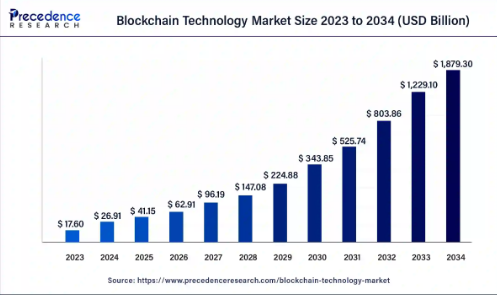

The global blockchain technology market size is calculated at USD 26.91 billion in 2024 and is expected to attain around USD 1,879.30 billion by 2034 with a CAGR of 52.9% from 2024 and 2034.

Blockchain Technology Market Overview:

The blockchain technology market refers to the sector that deals with developing, implementing, and commercializing blockchain-based solutions in various industries. Blockchain is a type of distributed, immutable ledger that enables the recording, tracking, and monitoring of transactions and assets across a corporate network. It provides real-time, shareable, and visible data, accessible only to users authorized within the network.

Blockchain works on the concept of storing data of transactions in blocks and linking them securely to form a chain of data wherein each block enhances the verification of the previous block, thus becoming tamper-proof. The advantages of blockchain technology include improved security and efficiency.

Blockchain Technology Market Key Insights:

- North America dominated the market with the largest market share of 46% in 2023.

- By type, the public cloud segment contributed the biggest market share of 61% in 2023.

- By components, the infrastructure and protocols segment recorded the highest market share of 63% in 2023.

- By applications, the payments segment generated more than 45% of the market share in 2023.

- By enterprise size, the large enterprises segment captured a major market share of 68.5% in 2023.

- By end use, the financial services segment accounted for the largest market share of 39% in 2023.

Blockchain Technology Market Regional Outlook:

The U.S. blockchain technology market size accounted for USD 8.70 billion in 2024 and is estimated to be worth around USD 619.28 billion by 2034, growing at a CAGR of 53.2% from 2024 to 2034.

North America led the blockchain technology market with the highest market share of 46% in 2023.

Blockchain technology is revolutionizing North American businesses, notably banking, supply chain management, and healthcare. Smart contracts and digital currencies make transactions faster, cost-effective, and more transparent in finance.

Blockchain technology in supply chain management allows real-time tracking, eliminating fraud and maintaining regulatory compliance. Healthcare firms are also using blockchain technology to increase data security, interoperability, and operational efficiency, resulting in enhanced patient care and operational efficiency. Furthermore, several companies in the region are making efforts to advance blockchain solutions. For instance,

- In January 2024, Casper Labs, a leader in blockchain technology, collaborated with IBM Corp., an American multinational technology company, to create an AI governance tool that employs decentralized ledger technology. This tool enables version control, monitoring, and access controls for AI models, increasing the versatility of blockchain solutions.

Asia Pacific is expected to witness significant growth in the market during the forecast period.

Countries such as China, Singapore, Japan, and South Korea have adopted the technology, and various companies and investors have been thriving. The rising digitization and adoption of smartphones in these countries encourage banking, supply chain management, healthcare, and gaming sectors to use blockchain applications. The cryptocurrency industry is booming due to the increased interest in decentralized finance, leading to a high demand for blockchain-based solutions.

Scope of Blockchain Technology Market:

| Report Attribute | Key Statistics |

| Market Size in 2024 | USD 26.91 Billion |

| Market Size by 2034 | USD 1,879.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 52.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Component, Application, Enterprise, End-Use, and Region |

| Type | Public CloudPrivate CloudHybrid Cloud |

| Component | Application & SolutionMiddlewareInfrastructure & Protocols |

| Application | Digital IdentityPaymentsExchangesSupply Chain ManagementSmart ContractsOthers |

| Enterprise | Large EnterprisesSmall & Medium Enterprises |

| End-Use | Financial ServicesHealthcareGovernmentMedia & EntertainmentTransportation & LogisticsRetailTravelOthers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Countries Covered | U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

Blockchain Technology Market Segments Outlook:

Type Outlook: The private cloud segment is expected to grow significantly during the forecast period.

Private cloud blockchain benefits enterprises concerned with security, data privacy, performance, and scalability. It provides an appropriate structure for business transactions, ensuring that transactions are safe, traceable, and reliable through permission management and data integrity.

Private cloud blockchains also provide data privacy, as their owners control access and visibility to such data; thus, only duly authorized parties can access sensitive information. These blockchains are faster and more efficient. The performance of the Hyperledger Fabric is directly related to its smart contract architecture and data model. Scalability is a critical component for its effective implementation.

Component Outlook: The infrastructure and protocol segment dominated the blockchain technology market in 2023.

Blockchain technology has evolved to support certain protocols that have both pros and cons. Proof of Work is crucial for cryptocurrencies such as Bitcoin. Distributed ledgers provide data on the history of all transactions, and smart contracts facilitate digital commerce.

The five major blockchain protocols are Hyperledger, Multichain, Enterprise Ethereum, Corda, and Quorum. Hyperledger intends to build the tools that enable any business to rapidly integrate blockchain technology. Multichain supports fiat currencies and stores of value from the real world. Corda has gained its certification from the R3 banking consortium. Quorum helps businesses in the financial sector.

- Citi and the Brazilian Development Bank (BNDES) collaborated with the Hyperledger Foundation to create business-grade blockchain services and solutions that leverage permissions, verified, and user-accessible corporate blockchains rather than public blockchains.

Application Outlook: The payments segment dominated the blockchain technology market in 2023.

