earnings per Share – Diluted, (xiv) EBITDA, adjusted EBITDA and trailing 12 month adjusted EBITDA, and (xv) free cash flow, trailing 12 month free cash flow and trailing 12 month free cash flow as a percent of Revenue. The non-GAAP information excludes, where applicable, the amortization of acquisition related intangible assets, the purchase accounting effect on inventory and property, plant and equipment, merger related costs (including integration costs), certain items related to divestitures, share-based compensation expense, restructuring and asset impairment charges, extinguishment of debt, foreign exchange gains and losses, income tax effect on adjustments described above and results from non-foundry equity-accounted investments.

The difference in the benefit (provision) for income taxes between our GAAP and non-GAAP results relates to the income tax effects of the GAAP to non-GAAP adjustments that we make and the income tax effect of any discrete items that occur in the interim period. Discrete items primarily relate to unexpected tax events that may occur as these amounts cannot be forecasted (e.g., the impact of changes in tax law and/or rates, changes in estimates or resolved tax audits relating to prior year tax provisions, the excess or deficit tax effects on share-based compensation, etc.).

Conference Call and Webcast Information

The company will host a conference call with the financial community on Tuesday, February 4, 2025 at 8:00 a.m. U.S. Eastern Standard Time (EST) to review the fourth quarter 2024 results in detail.

The call will be webcast and can be accessed from the NXP Investor Relations website at www.nxp.com. A replay of the call will be available on the NXP Investor Relations website within 24 hours of the actual call.