The global marine sensors market size was valued at USD 35.81 billion in 2024 and is expected to hit around USD 59.45 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

The global marine sensors market is projected to grow significantly, with estimates indicating an increase from USD 35.81 billion in 2024 to approximately USD 59.45 billion by 2034, reflecting a compound annual growth rate (CAGR) of around 5.5%. This growth is driven by heightened maritime activities, advancements in sensor technologies, and the expanding use of autonomous underwater vehicles (AUVs) and unmanned underwater vehicles (UUVs).

Asia Pacific is anticipated to lead the market, supported by substantial investments in naval defense and commercial shipping sectors. Key applications of marine sensors include navigation, communication, and environmental monitoring. However, challenges such as high development costs and stringent regulatory frameworks may impact market expansion.

Marine Sensors Market Key Takeaways

- Asia Pacific dominated the global marine sensors market with the largest market share of 46% in 2024.

- North America is observed to grow at the fastest rate during the forecast period.

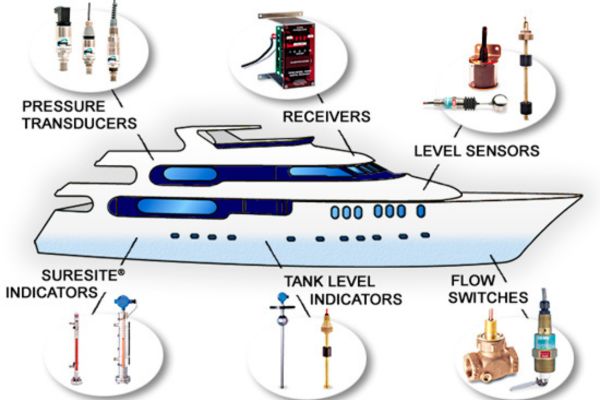

- By type, the flow and level sensors segment dominated the market share in 2024.

- By type, the acoustic sensors segment is expected to grow significantly during the forecast period.

- By platform, the military defense segment dominated the market in 2024.

- By platform, the commercial segment is expected to grow at the fastest rate during the forecast period.

- By application, the surveillance and monitoring segment dominated the market in 2024.

- By application, the communication and navigation segment is expected to grow at the fastest rate during the forecast period.

Impacts of Artificial Intelligence on Marine Sensors Market

ChatGPT said:

Artificial intelligence (AI) is revolutionizing the marine sensors market by enhancing data collection, processing, and real-time decision-making. AI-powered marine sensors improve accuracy in underwater navigation, environmental monitoring, and threat detection for naval defense. Machine learning algorithms enable predictive maintenance, reducing operational downtime and costs for maritime industries.

AI also enhances autonomous underwater vehicles (AUVs) and unmanned surface vehicles (USVs) by enabling adaptive learning for complex ocean environments. Additionally, AI-driven analytics optimize resource exploration, aiding in efficient offshore oil and gas extraction. Despite its benefits, challenges such as high implementation costs and cybersecurity threats remain concerns for the industry.

Regional Outlook of Marine Sensors Market

The regional outlook of the marine sensors market highlights significant growth across key geographical areas:

- North America dominates the market due to strong investments in naval defense, autonomous maritime technologies, and environmental monitoring initiatives. The U.S. Navy’s modernization efforts and advancements in underwater robotics further boost demand.

- Europe follows closely, driven by increasing research in oceanography, offshore energy exploration, and stringent environmental regulations. Countries like the UK, Germany, and France invest heavily in marine sensor technology for commercial and defense applications.

- Asia Pacific is expected to witness the fastest growth, fueled by expanding naval fleets, rising maritime trade, and increasing government investments in marine surveillance. Countries like China, Japan, and India are major contributors to regional market expansion.

- Latin America sees steady growth, mainly due to increasing offshore oil and gas exploration, particularly in Brazil and Mexico. Investments in oceanographic research and fisheries management also drive demand.

- Middle East & Africa experience gradual market expansion, supported by rising investments in offshore energy projects and marine security initiatives. The growing importance of maritime trade routes in the region contributes to the adoption of advanced marine sensors.

| Report Coverage | Details |

| Market Size by 2034 | USD 59.45 Billion |

| Market Size in 2025 | USD 37.67 Billion |

| Market Size in 2024 | USD 35.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Marine Sensors Market Report Coverage

Market Dynamics of Marine Sensors Market

Drivers

The marine sensors market is driven by the increasing adoption of sensors in fisheries and aquaculture. These sensors provide real-time data on essential environmental parameters like water quality, oxygen levels, salinity, and temperature, ensuring optimal conditions for marine life. In aquaculture, sensors help maintain precise control over the environment, promoting healthy fish growth. Additionally, fisheries management relies on sensors such as acoustic devices and underwater cameras to monitor fish populations and ensure sustainable resource management.