Blockchain technology, harnessed through encrypted distributed ledgers, provides fast, secure, and low-cost international payment processing. It eliminates intermediaries, has peer-to-peer transactions, and ensures the safety of data storage during transactions. Blockchain technology provides high transparency, as every transaction is recorded on the blockchain and thus immutable and visible to everybody.

Moreover, blockchain technology facilitates secure cross-border payment by reducing processing time, excluding intermediaries, and assuring payment and information security. The technique is also being tested for other transactions not involving Bitcoin.

- In February 2024, Boom, a blockchain-based digital payment network, introduced Boom Pay in Africa. This payment gateway has been integrated with Boom’s e-commerce platform for unbanked areas, making it easier for online retailers to accept digital payments from customers identified by KYC.

Enterprise Outlook: The large enterprise segment dominated the market in 2023.

Blockchain technology is transforming businesses by improving security, simplifying procedures, and increasing trust. It establishes a decentralized system that facilitates data sharing among parties.

Blockchain increases security and privacy, reduces costs, speeds up transaction processing, improves visibility and traceability, provides immutability, gives individuals authority over their data, promotes tokenization, and drives innovation by solving complicated issues and streamlining procedures.

Blockchain Technology Industry Report Content

Qualitative Analysis:

- Industry Overview

- Market Size

- Growth Prospects

- Industry Trends

- Market Drivers and Restraints

- Porter’s Analysis

- PESTEL Analysis

- Key Market Opportunities Prioritized

- Competitive Landscape

- Company Overview

- Financial Performance

- Product Benchmarking

- Latest Strategic Developments

Quantitative Analysis:

- Market size and forecast from 2023 to 2034

- Market estimates and forecast for type segments up to 2034

- Regional market size and forecast for type segments up to 2034

- Market estimates and forecast for component segments up to 2034

- Regional market size and forecast for component segments up to 2034

- Market estimates and forecast for application segments up to 2034

- Regional market size and forecast for application segments up to 2034

- Market estimates and forecast for enterprise segments up to 2034

- Regional market size and forecast for enterprise segments up to 2034

- Market estimates and forecast for end-use segments up to 2034

- Regional market size and forecast for end-use segments up to 2034

- Company financial performance

Blockchain Technology Market Dynamics

Driver: Increased transparency and efficiency

The market is experiencing significant growth due to blockchain technology’s increased transparency and efficiency, which is the primary concern during transactions. This approach eliminates the need for multiple business databases by having transaction and data recordings on a distributed ledger in various places.

In turn, every network member is allowed permission to view the same information, increasing transparency to fight fraud. Blockchain automates traditional paper-intensive procedures, making transactions quick and efficient. It also maintains the paperwork and data of transactions on the Blockchain, thus eliminating paper exchange and multiple ledger reconciliation.

Restraint: Scalability issues

The blockchain technology market presents severe technological challenges. Scalability issues are one of those that stand in the way of its widespread adoption, particularly in the case of public blockchains.

Legacy transaction networks, such as Visa, process hundreds of transactions per second, while the most prominent blockchain networks process transactions at a much slower rate. For example, Bitcoin processes three to seven transactions per second, while Ethereum processes up to 20 transactions per second.

Opportunity: Advancements in Blockchain Technology

- One World Chain (OWCT), a Decentralized Ethereum Scaling Platform and EVM-compatible Blockchain, is making tremendous breakthroughs in its blockchain technology. It is displaying its dedication to transforming the digital currency industry while also staying ahead of the growing fintech and blockchain industries.

Blockchain technology, initially linked with digital currency, represents an exciting means of digital transformation. It brings transparency and builds trust. It is bound to disrupt supply chains, healthcare, and financial services.

Blockchain-based solutions in supply chain management provide end-to-end visibility into supply networks, confirming product authenticity and integrity. In healthcare sector, blockchain enhance shared electronic health records, putting people in charge of their information, opening the way for growth of blockchain technology market. In general, blockchain technology is expected to impact various industries.

Blockchain Technology Market Key Companies

- IBM Corp. (U.S.)

- Deloitte Touche Tohmatsu Ltd. (U.K.)

- Chain, Inc. (U.S.)

- Microsoft Corp. (U.S.)

- The Linux Foundation (U.S.)

- Global Arena Holding, Inc. (U.S.)

- Ripple (U.S.)

- Monax (U.S.)

- BTL Group Ltd. (U.K.

- Circle Internet Financial Ltd. (U.S.)

- Digital Asset Holdings, LLC (U.S.)

Recent News of Blockchain Technology Market

- In August 2024, KfW collaborated with Boerse Stuttgart Digital to issue a blockchain-based digital bond, demonstrating the considerable integration of blockchain technology into traditional financial processes.

- In August 2024, IOTA, a distributed ledger, released a blockchain-powered application to simplify the administration of music rights in films, which has historically been time-consuming.

- In August 2024, Bitget and the University of Zurich collaborated to train the next generation of blockchain specialists to bridge the gap between academia and industry by providing students with the skills they need to succeed in the rapidly growing blockchain environment.

- In December 2023, RYVYL and R3, a leading global provider of enterprise blockchain software, teamed up to bring to market RYVYL Block, a Blockchain-as-a-Service platform developed to grow blockchain adoption within banking and payments.

Segments Covered in the Report

By Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Component

- Application & Solution

- Middleware

- Infrastructure & Protocols

By Application

- Digital Identity

- Payments

- Exchanges

- Supply Chain Management

- Smart Contracts

- Others

By Enterprise

- Large Enterprises

- Small & Medium Enterprises

By End-Use

- Financial Services

- Healthcare

- Government

- Media & Entertainment

- Transportation & Logistics

- Retail

- Travel

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait