The global automotive AI market size is forecasted to reach around USD 44.76 billion by 2034 and is growing at a CAGR of 25.74% from 2025 to 2034.

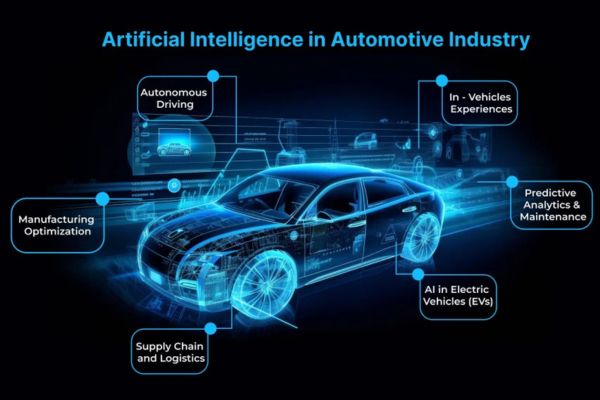

The integration of artificial intelligence (AI) into the automotive industry is driving a revolutionary shift. AI is enabling companies to better monitor operations, refine strategies, develop autonomous and semi-autonomous technologies, and enhance overall digital performance. This rapid transformation is being powered by the rising demand for self-driving vehicles, AI-enabled traffic management, next-gen automotive solutions, and favorable government policies.

Autonomous driving technology is one of the key growth engines of the automotive AI market. AI systems enable real-time decision-making for vehicles, greatly enhancing safety and operational efficiency. As consumer interest in self-driving cars grows and regulatory frameworks become more supportive, investments in AI for autonomous vehicles are accelerating. This is fueling innovation and broad adoption across the sector. Additionally, many governments are actively encouraging the use of AI in the automotive space through incentives, funding, and policy initiatives. These efforts are pushing automakers to adopt AI solutions that align with evolving safety and emissions standards.

AI is also central to the digital transformation of the automotive value chain—from manufacturing to sales. In production, AI improves quality control and operational efficiency, while in sales and customer service, it enhances engagement and satisfaction. Major investments in AI R&D, along with collaborations between automakers and tech firms, are driving the creation of AI-powered solutions specifically designed for the automotive industry.

Key Takeaways

- North America has accounted for a revenue share of 39.1% in 2024.

- Europe has captured revenue share of 28.3% in 2024.

- By level of autonomy, Level 2 segment has held revenue share of 62% in 2024.

- By vehicle type, passenger vehicles segment has generated revenue share of 85.7% in 2024.

- By component, hardware segment has registered revenue share of 76.4% in 2024.

- By technology, machine learning segment has recorded revenue share of 38% in 2024.

Automotive AI Market Dynamics

Driver: Growing Demand for Enhanced User Experience and Convenience

The push for smarter, more personalized driving experiences is reshaping vehicle design. Human-machine interface (HMI) technologies have made vehicle systems more intuitive, allowing users to easily control entertainment, lighting, and climate systems.

Electronics, once a minor cost component, now account for 8–12% of total vehicle cost—up from just 1–2%—due to the surge in demand for advanced features. Modern cars are increasingly equipped with AI-powered driver assistance systems that monitor driver fatigue and adapt in real time. These systems can learn a driver’s habits, preferences, and destinations to create a highly customized and comfortable driving experience. Automotive manufacturers are partnering with software firms to deliver this next level of user personalization.

Restraint: High Vehicle Costs

The cost of integrating advanced autonomous features remains a significant challenge. Many of these technologies are currently only available in premium vehicles due to their high price, limiting their accessibility to a broader market.

As autonomous and semi-autonomous features like lane assist, adaptive cruise control, and forward collision warnings become more common, they drive up overall vehicle costs. While this is manageable for high-end models, it presents a barrier for small and mid-sized car buyers. Furthermore, autonomous systems require supportive infrastructure, such as clearly marked lanes, which adds to the overall cost of implementation.

To remain competitive, automakers are striving to offer affordable safety features across all vehicle segments, but cost pressures could slow down the mass adoption of AI technologies in the automotive space.

Opportunity: The Rise of In-Car Payments

In-car payment technology is emerging as a major opportunity. It allows drivers to seamlessly pay for fuel, tolls, parking, and even groceries from within their vehicle.

