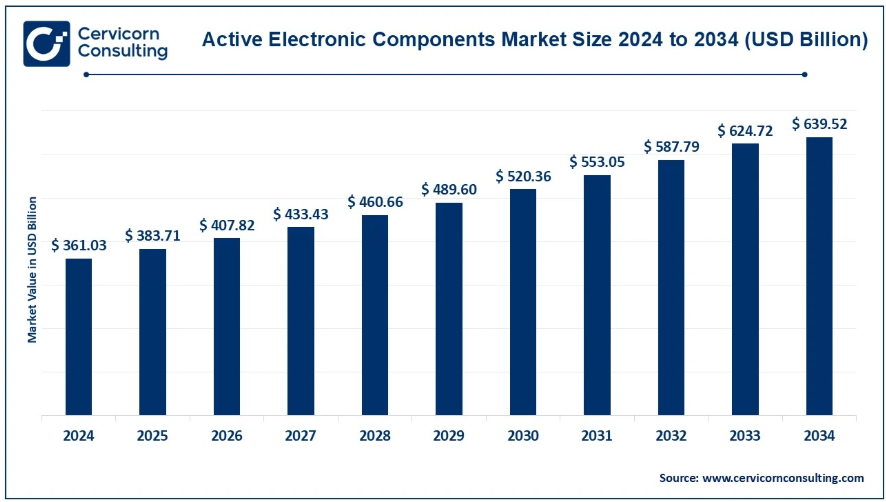

According to Cervicorn Consulting, the global active electronic components market size was valued at USD 361.03 billion in 2024 and is projected to exceed around USD 639.52 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.28% from 2025 to 2034.

Active electronic components control the flow of electricity and are integral to every type of printed circuit board (PCB). These components include diodes like Schottky diodes, LEDs, Zener diodes, and photodiodes; generators such as DC generators and alternators; and a range of transistors like FETs, JFETs, bipolar junction transistors, and MOSFETs, as well as voltage and current sources.

The increasing prevalence of connected devices, which require numerous active electronic components, coupled with the growing demand across various sectors, is fueling the expansion of the active electronics market. This surge is further driven by active component manufacturers seeking to develop innovative products and solutions to meet new market demands.

The convergence of connected devices such as smartphones, tablets, TVs, gaming consoles, smart appliances, security systems, and smart meters has led to several advancements in electronic components. This trend is expected to drive increased demand for IoT electrical components. Many of these connected devices, which can run for extended periods—months or even years—without the need for maintenance, require energy-efficient IoT end-node applications. The decline in the cost of components like processors and sensors, combined with the rise of wireless communication, has facilitated the development of smart devices capable of interacting autonomously.

In the automotive industry, technology is rapidly advancing, integrating more automotive electrical components. While fully autonomous vehicles are still on the horizon, cars are becoming increasingly complex with the integration of electrification, networking, AI sensors, and integrated software. Today, conventional combustion engine cars contain between 2,000 and 3,000 capacitors, a number that is expected to grow as more vehicle services become electrified. As automotive components become more sophisticated, they also become more expensive due to liability concerns and longer warranties.

To appeal to a broader customer base, global automotive manufacturers are focusing on incorporating cutting-edge electronics and technologies into their vehicles. The rise of premium and ultra-luxury cars is also driving the adoption of active electronic components within the automotive sector. A notable example of this is NXP Semiconductors’ partnership with Hon Hai Technology Group in July 2022 to create platforms for next-generation smart, connected vehicles. Hon Hai aims to leverage NXP’s automotive technology portfolio and expertise in safety and security to drive innovations in electrification, connectivity, and autonomous driving, further boosting demand for active components in the automotive industry.

Market Overview:

- The U.S. active electronic components market was valued at USD 56.36 billion in 2024 and is projected to reach USD 99.83 billion by 2034.

- The Asia-Pacific region is expected to capture 55.60% of the market share by 2024.

- North America holds a 22.30% market share in 2024.

- The semiconductor devices segment accounted for 58.20% of the revenue share in 2024.

- The consumer electronics sector represented 30.80% of the revenue share in 2024.

Uses of active electronic components in various sectors:

| Sector | Use of Active Electronic Components |

| Consumer Electronics | – Power regulation in devices like smartphones, tablets, TVs, and laptops. – Signal processing in audio and video equipment. – Voltage and current regulation in power supplies. |

| Automotive Industry | – Power management in electric and hybrid vehicles. – Control of infotainment and navigation systems. – Autonomous driving technologies (sensors, cameras, and communication systems). – Integration of AI, electrification, and safety features. |

| Telecommunications | – Signal amplification and modulation in communication devices. – Power regulation in network equipment. – Energy-efficient components for wireless communication (5G). |

| Industrial Electronics | – Automation and control systems. – Power regulation in manufacturing equipment. – Signal conditioning and processing for sensors and actuators. |

| Aerospace and Defense | – Power control in avionics and satellite systems. – Signal processing for radar, communication, and navigation systems. – High-reliability components for mission-critical systems. |

The rising usage of diodes will boost the market growth

Increasing Demand for Diodes

Diodes, which facilitate one-way electrical signal transmission in circuits, are widely used in electronic devices. Due to their energy efficiency—losing less power as current passes through—they are ideal for low-current applications. With the growth of electronic devices, the demand for signal diodes is rising. According to the Federal Reserve, industrial production of home electronics increased by 15.2% between January 2022 and January 2023, signaling further growth in the electronics and appliance industry. As demand for electronic devices rises, so does the need for signal diodes, supporting market growth for active components.

Increasing demand in the automobile industry will boost market growth

The automotive industry is increasingly incorporating electronics and technology to appeal to customers. The rise in luxury and high-end vehicles boosts the use of active components in this sector. For example, in July 2022, NXP Semiconductors and Hon Hai Technology Group announced a partnership to develop platforms for smart connected luxury cars. By utilizing NXP’s technology in electrification, connectivity, and autonomous driving, this partnership is expected to drive demand for electronic components. According to the International Organization of Motor Vehicle Manufacturers (OICA), global motor vehicle production increased by 6% from 2021 to 2022, further elevating the need for active components in vehicles.

Asia Pacific region is expected to dominate the market

The Asia-Pacific region is projected to dominate the active electronic components market during the forecast period. This is primarily driven by the booming electronics industries in countries like China and India. For instance, China’s electronics manufacturers experienced a 12.7% year-over-year growth in early 2022, outpacing the overall industrial sector. The region’s rapid rollout of 5G networks, IoT applications, and the increasing adoption of electric vehicles (EVs) will further fuel demand for active electronic components. Data from the IEA shows that the number of electric vehicles registered in China nearly tripled from 2020 to 2021, indicating substantial growth in the EV sector and boosting the market for active electronic components.

Get more details@ https://www.cervicornconsulting.com/active-electronic-components-market