Restraint

Sensor interference poses a significant challenge to the marine sensors market. Inaccurate readings can severely impact critical applications, leading to operational inefficiencies, costly downtimes, and production delays. Industries like automotive and aviation, which depend on sensor reliability, face heightened risks, including potential safety hazards. Frequent troubleshooting and maintenance due to interference further decrease system reliability and increase operational expenses, limiting market growth.

Opportunity

Remote sensing technologies offer substantial growth opportunities in the marine sensors market. These technologies play a crucial role in environmental monitoring, wildlife conservation, and natural resource management. Early detection of environmental changes allows for proactive decision-making in habitat preservation and resource management. Remote sensing is also valuable in urban planning, agriculture, and forestry, helping optimize water management, track urban expansion, and assess forest health.

By Type Insights

Flow and level sensors dominated the marine sensors market in 2024, driven by their essential role in marine fleets. These sensors are widely used for monitoring gas or liquid flow rates, optimizing energy consumption, and enhancing ship efficiency. Advanced ballast water management systems also rely on flow and level sensors to maintain stable and reliable operations.

The acoustic sensors segment is expected to experience the fastest growth, attributed to its advantages in maritime navigation and environmental monitoring. Acoustic sensors help detect underwater sound waves, analyze hazards, and reduce noise pollution. They play a crucial role in improving maritime safety, protecting marine life, and enabling real-time data collection for effective decision-making.

By Platform Insights

The military defense sector led the marine sensors market in 2024, driven by the increasing adoption of technology-based sensors in naval applications. Military ships, submarines, and vessels utilize advanced sensor systems, including radar, infrared imaging, RF triangulation, and perimeter intrusion detection systems (PIDS), to enhance situational awareness and threat detection.

The commercial sector is anticipated to grow at the fastest rate, fueled by the rising use of marine transportation and commercial vessels. Sensors in commercial ships are essential for monitoring inclination, acceleration, flow rates, temperature, and pressure, significantly improving vessel reliability and performance.

By Application Insights

Surveillance and monitoring emerged as the dominant segment in 2024, supported by advancements in intelligence and reconnaissance sensors. These sensors enhance maritime security by analyzing potential threats, detecting undersea objects, and improving autonomous vessel operations with AI integration.

The communication and navigation segment is projected to grow rapidly, driven by advancements in semiconductor technology, particularly in indium phosphide and gallium arsenide. Wide-bandwidth marine sensors improve object detection and targeting, playing a vital role in ensuring safe and efficient navigation in maritime environments.

Marine Sensors Market Companies

- BAE System Plc. (U.K.)

- Garmin Ltd. (U.S.)

- Gill Instruments (India)

- Honeywell International Inc. (U.S.)

- Lockheed Martine Inc. (U.S.)

- NRG System Inc. (U.S.)

- Raytheon Company (U.S.)

- SAAB AB (Sweden)

- Thales Group (France)

Recent Developments in Marine Sensors Market

The marine sensors market has experienced notable developments recently:

Market Growth and Projections

The global marine sensors market is on an upward trajectory. In February 2025, reports indicated that the market is projected to grow from USD 1.4 billion in 2023 to USD 1.9 billion by 2028, reflecting a compound annual growth rate (CAGR) of 6.5%. This growth is driven by increasing demand for unmanned underwater vehicles (UUVs) and autonomous underwater vehicles (AUVs), alongside advancements in maritime transportation and naval technologies.

Technological Innovations

Teledyne Marine announced plans to unveil new products at Ocean Business 2025, including advanced sensors and an evolution of the Workhorse Acoustic Doppler Current Profiler (ADCP). These innovations aim to enhance underwater data collection and analysis capabilities.

Additionally, the integration of artificial intelligence (AI) into marine sensors is transforming the industry. AI enables real-time data analysis, predictive maintenance, and improved operational efficiency, thereby enhancing safety and environmental protection in maritime operations.

Strategic Investments

In December 2024, Lightsmith Group led a $20 million investment in Parsyl, a marine insurer that utilizes sensor data to monitor temperature-sensitive sea shipments. This funding underscores the growing importance of data-driven solutions in managing maritime risks.

Defense Applications

The U.S. Navy is exploring the development of robotic crawlers equipped with sensors to detect and neutralize underwater mines. These autonomous devices aim to improve safety and efficiency in mine-clearing operations, highlighting the critical role of sensor technology in defense strategies.

These developments reflect the dynamic nature of the marine sensors market, characterized by technological advancements, strategic investments, and expanding applications across various sectors.

Segments Covered in the Report

By Type

- Acoustic Sensors

- Magnetic Sensors

- Sonars

- Pressure Sensors

- Temperature Sensors

- Flow and Level Sensors

- Others (Magnetometer, Infrared Sensors, Seismic Sensors)

By Platform

- Military and Defense

- Commercial

By Application

- Intelligence and Reconnaissance

- Communication and Navigation

- Electronic Warfare

- Target Recognition

- Surveillance and Monitoring

- Others (Combat Operations and Command and Control)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa