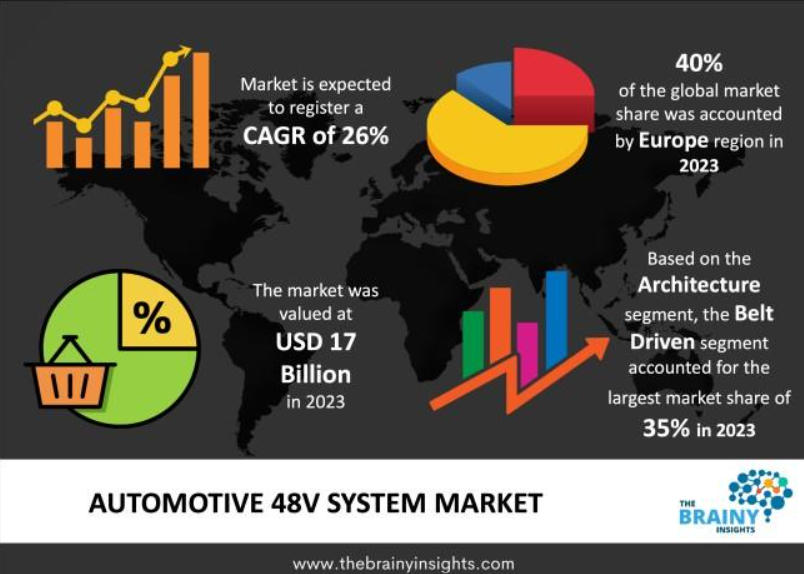

The Brainy Insights estimates that the global automotive 48V system market, valued at USD 17 billion in 2023, will reach USD 171.45 billion by 2033. The 48V system was developed as an enhanced electrical platform added over the traditional 12V electrical system to meet the growing power demands of modern vehicles. While 12V circuits were initially used, their limitations became evident with the introduction of high-power devices such as electric turbochargers, advanced media systems, electric steering, and regenerative braking. The 48V system provides increased power, efficiency, and safety while minimizing wiring weight and cost. It typically includes a 48V battery, a DC/DC converter, and an electric motor, making it ideal for applications like start/stop systems, electric superchargers, and mild hybrid operations. By enabling regenerative braking and boosting power when needed, this system enhances fuel efficiency, reduces CO2 emissions, and improves driving dynamics while reducing strain on the 12V battery and wiring for increased reliability.

Key Insights of the Global Automotive 48V System Market

Market Dominance: Europe

Europe is expected to lead the market during the forecast period due to its well-established automotive industry, stringent CO2 regulations, and early adoption of hybrid systems. European automakers increasingly rely on 48V mild hybrid technology as a cost-effective solution to meet emission standards. Government incentives, tax breaks, and subsidies further drive the adoption of 48V-integrated mild hybrid vehicles. Additionally, the region continues to expand its 48V system infrastructure and electric and hybrid vehicle charging networks.

Segment Analysis

- By Architecture: In 2023, the belt-driven segment dominated the market with a 35% share, generating USD 5.95 billion in revenue.

- By Vehicle Type: Passenger cars held the largest market share of 56%, accounting for USD 9.52 billion in revenue.

- By Vehicle Class: The mid-segment led with a 38% market share, amounting to USD 6.46 billion in revenue.

Market Developments

The recently launched Audi Q5, built on the Premium Platform Combustion (PPC) platform, features partially electrified combustion engines with 48V mild hybrid technology. The vehicle offers a dynamic design, advanced infotainment, and enhanced efficiency, showcasing the growing trend of integrating 48V systems in new models.

Market Dynamics

Drivers: Increasing Electrification of Automobiles

The transition to electric and hybrid vehicles is a key driver of 48V system adoption. As automakers shift from internal combustion engines (ICE) to electric vehicles (EVs) and hybrids, efficient electric architectures become crucial. The 48V system supports hybridization in a cost-effective manner, enhancing fuel efficiency and reducing emissions without requiring high-voltage systems like PHEVs or full EVs. Stricter emission regulations worldwide further propel the demand for 48V systems, as automakers seek compliance through improved fuel economy and low-emission solutions.

Restraints: High Upfront Costs

The integration of 48V systems incurs substantial initial costs due to additional components such as DC/DC converters, electric motors, specialized wiring, and 48V batteries. These components, though more efficient than conventional 12V parts, increase vehicle production costs. This cost burden can be challenging in competitive markets, potentially slowing the adoption of 48V technology.

Opportunities: Technological Advancements

Improvements in 48V system components, such as batteries, DC/DC converters, and motors, are making these systems more compact, reliable, and cost-effective. Enhanced battery efficiency allows for better mild hybrid capabilities, making 48V integration an attractive option for automakers looking to electrify their fleets without the expense of high-voltage systems. Government incentives and favorable policies supporting EV adoption further accelerate market growth.

Challenges: Integration Complexity

Most existing vehicles rely on 12V systems, requiring significant modifications to accommodate 48V architectures. The need for new components like 48V batteries and DC/DC converters increases engineering and development costs. Additionally, limited awareness and acceptance among consumers, coupled with inadequate support infrastructure, hinder widespread adoption. The relative novelty of 48V technology means that maintenance and repair expertise, as well as component supply chains, are not as developed as those for traditional 12V systems.

Key Market Players

- BorgWarner Inc.

- Continental AG

- Delphi Technologies

- East Penn Manufacturing Company

- GS Yuasa International Ltd.

- Hitachi, Ltd.

- Johnson Controls International

- Magna International Inc.

- Robert Bosch GmbH

- Schaeffler AG

- Valeo

- ZF Friedrichshafen AG

Market Segmentation

By Architecture:

- Belt Driven

- Crankshaft Mounted

- Transmission Output Shaft

- Dual Clutch Transmission Mounted

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

By Vehicle Class:

- Entry

- Mid

- Premium

- Luxury

By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil, Rest of South America)

- Middle East & Africa (UAE, South Africa, Rest of MEA)

Source: www.thebrainyinsights.com

The global automotive 48V system market is poised for substantial growth, driven by the push for vehicle electrification, regulatory pressures, and continuous advancements in hybrid technology. While challenges such as integration complexity and high initial costs persist, technological improvements and government incentives are expected to create new opportunities for market expansion.