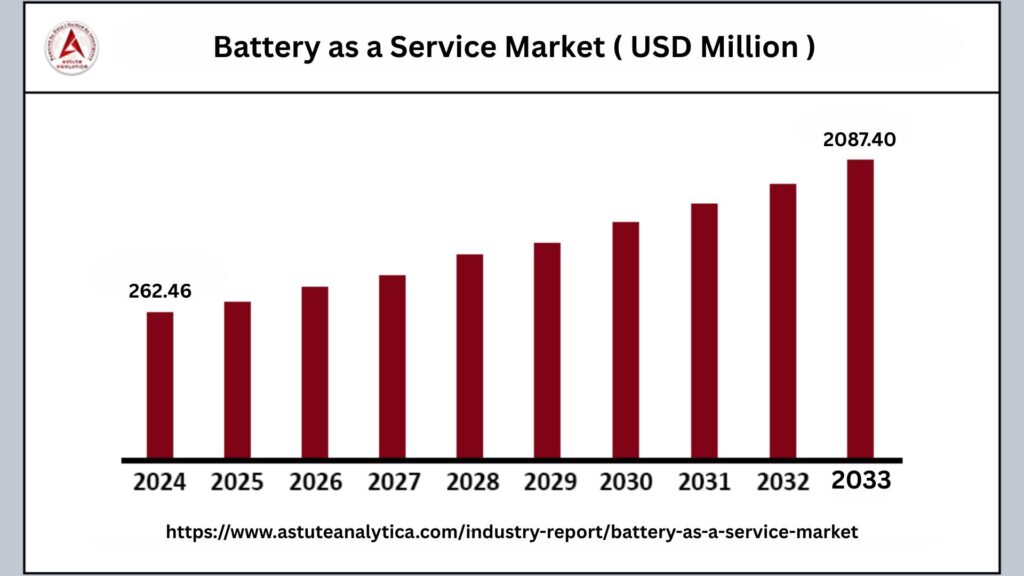

The global Battery as a Service market was valued at US$ 262.46 million in 2024 and is projected to reach US$ 2,087.40 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 25.91% during the forecast period from 2025 to 2033.

Battery-as-a-Service (BaaS) represents an innovative business model in which electric vehicle (EV) owners subscribe to battery services instead of buying the battery outright. This approach fundamentally changes the traditional ownership structure by decoupling battery ownership from the vehicle itself. As a result, consumers can significantly reduce the upfront cost of purchasing an electric vehicle, making EVs more financially accessible to a broader audience.

The global BaaS market is witnessing substantial growth, fueled primarily by the rapid adoption of electric vehicles worldwide. As governments enforce stricter emissions regulations and consumers increasingly prioritize sustainable transportation, demand for electric mobility solutions continues to rise. However, one of the biggest hurdles in EV adoption remains the high cost of batteries, which typically account for a large portion of the vehicle’s price. BaaS addresses this challenge by offering a flexible, cost-effective alternative that lowers financial barriers and enhances convenience.

Battery as a Service Market Key Takeaways

- By product type, the stationary segment firmly holds its dominance in the battery as a service (BaaS) market, commanding an impressive 82.6% share of the total revenue.

- When examining the market by service type, the subscription model continues to lead, contributing 75.1% of the revenue.

- In terms of vehicle type, passenger cars remain at the forefront of the BaaS market, accounting for 56.5% of revenue share.

Regional Analysis

Asia Pacific Dominates the Battery as a Service Market

The Asia Pacific region continues to dominate the global battery as a service (BaaS) market, driven by its rapid and widespread adoption of electric vehicles (EVs). This dominance reflects a comprehensive shift in transportation preferences across the region, with significant growth observed.

- Surge in Electric Vehicle Adoption Across Segments: Electric vehicle adoption in Asia Pacific is surging at an unprecedented pace, encompassing a broad spectrum of vehicle types. Passenger EVs are gaining popularity among urban consumers seeking sustainable and cost-effective transportation options, while commercial EV fleets—such as delivery vans, buses, and logistics vehicles—are rapidly expanding as businesses aim to reduce operational costs and comply with environmental regulations.

- BaaS as a Cost-Effective Solution: The rising popularity of EVs in the Asia Pacific region is paralleled by an increasing demand for BaaS models, which offer practical solutions to two major challenges faced by EV users: range anxiety and high upfront costs. Battery as a service allows consumers and fleet operators to avoid the substantial initial expense of purchasing batteries outright, converting these costs into manageable subscription fees.

