Battery demand for stationary energy storage is set to grow in line with an increasing number of renewable energy resources being added to electricity grids globally. Deployments will also be driven by pressure from governments and states to reach targets pertaining to renewable energy generation and energy storage. An evolving and improving regulatory landscape will also allow energy and battery storage markets to flourish.

Global cumulative stationary battery storage capacity is set to exceed 2 TWh. This will see annual stationary storage deployments grow at a CAGR of 30% from 2023-2033.

Technology trends for stationary battery storage

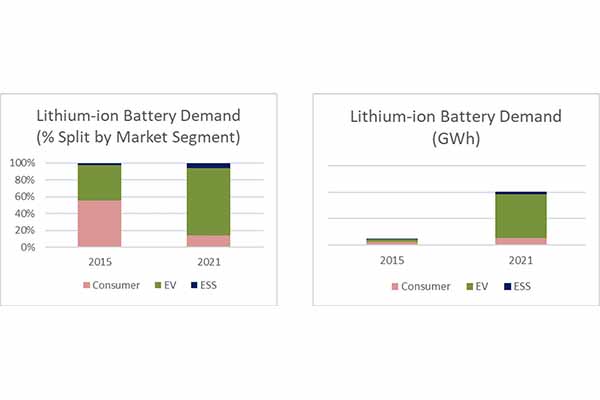

Over the past decade, Li-ion batteries have become an increasingly important stationary energy storage technology. They now account for 90% of global installations of electrochemical energy storage. The main driver for their adoption has been the fast improvement in their performance and reduction in their cost.

LFP and NMC chemistries are the most popular in storage applications, though a shift towards LFP for grid-scale batteries is expected. Reasons for this include lower costs, better safety properties, and higher cycle life of LFP versus NMC. Residential battery suppliers are far more agnostic to battery chemistry choice, as these batteries’ lifetimes are dictated more by consumer use behaviour than their intrinsic properties and chemistry. Regardless, LFP and NMC will continue to reign as the two dominant chemistries in the residential market.

Other analyses/discussions include the latest residential storage market trends, market size (US$), key players with revenues data, etc. supplemented by new primary information from key company interviews. The first company interviewed is BSL Battery, who operate in China, develop, and sell batteries into the solar/residential and low speed vehicle markets. The second company interviewed is E3/DC GmbH, who operate in Germany, develop, and sell battery systems to the residential market, and are planning to expand into the Vehicle-to-X (V2X) market. The E3/DC interviewee was a Director for their Battery Business and provided key insights into residential market trends.

The grid-scale market is leaning towards longer duration of battery storage, to accommodate growing volumes of renewable energy capacity on electricity grids. Li-ion may not be well suited to long-duration storage in future, whereas RFBs can store 10 hours of energy, presenting another means for energy companies to install longer-duration grid-scale storage in future. However, this market is still in its early stages, with grid-scale proof-of-concept projects starting to emerge. For instance, in 2022, Sumitomo Electric brought one of the world’s largest vanadium RFBs online in Japan.

Applications, business models and revenue streams

Annual front-of-the-meter (FTM) installations will take a larger share of global annual Battery Energy Storage System (BESS) installations, by GWh, than behind-the-meter (BTM) installations in the next decade.

These batteries can provide a range of utility and ancillary services, giving Transmission System Operators (TSOs) the tools necessary to provide adequate national energy security and supply. Moreover, the means for large battery systems to produce revenues for their owners are becoming more apparent, through means such as revenue stacking. As business models continue to mature, investor confidence in BESS profitability will grow, thus facilitating reduced future project costs and increased installation volumes.

Batteries provide value in the BTM market primarily for the customer side. With regions such as Germany phasing out FiT schemes, consumers will take advantage of price arbitrage using their batteries when grid prices are most expensive at times of peak demand.

This report provides a holistic view, with depictions and explanations, of the various electricity markets that battery storage assets can operate in across all market sectors, in tandem with revenue generation mechanisms.

Market drivers: renewable energy deployment, battery storage targets, regulation

The adoption of energy storage systems (ESS) is necessary for higher levels of renewable energy penetration and integration. As well as this, energy and battery storage targets and clear policy frameworks are necessary if the number of global BESS deployments is to be expedited.

Several U.S. States have energy storage and renewables mandates. With more states announcing new battery storage targets, and expanding older targets (such as New York), this trend is expected to continue and will be a key driver for U.S. BESS growth.

The state-level Australian renewable energy targets and storage incentives are key drivers for their high historical and forecasted BESS installation rates.

Key aspects

This report provides the following information

Technology trends:

- Overview of materials and chemistries used in batteries for stationary energy storage, including their presence in the current market climate.

- Presents the growth of Li-ion deployments in recent years, with analysis behind the drivers for this.

- Comparisons of other relevant stationary storage technologies are presented and include: redox flow batteries (RFB), lead-acid batteries (LA), hydrogen fuel cells, high potential Energy Storage Systems (ESS) (Mechanical, Gravitational, CAES, LAES)

- Residential Battery Storage: battery chemistry and property trends (capacity, modular designs, cycle life, warranties) discussed and analyzed from dozens of products/companies.

Value chain analysis:

- Explanation of battery storage services in front-of-the-meter (FTM) and behind the meter (BTM).

- Provides an overview of BESS applications in residential, commercial & industrial (C&I) and utility/grid-scale settings, and how this helps with increasing volumes of renewable energy integration to the grid, stabilization of the grid, etc.

- Analysis and discussion providing a holistic view of the different electricity markets that battery storage assets can operate in across all market sectors.

- Depiction and explanations are provided for the mechanisms that can generate lucrative revenue streams for battery storage asset owners through means such as revenue stacking, Power Purchase Agreements, etc.

- Overview of key players in both residential and large-scale battery (C&I / grid / utility) markets. Includes analysis of incumbent technologies, company market share and region-specific supply chain developments.

- Other residential battery analyses and discussions include latest residential storage market trends, market size (US$), key players with revenues data and company/technical product SWOT analyses.

- Includes new primary information from key company interviews, including insights into company financials, market trends, product offerings, product designs and key areas of product development in the near-term.

- Includes matrix of global players by business application and profiles of the major players in large scale BESS. Includes technical product specifications and recent major installations.

Market Forecasts & Regional Analysis:

- Granular ten-year market forecasts for installations of FTM & BTM Battery Energy Storage Systems (ESS) (in annual MWh, GWh, TWh installed).

- The seven most active countries have 2023 – 2033 forecasts with annual MWh installed for residential / C&I / grid-scale splits, with FTM / BTM splits otherwise.

- Includes detailed discussion and in-depth analysis on regional regulation developments, renewable generation and energy and battery storage targets.

- This has been informed by key player activity and major project installations, government- and state-level announcements, and future project pipelines. Discussion around these drivers for future stationary storage deployments are documented, scrutinised, and discussed.