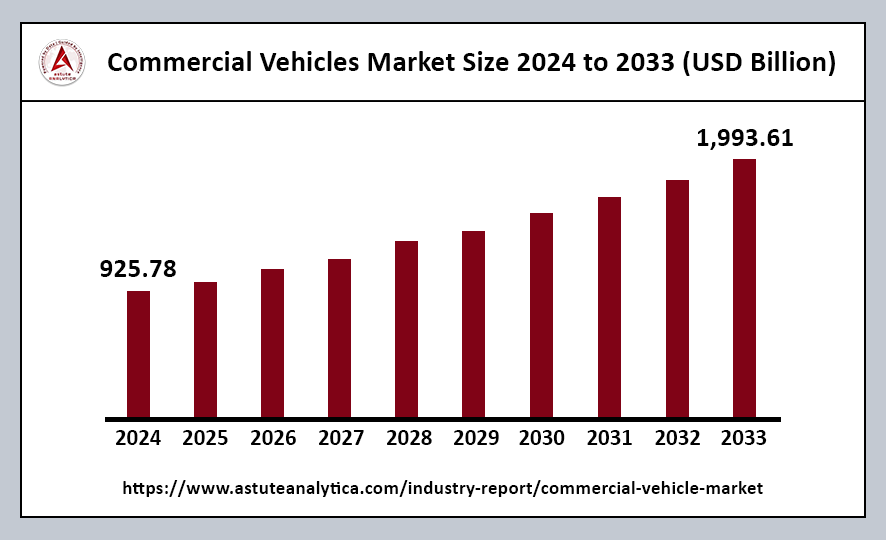

The global commercial vehicles market was valued at US$ 925.78 billion in 2024 and is projected to reach US$ 1,993.61 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 9.20% during the forecast period from 2025 to 2033.

Commercial vehicles are specifically designed motor vehicles used for transporting goods, passengers, or services that generate income. Their popularity is on the rise, particularly in India, driven by several key factors including infrastructure development, the expansion of e-commerce, and supportive government initiatives.

In 2024, the commercial vehicles market demonstrated remarkable resilience and growth, with global sales of medium and heavy commercial vehicles reaching approximately 3.3 million units. This growth is significantly fueled by government initiatives aimed at constructing highways and expressways, which, in turn, boost the demand for Light Commercial Vehicles (LCVs).

Additionally, initiatives like “Make in India” are attracting foreign investments and enhancing domestic manufacturing capabilities. These efforts not only support the growth of the commercial vehicle sector but also contribute to the overall economic development of the region, positioning India as a key player in the global commercial vehicle market.

Commercial Vehicles Market Key Takeaways

- Light Commercial Vehicles (LCVs) account for a substantial 55% of global commercial vehicle sales.

- In terms of end-users, logistics applications drive over 28% of commercial vehicle usage.

- Internal Combustion Engine (ICE) vehicles retain an impressive 83% share of commercial vehicle sales.

Regional Analysis

North America Control Over 45% Market Share

North America holds a commanding over 45% market share in the commercial vehicles sector, with the United States serving as the cornerstone of this dominance.

- Collaborative Efforts Among North American Nations: The market dominance of North America is underpinned by the collaborative efforts of the United States, Canada, and Mexico. Each country plays a crucial role in the region’s commercial vehicle ecosystem, creating a cohesive network that supports trade and logistics. This cooperation enhances the efficiency of supply chains and contributes to the overall growth of the commercial vehicle market.

- E-Commerce Boom Driving Demand: The booming e-commerce sector is a significant growth driver in the North America commercial vehicle market. In 2022, e-commerce sales in the United States reached an impressive $1.03 trillion, leading to a heightened demand for last-mile delivery vehicles.

- Investments in Infrastructure Development: Aggressive investments in infrastructural development across North America have played a vital role in supporting the growth of the commercial vehicle market. These developments not only facilitate trade but also enhance the overall competitiveness of the region’s commercial vehicle market.

- Favorable Government Support: Favorable government support has been instrumental in driving the growth of the North America commercial vehicles market. Policies that promote investment in infrastructure, encourage the adoption of clean technologies, and support the automotive industry create an environment conducive to growth.

Overview of the Asia Pacific Regional Market

The Asia Pacific regional market is poised for significant growth during the forecast period, driven by an increasing demand for transportation, warehousing, and unified logistics solutions.

- Strengthening Road Infrastructure: One of the key factors contributing to the growth of the Asia Pacific market is the strengthening of road infrastructure. Governments across the region are investing heavily in the development and maintenance of transport networks, which facilitate smoother and more efficient movement of goods.

- Availability of Cost-Effective Labor and Raw Materials: The easy availability of cost-effective labor and raw materials in Asia Pacific is another significant contributor to market growth. Countries like China and India offer a vast workforce that is often more affordable compared to other regions. This cost advantage allows businesses to operate more efficiently and competitively, making it an attractive destination for local and foreign investments.

- Rising Number of Manufacturing Facilities: The rising number of manufacturing facilities, particularly in developing economies such as China and India, plays a crucial role in the expansion of the Asia Pacific regional market. This increase in manufacturing capacity requires robust logistics and warehousing solutions to ensure timely and efficient distribution of goods. As a result, the growth of manufacturing facilities is directly linked to the need for enhanced logistics infrastructure.

Top Trends Escalating the Commercial Vehicles Market

Increased Adoption of Electric Vehicles: The shift towards electric vehicles (EVs) is gaining momentum in commercial transportation, driven by the increasing need for zero-emission solutions. This trend is further supported by government incentives and regulations aimed at reducing carbon footprints. As more companies commit to sustainability goals, the adoption of electric commercial vehicles is expected to accelerate, reshaping the transportation landscape.

Growth of Omnichannel Sales Integrating Offline and Online Channels: The rise of omnichannel sales strategies is transforming how businesses approach their customers. This approach allows businesses to reach a broader audience, enhance customer engagement, and improve sales efficiency.

Rise of Autonomous Vehicles and Self-Driving Technologies in Commercial Fleets: The emergence of autonomous vehicles and self-driving technologies is revolutionizing commercial fleets. As technology continues to advance, more companies are exploring the potential of integrating autonomous vehicles into their operations. This shift has the potential to streamline logistics and transportation processes and address the growing demand for innovative solutions in the commercial sector.

E-Commerce Expansion Driving Demand for Efficient Logistics and Delivery Solutions: The rapid expansion of e-commerce has significantly increased the demand for efficient logistics and delivery solutions. With consumers expecting quick and reliable delivery options, businesses are forced to adapt their supply chains to meet these heightened expectations. This demand has spurred innovation in logistics, with companies investing in technologies that enhance tracking, optimize delivery routes, and improve overall efficiency.

Urbanization Necessitating Enhanced Commercial Transportation Infrastructure in Growing Cities: Urbanization is driving a need for enhanced commercial transportation infrastructure in rapidly growing cities. Investments in public transport, road expansions, and smart city technologies are essential to ensure that urban areas can support sustainable commercial transportation while meeting the needs of their residents.

Technological Advancements in Electric and Autonomous Vehicle Technologies: Rapid technological advancements in electric and autonomous vehicle technologies are reshaping the transportation landscape. Simultaneously, advancements in artificial intelligence and machine learning are enhancing the capabilities of autonomous vehicles, and improving navigation, and safety features. These breakthroughs not only provide businesses with more efficient transportation options but also contribute to the overall evolution of the automotive industry.

Commercial Vehicles Market Segmentation

By Vehicle Type

Light Commercial Vehicles (LCVs) account for a significant 55% share of the total commercial vehicles market worldwide. This strong presence is largely attributed to their adaptability and cost-effectiveness in meeting ever-changing transportation demands.

LCVs include various vehicle types such as passenger vans, cargo vans, pickup trucks, light trucks, and minibuses. These vehicles are designed to accommodate payload capacities of up to 3.5 tons, making them versatile options for businesses and consumers. Their ability to efficiently handle several tasks has solidified their importance in the global transportation landscape.

By Propulsion Type

By 2025, Internal Combustion Engine (ICE) vehicles are projected to maintain a 75% share of overall commercial vehicle sales. This enduring dominance reflects their deep-rooted advantages in established infrastructure, cost-effectiveness, and global familiarity.

The widespread availability of fueling stations in the commercial vehicles market, along with a mature parts supply chain and extensive maintenance services, significantly benefits operators. These factors are crucial for those who require reliable, long-haul solutions, reinforcing the continued reliance on ICE vehicles in the industry. As a result, despite the growing interest in alternative fuel options, ICE vehicles remain a cornerstone of commercial transportation.

By End Use

Logistics applications account for over 28% of commercial vehicle utilization. The swift rise of online shopping has been a major catalyst in this growth, significantly intensifying the demand for last-mile delivery services. These services are essential for meeting consumer expectations for prompt order fulfillment.

Urban centers have particularly benefited from this trend, witnessing notable growth in the use of smaller, more versatile vehicles. These vehicles are designed to deftly maneuver through congested streets while maintaining the short delivery windows that customers now expect. As a result, the logistics sector continues to evolve, adapting to the changing landscape of consumer behavior and technological advancements.

Recent Developments in the Commercial Vehicles Market

- Isuzu’s Export Success: In April 2025, Isuzu emerged as the top exporter of commercial vehicles from India for the fiscal year 2024-25. The company’s exports grew by 24%, increasing from 16,329 units in FY2023-24 to 20,312 units in FY2024-25.

- Renault’s Electric LCV Launch: In April 2025, Renault is set to launch three electric light commercial vehicles (LCVs) at the Commercial Vehicle Show 2025. These vehicles will be the first to feature the flexible, scalable architecture developed by Ampere around the Software Defined Vehicle (SDV) concept.

- Stellantis’ Collaboration for Electric Conversion: In April 2025, Stellantis Pro One, the business unit dedicated to commercial vehicles, confirmed its collaboration with Qinomic, a French high-tech company. This partnership focuses on creating innovative and sustainable mobility solutions and has announced a retrofit system that transforms light commercial vehicles (LCVs) with combustion engines into electric vehicles.

- Jupiter Electric Mobility’s New Launch: In March 2025, Jupiter Electric Mobility (JEM), the electric vehicle arm of the Jupiter Group, launched its first electric light commercial vehicle, the JEM TEZ. This endeavor was supported by major original equipment manufacturers (OEMs) like Tata Motors and Volvo.

- EKA Mobility’s Comprehensive Range: In January 2025, EKA Mobility launched a comprehensive range of electric commercial vehicles at the Bharat Mobility Auto Expo 2025. The initiative aims to position India as a mobility hub in the global landscape by providing a unified platform for the entire ecosystem.

Top Companies in the Commercial Vehicle Market

- Ashok Leyland

- Bosch Rexroth AG

- Daimler

- Volkswagen AG

- Toyota Motor Corporation

- Mahindra and Mahindra

- TATA Motors

- AB Volvo

- Scania AB

- General Motors

- Ford Motor Company

- Other Prominent Players

Market Segmentation Overview

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicles (EVs)

- Hybrid

By End Use

- Industrial

- Mining & Construction

- Logistics

- Public Transportation

- Retail & E-Commerce

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/commercial-vehicle-market