- Policy Support and Incentives: A significant factor underpinning the rapid expansion of the Asia Pacific BaaS market is the proactive implementation of supportive policies and incentives by governments across the region. Countries such as China, India, South Korea, and Japan have introduced a variety of measures, including subsidies, tax breaks, and mandates aimed at promoting electric vehicle adoption and reducing greenhouse gas emissions.

North America Dominates the Battery as a Service Market

North America is experiencing a steady and sustained increase in electric vehicle (EV) adoption, reflecting growing consumer interest in sustainable transportation solutions.

- Government Incentives Encouraging EV Growth: The expansion of EV adoption in North America is strongly supported by a range of government incentives designed to lower barriers and encourage cleaner transportation. Federal, state, and local governments offer various subsidies, tax credits, and rebates that significantly reduce the upfront cost of purchasing electric vehicles.

- Technological Advancements Driving Market Momentum: Advancements in EV technology have played a crucial role in accelerating adoption across North America. Improvements in battery efficiency, charging speed, and vehicle range have addressed many early concerns associated with electric vehicles. Additionally, innovations in smart grid integration and energy management systems enhance the overall ownership experience.

- Battery as a Service Models Addressing Cost Barriers: Battery as a Service (BaaS) models are gaining prominence in North America as an effective strategy to overcome the cost barriers often linked with EV ownership. By offering subscription-based access to batteries rather than requiring full purchase, BaaS enables consumers to significantly reduce the initial investment needed to acquire electric vehicles.

Europe Holds Strong in the Battery as a Service Market

Europe continues to secure its position as the second-largest market in the global battery as a service (BaaS) landscape. This strong foothold is driven by the rapid growth of electric vehicle (EV) adoption, with Germany, France, and Norway emerging as the front-runners in terms of EV sales.

- Leading Market Players and Extensive Swap Station Network: Key industry players such as Stellantis, Renault, and Swobbee have established a significant presence in Europe, operating a network of approximately 2,100 battery swap stations spanning 12 countries. This extensive infrastructure facilitates convenient and rapid battery exchanges, addressing range anxiety and reducing charging downtime for EV users.

- Market Value and EU Infrastructure Funding Support: The European BaaS market generates an estimated annual revenue of US$ 1.85 billion, a figure bolstered by substantial funding from the European Union aimed at expanding and modernizing EV infrastructure through 2026. EU grants and subsidies play a pivotal role in accelerating the rollout of charging and swapping stations, making it easier for consumers and businesses to transition to electric mobility.

- Commercial Sector Adoption Driven by Regulatory Pressure: Commercial adoption of BaaS models in Europe is accelerating, largely in response to tightening regulatory requirements aimed at reducing carbon emissions in the logistics and transportation sectors. Logistics companies are leading this transition, with over 45,000 vehicles shifting to battery-as-a-service arrangements.

Top Trends Escalating Battery as a Service Market

Automated Battery Swapping Stations Handling Massive Volumes: Automated battery swapping stations have become a critical infrastructure component in the battery as a service (BaaS) ecosystem, with over 340,000 exchanges processed daily. These stations provide a swift and convenient alternative to traditional charging by enabling users to swap depleted batteries for fully charged ones in a matter of minutes.

Solid-State Batteries: The Future of Battery Technology: Solid-state batteries are emerging as the next-generation technology poised to revolutionize energy storage with enhanced performance characteristics. Unlike conventional lithium-ion batteries, solid-state variants use solid electrolytes, offering higher energy density, improved safety, and faster charging capabilities.

Battery Recycling Integration for Sustainable Operations: Sustainability is becoming a central focus within the BaaS market, with battery recycling integration playing a crucial role in maintaining environmentally responsible service operations. As battery usage expands, managing end-of-life batteries through effective recycling processes is essential to reduce environmental impact and recover valuable materials such as lithium, cobalt, and nickel.

Government Incentives and Regulations Fueling EV Adoption: Government incentives and regulatory frameworks worldwide are major catalysts propelling electric vehicle adoption and, by extension, the growth of the BaaS market. Policies such as tax credits, subsidies, emission reduction mandates, and stricter fuel efficiency standards encourage consumers and businesses to transition from internal combustion engines to electric mobility.

Rising Battery Costs Drive Subscription-Based Ownership: The persistently high costs associated with battery production and replacement are compelling consumers to gravitate toward subscription-based ownership models. Instead of purchasing batteries outright, which represents a significant portion of an electric vehicle’s total cost, users prefer subscription services that spread expenses over time and reduce upfront financial burdens.