With the rise of Open Banking and enhanced security protocols, in-car wallets can offer frictionless, direct-from-bank payments—eliminating the need for third-party processors. These systems enhance user experience and reduce transaction fees. Fuel, tolls, and parking are currently the most common use cases for in-car payments.

Adoption is gaining traction in markets like Germany, the UK, and France. AI-driven voice assistants and natural language processing are playing a key role in enabling these services. Major players such as Visa and Mastercard are actively collaborating with automakers to bring in-car payment features to life. For instance, Hyundai partnered with Xevo in 2019 to create a telematics platform with integrated digital payments.

Challenge: Weather-Related Sensor Limitations

Unfavorable weather remains a significant hurdle for autonomous vehicles. These cars rely on an array of sensors—cameras, radar, lidar—to detect and respond to their environment.

Adverse conditions like rain, fog, or snow can impair sensor accuracy, affecting the vehicle’s ability to make safe decisions. Since these sensors feed crucial data to the car’s control system, poor visibility can compromise safety.

While ongoing advancements in sensor technology aim to mitigate these issues, fully autonomous driving in all weather conditions is still a work in progress. Nevertheless, the long-term vision remains clear: AI-powered driving will increase road safety, reduce environmental impact, and improve traffic efficiency—ultimately transforming how we travel.

Automotive Artificial Intelligence (AI) Market Segmental Analysis

GPU to Dominate the Automotive AI Market

Throughout the forecast period, Graphics Processing Units (GPUs) are expected to hold the largest share of the automotive artificial intelligence (AI) market. As autonomous driving and advanced driver assistance systems (ADAS) continue to evolve, the role of GPUs becomes increasingly critical.

GPUs are essential for real-time processing and analysis of complex sensor data, a key requirement for ADAS platforms. They also power the sophisticated visual displays found in modern vehicles—supporting multiple high-resolution screens for navigation, environmental data, and infotainment. In mid-range vehicles, 1080p displays are now standard, while luxury models are beginning to incorporate 4K displays, further driving GPU adoption.

Human-Machine Interface (HMI) Leading in AI Application

The Human-Machine Interface (HMI) segment is projected to hold the largest share among AI applications in the automotive sector. HMIs enable seamless interaction between passengers and the vehicle, offering convenience, entertainment, and critical driving information.

Core HMI components include electromechanical devices such as keypads, indicators, and alarms, but the most transformative features lie in infotainment systems. These include speech and gesture recognition, eye tracking, driver monitoring, and natural language processing capabilities. OEMs are increasingly incorporating advanced HMI systems to offer a more intuitive, personalized experience and to differentiate their brand.

The evolution of smart cars—from concept to commercial reality—is making features like autonomous braking, adaptive cruise control, and self-parking more commonplace. Demand for sophisticated HMI systems is especially strong in developed regions, where consumers favor long-distance travel in private vehicles and benefit from advanced road infrastructure.

Machine Learning: A Key Pillar of Automotive AI

Machine learning holds the second-largest share in the automotive AI market. It enables vehicles to interpret and learn from diverse driving environments, enhancing safety, reducing accidents, and improving overall efficiency.

From supervised and unsupervised learning to deep learning and reinforcement learning, machine learning methods are critical in extracting actionable insights from massive and fast-changing datasets typical of the automotive sector. These technologies help develop predictive models that inform decision-making, optimize vehicle performance, and support smarter automation.

North America to Lead the Global Automotive AI Market

North America is projected to be the leading contributor to the global automotive AI market through 2034. The region is experiencing steady growth due to rapid advancements in autonomous vehicle technologies and stringent government regulations promoting road safety.

With a high concentration of leading tech companies and automotive manufacturers, North America benefits from early access and adoption of cutting-edge AI innovations. The U.S. government’s support through incentives and funding is also accelerating AI development.

The American automotive landscape is dominated by industry giants like Ford, General Motors, and Fiat-Chrysler, all of which are heavily investing in AI to enhance vehicle features. U.S. vehicles commonly include advanced systems such as adaptive cruise control, lane departure warnings, gesture and voice recognition, and blind spot detection—highlighting the region’s readiness for AI integration.Get more details research@ https://www.cervicornconsulting.com/sample/2327