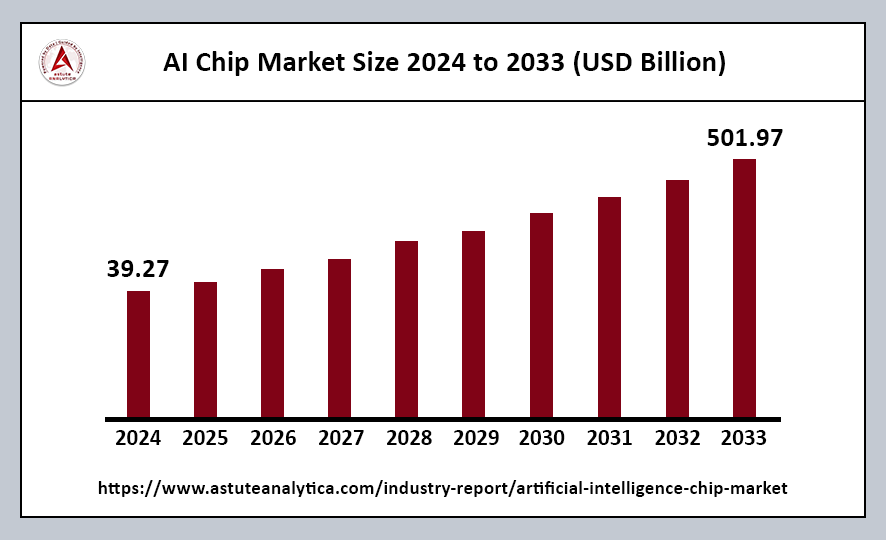

The global AI chip market was valued at US$ 39.27 billion in 2024 and is projected to reach a market valuation of US$ 501.97 billion by 2033. This growth represents a CAGR of 35.50% during the forecast period from 2025 to 2033.

AI chips are specialized semiconductors designed to accelerate artificial intelligence tasks, particularly those involving large-scale matrix operations and parallel processing, such as training and running AI models. The global revenue from AI semiconductors is projected to reach $71 billion in 2024, a 33% increase from 2023. This growth is fueled by the ongoing global AI renaissance, which began last year and has significantly boosted market expansion, leading to impressive valuations in the coming years.

The demand for these devices is expected to skyrocket in the years ahead. While Nvidia currently dominates the AI chip industry with a commanding 80% market share, both large corporations and smaller businesses are actively seeking alternatives to diversify their AI chip options. This surge in demand for AI chips has also created substantial opportunities for venture capital investors, who have invested tens of billions of dollars into startups in this space.

Artificial Intelligence (AI) Chip Market Key Takeaways

- By Type, GPUs have emerged as the most prominent type of AI chip in the market, commanding over 30% of the share.

- In terms of technology, System-on-Chip (SoC) technology has secured over 35% of the AI chip market.

- By industry, the IT and telecommunications sector has emerged as the largest consumer of AI chips, accounting for over 30% of the market’s revenue.

- Currently, computer vision holds a significant position in the market, commanding over 38% of the AI chip market share.

Regional Analysis

North America: The Dominant Force in the AI Chip Market

North America dominates the AI chip market with over 40% market share, propelled by the presence of leading tech companies and a robust innovation ecosystem. The United States alone contributes over 80% of the region’s revenue, with industry giants such as Nvidia, Intel, and AMD leading the charge. The growing adoption of AI across various industries is significantly driving the demand for AI chips in North America.

The strong ecosystem of technology companies, research institutions, and venture capital firms creates a solid foundation for the innovation and adoption of AI chipsets. Furthermore, the widespread acceptance of AI-powered applications in sectors such as healthcare, finance, and automotive has further fueled the demand for high-performance AI chipsets.

Europe’s Notable Market Share

In 2024, Europe held a notable share of the global AI chip market. The region’s highly developed automotive and industrial sectors have significantly contributed to the demand for AI chipsets, particularly in areas like autonomous vehicles, smart manufacturing, and predictive maintenance. Europe’s commitment to AI adoption is underscored by initiatives such as the European Union’s AI Strategy, which aims to promote AI development and deployment across the region. Additionally, innovative applications of AI within the broadcasting and entertainment sectors have opened up new opportunities in this region.

Asia Pacific: The Fastest Growing Market

The Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. This growth is attributed to the rapid digital transformation and technological advancements in countries such as China, Japan, South Korea, and India. The region’s increasing demand for AI-powered applications—from smart cities to autonomous vehicles and industrial automation—has spurred the adoption of high-performance AI chipsets. Additionally, software companies in this region are actively collaborating with prominent AI solution providers to enhance their AI capabilities, further driving market growth.

Top Trends Escalating the Artificial Intelligence (AI) Chip Market

Shift Towards Specialized AI Chips: There is a notable shift towards specialized AI chips optimized specifically for generative AI workloads. By tailoring the architecture and functionality of these chips to suit generative tasks, companies can achieve faster processing times and improved performance, making them essential for applications in creative fields, content generation, and more.

Increasing Adoption of Neuromorphic Computing: The increasing adoption of neuromorphic computing is another significant trend in the AI chip market. This approach not only enhances the capabilities of AI systems in learning and adaptation but also allows for more energy-efficient processing. As research progresses, the potential of neuromorphic computing to revolutionize AI applications becomes increasingly apparent.

Rising Demand for Energy-Efficient AI Chips: The demand for energy-efficient AI chips is rising, particularly in data center applications. As organizations strive to reduce their carbon footprints and operating costs, energy efficiency has become a top priority. AI chips that consume less power while delivering high performance are increasingly sought after, allowing data centers to manage workloads more sustainably.

Proliferation of AI-Driven Autonomous Vehicles: The proliferation of AI-driven autonomous vehicles is another area driving demand for advanced AI chips. These vehicles require real-time data processing to interpret their surroundings, make decisions, and navigate safely. As this sector continues to grow, the need for high-performance chips tailored for real-time analysis will expand.

Expansion of Generative AI Models: The expansion of generative AI models is leading to a growing requirement for specialized high-performance chips. As these models become more complex and widely adopted across various industries—including art, music, and content production—the need for chips that can efficiently support their training and execution becomes essential.

Growth in Edge Computing Devices: There is a marked growth in edge computing devices, such as smartphones and Internet of Things (IoT) devices, that require AI chips. As more devices become connected and capable of performing AI tasks locally, the demand for efficient AI chips that can operate in constrained environments is increasing.

Artificial Intelligence (AI) Chip Market Segmentation

By Type

GPUs have emerged as the most prominent type of AI chip in the market. Their dominance can be attributed to their unparalleled parallel processing capabilities, which are crucial for training and running complex AI models. The global demand for GPUs has surged in recent years, driven by the exponential growth in AI applications. As organizations increasingly leverage AI technologies across various sectors, the reliance on GPUs for efficient and effective processing has become more pronounced. This trend solidifies GPUs’ position as a key player in the AI chip landscape.

By Technology

System-on-Chip (SoC) technology has captured over 35% of the AI chip market, thanks to its unique ability to integrate multiple components into a single chip. This integration not only reduces power consumption but also significantly enhances efficiency. SoCs are especially well-suited for edge AI applications, where the requirements for compactness and low power usage are critical. By consolidating various functionalities into one chip, SoCs enable more effective processing in environments where space and energy are limited, making them a preferred choice for many AI-driven applications.

By Industry

The IT and telecommunications industry has emerged as the largest consumer of the AI chip market. This trend is largely driven by the increasing adoption of AI technologies in key areas such as network optimization, cybersecurity, and customer service. As telecom operators seek to enhance their operations, they are deploying AI-powered solutions to manage over 1 billion connected devices worldwide.

This significant demand translates to the need for over 500,000 AI chips annually in the telecommunications sector. Additionally, the rollout of 5G networks has further fueled the demand for AI chips, as these networks require advanced AI algorithms for real-time data processing. This combination of factors positions the IT and telecommunications industry at the forefront of AI chip consumption.

By Application

The Natural Language Processing (NLP) segment is poised for rapid growth at the fastest CAGR in the coming years. This expansion is primarily driven by the rapid adoption of generative AI models such as GPT and BERT. These advanced models demand massive computational resources, with the training of a single GPT-3 model requiring over 1,000 GPUs and 10,000 CPU hours. Key consumers of AI chips for NLP include tech giants like Google, Microsoft, and OpenAI. These companies are actively deploying these models across various applications, including search engines, virtual assistants, and content-generation tools.

Artificial Intelligence (AI) Chip Market Recent Developments

- Nvidia Unveils AI Superchips: In March 2025, Nvidia CEO Jensen Huang unveiled a fresh line of AI superchips at the company’s annual GTC conference, held in San Jose, California. These chips are specifically designed for building and running artificial intelligence (AI) models.

- Malaysia’s AI and Semiconductor Collaboration: In March 2025, Prime Minister Datuk Seri Anwar Ibrahim launched a groundbreaking collaboration with the United Kingdom’s Arm Holdings. This partnership is set to transform Malaysia’s artificial intelligence (AI) and semiconductor sector.

- Meta Tests In-House AI Chip: In March 2025, Meta, the owner of Facebook, began testing its first in-house chip for training artificial intelligence systems. This represents a key milestone as the company seeks to design more of its custom silicon and reduce reliance on external suppliers like Nvidia.

- India’s AI Chip Development: In February 2025, the Ministry of Electronics and Information Technology (MeitY) partnered with the Centre for Development of Advanced Computing (C-DAC) and the National e-Governance Division to develop an AI chip. This chip will be built using the open-source RISC-V (Reduced Instruction Set Computer) architecture, allowing for a customizable processor core.

- Amazon’s Next Generation AI Chip: In November 2024, Amazon reportedly prepared to launch its next generation of artificial intelligence (AI) chip – Trainium 2. This initiative aims to reduce the company’s reliance on industry leader Nvidia.

Top Companies in the AI Chips Market

- AMD

- TSMC

- IBM

- NVIDIA

- Microsoft

- Intel

- Huawei

- Qualcomm

- AWS

- Other Prominent Players

Market Segmentation Overview:

By Chip Type

- GPU

- ASIC

- FPGA

- CPU

- Others

By Technology

- System-on-Chip (SoC)

- System-in-Package (SiP)

- Multi-Chip Module (MCM)

- Others

By Application

- Natural Language Processing (NLP)

- Computer Vision

- Robotics

- Network Security

- Others

By Industry

- Healthcare

- Automotive

- Consumer Electronics

- Retail and E-commerce

- BFSI

- IT and Telecommunication

- Government and Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/artificial-intelligence-chip-market