Industrial Electrification: The ongoing electrification of industrial sectors is generating increased demand for heavy-duty battery leasing solutions within the BaaS market. Industries such as logistics, construction, and manufacturing are adopting electric vehicles and machinery to reduce emissions and improve operational efficiency. Heavy-duty batteries required for these applications are often costly and complex, making leasing an attractive option to manage capital expenses and maintenance.

Battery as a Service Market Segmentation

By Product Type

The stationary segment maintains a dominant position in the battery as a service (BaaS) market, commanding an impressive 82.6% share of total revenue. This leadership is primarily driven by the surging demand for grid-scale energy storage solutions. As energy grids worldwide increasingly integrate renewable sources such as solar and wind, the need for reliable and scalable stationary battery storage has become critical to balancing supply and demand, stabilizing the grid, and ensuring uninterrupted power delivery.

The economic benefits of stationary BaaS installations are becoming increasingly clear, particularly when examining operational efficiencies. Providers managing large fleets of stationary batteries—often exceeding 50,000 units—are leveraging advanced technologies such as predictive analytics and optimized maintenance schedules to significantly reduce costs.

By Service Type

The subscription model continues to dominate the battery as a service (BaaS) market, contributing a commanding 75.1% of total revenue. This model has revolutionized the way both businesses and consumers access battery technology by eliminating the need for large upfront capital investments. Instead of purchasing batteries outright, users subscribe to battery services, allowing them to spread costs over time and enjoy greater financial flexibility.

Modern subscription platforms have significantly evolved from traditional rental agreements, offering sophisticated and user-centric services that enhance customer experience and loyalty. Leading companies like Gogoro exemplify this transformation, managing an impressive volume of 11 million monthly transactions across their subscriber base. This high level of activity demonstrates strong customer engagement and reliance on subscription-based battery services.

By Vehicle Type

Passenger cars remain the dominant segment in the battery as a service (BaaS) market, commanding a substantial revenue share of 56.5%. This leadership highlights the rapid growth and widespread acceptance of electric vehicles (EVs) among urban consumers who are increasingly exploring cost-effective and convenient ownership options.

The high market share is driven by the growing demand for electric passenger cars that offer sustainable mobility solutions while addressing concerns over the high upfront costs typically associated with EV ownership. The BaaS model has resonated particularly well with this segment, as it allows consumers to separate the cost of the battery from the vehicle purchase.

Recent Developments in the Battery as a Service Market

- Ather Energy’s Entry with Battery-as-a-Service Model: In June 2025, Bengaluru-based Ather Energy is gearing up to launch an innovative business model aimed at intensifying competition in the electric two-wheeler market. Facing competition from established players like TVS Motor and Bajaj Auto, as well as new entrants such as Ola Electric, Ather plans to introduce a battery-as-a-Service (BaaS) model for its two-wheelers.

- Nio’s Firefly Launches Battery Rental Plan: In June 2025, Nio’s sub-brand Firefly, which specializes in small electric vehicles, accelerated the launch of its battery rental car purchase plan as a key strategy to boost sales. Firefly introduced its Battery as a Service (BaaS) purchase plan, effectively reducing the starting price of its only model.

- Vida by Hero MotoCorp Adopts Subscription-Based BaaS: In a similar effort to enhance affordability and accessibility in electric mobility, Vida, the electric mobility brand from Hero MotoCorp, announced plans in June 2025 to introduce a subscription-based Battery-as-a-Service (BaaS) model. Set to launch on July 1, 2025, this model will accompany the release of Vida’s new electric scooter, the Vida VX2.

- Nuvve’s BaaS Offering Supports Grid Modernization: In May 2025, Nuvve, a company specializing in grid modernization and vehicle-to-grid (V2G) technologies, introduced its subscription-based battery-as-a-service (BaaS) solution. This offering is designed to assist electric cooperatives and other load-serving entities in improving grid performance, managing peak electricity demand, and reducing infrastructure costs.

Top Players in the Global Battery as a Service Market

- NIO

- Epiroc

- Global Technology Systems, Inc.

- Contemporary Amperex Technology Co

- Swobee

- Harding Energy, Inc.

- ReJoule

- Octillion

- Numocity

- Skoon

- Numocity

- Skoon

- Other Prominent Players

Market Segmentation Overview:

By Product Type:

- Stationary

- Mobile/Portable

By Service Type:

- Subscription (Rental)

- Pay Per Use

By Vehicle Type:

- 2 & 3-Wheeler

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Others (Telehandler, forklifts, and others)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa