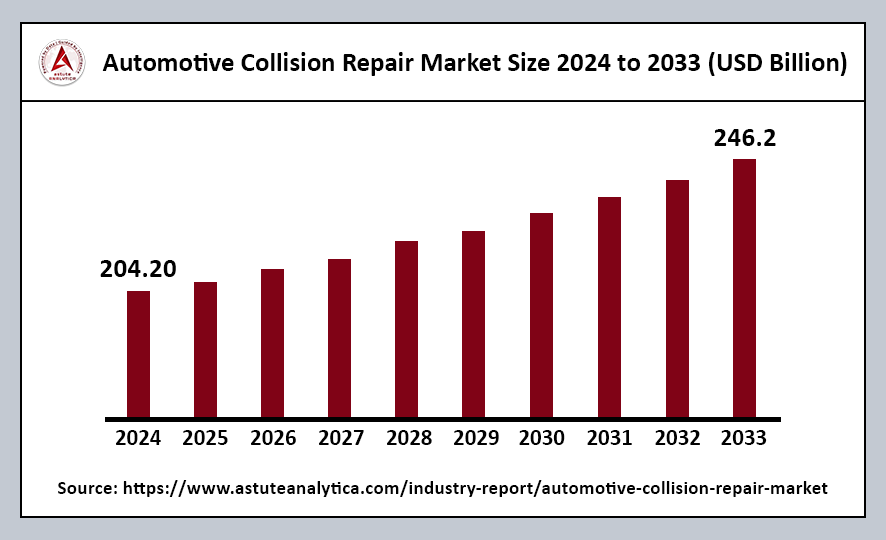

The global automotive collision repair market was valued at US$ 204.20 billion in 2024 and is projected to reach US$ 246.2 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 2.10% during the forecast period from 2025 to 2033.

The automotive collision repair industry is a significant and rapidly growing market, driven by several key factors including increased vehicle ownership, the frequency of traffic accidents, and the complexity of modern vehicles. As more consumers acquire vehicles, the need for repair services rises in tandem, creating a robust demand for collision repair facilities. One notable example of the industry’s breadth is highlighted by the European Road Safety Observatory, which documented 2.8 million structurally damaged vehicles across the continent. This staggering number underscores the extensive amount of collision repair work that is necessary to return vehicles to a safe and operational condition.

Automotive Collision Repair Key Takeaways

- By Product Types, in the automotive collision repair market, spare parts maintain a commanding presence, holding over 65% market share.

- When considering the sales channels within the automotive collision repair market, Original Equipment (OE) components lead with over 56% market share.

- In terms of vehicle type, light vehicles dominate the automotive collision repair market, capturing over 72% market share.

Regional Analysis

Europe’s Dominance in the Automotive Collision Repair Market

Europe stands as the leading region in the automotive collision repair market, commanding over 39% market share. This significant presence can be attributed to several key factors, including dense road networks, high rates of car ownership, and robust insurance coverage.

- Strong Consumer Protection Laws: One of the primary factors propelling Europe to the forefront of the global automotive collision repair market is its robust consumer protection laws. Legislation such as Regulation (EU) 2018/858 mandates high repair standards, ensuring consumers receive quality service and repairs.

- Influence of Local Automakers: Another significant contributor to Europe’s market leadership is the influence of local automakers such as Volkswagen, Renault, and Stellantis. These manufacturers heavily promote the use of Original Equipment (OE) components, which spurs domestic consumption of parts.

- Encouragement of Private Car Ownership: In addition to legislative and industry influences, property norms in countries like Italy and Spain encourage private car ownership over-reliance on mass transit. These societal trends result in increased daily vehicle use, leading to a higher incidence of accidents and, consequently, a greater demand for collision repair services.

Significant Revenue Share in North America

In 2024, North America accounted for a substantial revenue share of the global automotive collision repair market. This strong market presence can be attributed to several factors, including the region’s advanced infrastructure, high vehicle ownership rates, and a growing emphasis on safety and quality in automotive repairs.

- Higher Technology Adoption Rate: One of the primary drivers of North America’s market leadership is its higher technology adoption rate. This rapid technological advancement is facilitating the faster and broader adoption of hybrid electric automobiles compared to other geographical regions. As more consumers opt for these environmentally friendly vehicles, the demand for specialized repair services will inevitably rise.

- Rise of Specialized Automotive Collision Repair Centers: Given the increasing prevalence of hybrid electric vehicles, North America is expected to see a growing proportion of specialized automotive collision repair centers dedicated to servicing specific makes and models, particularly those that are alternative fuel-powered.

- Implications for the Repair Industry: The emergence of specialized repair centers represents a significant shift in the automotive collision repair landscape. As traditional repair shops adapt to accommodate the unique requirements of hybrid and electric vehicles, they will need to invest in specialized equipment and training.

Rapid Growth in the Asia Pacific Region

The Asia Pacific region is anticipated to experience the fastest compound annual growth rate (CAGR) from 2025 to 2033. This growth trajectory is primarily fueled by an increasing number of vehicle sales across the region.

- Impact of Vehicle Sales on Industry Growth: The surge in vehicle sales contributes directly to the growth of the collision repair market. With more vehicles on the road, the likelihood of accidents and subsequent damages increases, creating a higher demand for repair services.

- Challenges of Driving Regulations: An additional factor contributing to the growth of the regional market is the upsurge in vehicular damage due to a lack of stringent driving regulations in many Asia Pacific countries. Inconsistent enforcement of traffic laws and regulations can lead to a higher incidence of accidents, further driving the demand for collision repair services.

- A Hub for Component Supply: The Asia Pacific region is also perceived as a vital source of components for both local companies and multinational corporations. Many businesses aim to supply low-cost components to prominent vehicle manufacturers, capitalizing on the region’s manufacturing capabilities.

Top Trends Escalating the Automotive Collision Repair Market

Expanded In-Shop Calibration Bays: The automotive collision repair industry is witnessing a significant expansion in in-shop calibration bays that support advanced driver-assistance features after a crash. These specialized bays are designed to recalibrate sensors and systems that are crucial for the safe operation of vehicles equipped with advanced technologies.

AI-Driven Damage Assessment Tools: The introduction of AI-driven damage assessment tools is revolutionizing collision repair by accelerating claims and approvals. These advanced tools utilize machine learning algorithms to quickly evaluate the extent of damage and provide accurate estimates for repairs.

Partnerships Between Dealerships and Insurance: There is a growing trend of partnerships between dealerships and insurance companies aimed at creating seamless collision experiences for customers. These collaborations facilitate direct communication and coordination between repair shops and insurers, simplifying the claims process and improving service delivery.

Growing Consumer Awareness: Increasing consumer awareness about the importance of quality automotive collision services is fostering greater demand in the market. As vehicle owners become more informed about the intricacies of collision repairs, they are more likely to seek out shops prioritizing quality and reliability.

Increased Electrified Fleets: The rise of electrified fleets is creating a demand for specialized repairs, particularly in EV battery collision repairs worldwide. As more electric vehicles (EVs) hit the roads, the need for trained technicians and specialized equipment to handle battery-related repairs becomes crucial.

OEM-Backed Certifications: There is a notable shift towards growing user preference for OEM-backed certifications, which is accelerating the adoption of repair standards across the industry. Consumers are increasingly seeking out repair shops certified by manufacturers, as this assures quality and adherence to factory specifications.

Automotive Collision Repair Market Segmentation

By Product Types

Spare parts maintain a commanding presence in the automotive collision repair market, capturing over 65% market share. This dominance is primarily because crash-related damage almost always necessitates component replacements. As vehicles are involved in accidents, the need for spare parts becomes essential for restoring functionality and safety.

Another significant factor contributing to the dominance of spare parts is the surge in advanced driver-assistance systems (ADAS). As these technologies become more prevalent in modern vehicles, the complexity of repairs often increases, leading to a higher demand for specific spare parts designed to support these advanced systems. This trend underscores the critical role that spare parts play in the automotive collision repair landscape.

By Sales Channel

Original Equipment (OE) components lead the automotive collision repair market, holding over 56% market share. Their dominance is largely due to their ability to consistently match factory specifications, which guarantees reliability and a seamless fit for repairs.

This leading position is further fueled by extended service agreements and ongoing brand-backed research within the automotive collision repair market. Such support not only enhances the credibility of OE components but also reinforces their preference among consumers and repair professionals alike.

By Vehicle Type

Light vehicles dominate the automotive collision repair market, capturing over 72% share due to their sheer volume and widespread use in personal transportation. This significant presence is attributed to the fact that these vehicles are commonly owned and driven, making them frequent subjects of collision repairs.

Another reason for the dominance of light vehicles in the automotive collision repair market is their approachable cost and the mainstream availability of parts. This accessibility makes repairs more feasible for vehicle owners, further solidifying light vehicles’ position as the leading category in the collision repair industry.

Recent Developments in the Automotive Collision Repair Market

- Sustainable 3D Printing in Automotive Parts: In April 2025, printed sustainably with 3D additive technology from Auto Additive, these innovative parts are available in Canada through Parts Plex, a Uniparts OEM supplier. The 3D printed material and process meet GM’s GMW18647 worldwide standards, ensuring durability and compatibility for high-quality automotive repairs.

- CARSTAR Academy Launch: In April 2025, CARSTAR announced the founding of CARSTAR Academy, a program designed to raise awareness about opportunities in the collision repair sector. The initiative promotes enrollment in college-level courses through the disbursement of scholarships.

- Kirmac Automotive Expansion: In February 2025, Kirmac Automotive announced the opening of its newest and largest location in Langley, B.C. This brownfield expansion has been transformed into a state-of-the-art collision center.

- Sin City Collision Center Partnership: In February 2025, Sin City Collision Center announced a new community partnership with the Clark County School District (CCSD) Automotive Technology program. This collaboration aims to introduce students to exciting career opportunities in collision repair and the specialized skills required for EV repairs.

Top Players in the Automotive Collision Repair Market

- 3M

- Automotive Technology Products LLC

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Mann+Hummel Group

- Martinrea International Inc.

- Mitsuba Corporation

- Robert Bosch GmbH

- Takata Corporation

- Other Prominent Players

Market Segmentation Overview:

By Product

- Paints & Coatings

- Consumables

- Spare Parts

By Service Channel

- DIFM

- DIY

- OE

By Vehicle Type

- Heavy-duty Vehicle

- Light-duty Vehicle

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/automotive-collision-repair-market