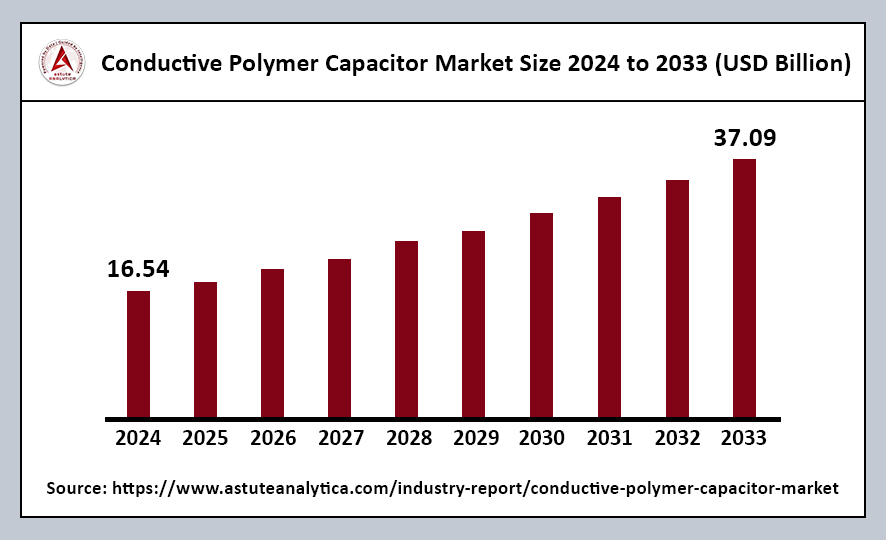

The global conductive polymer capacitor market was valued at US$ 16.54 billion in 2024 and is projected to reach US$ 37.09 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 10.62% during the forecast period from 2025 to 2033.

The conductive polymer capacitor market is thriving due to several key factors, including rising power demands, robust materials innovation, and strategic alliances among major producers. These elements are driving the global electronics industry toward designs that are not only more efficient but also stable and miniaturized. Prominent brands such as Panasonic, Kemet, and Vishay hold significant shares in the conductive polymer capacitor market.

These companies differentiate themselves by offering extensive product assortments that meet the reliability demands of large-scale original equipment manufacturers (OEMs). Their commitment to quality and innovation ensures it remain competitive in a rapidly evolving market. With ongoing advancements in technology and materials, along with strategic partnerships among leading manufacturers, this market is set to play a critical role in the future of electronic design and functionality.

Conductive Polymer Capacitor Market Key Takeaways

- By Type, Conductive polymer aluminum capacitors maintain a strong lead in the global market, commanding over 60% market share.

- In terms of shape, the chip type configuration holds a significant position, accounting for over 50% market share in the conductive polymer capacitor market.

- When examining applications, the consumer electronics sector claims a 40% share of the conductive polymer capacitor market.

- Regarding anode materials, aluminum dominates the market with over 70% share in conductive polymer capacitors.

Regional Analysis

Asia Pacific’s Leadership in the Conductive Polymer Capacitor Market

Asia Pacific has emerged as a leader in the conductive polymer capacitor market, capturing over 45% revenue share. This dominance can be attributed to the region’s high-tech manufacturing capacity, robust supply chains, and the rapid expansion of the consumer electronics sector.

- High-Tech Manufacturing Capacity and Supply Chains: The region’s high-tech manufacturing capacity is exemplified by major electronics contract manufacturers such as Foxconn and Pegatron, which operate extensively in China. These companies play a pivotal role in meeting the local demand for polymer capacitors, which has surged to support assembly lines producing millions of devices each month for global brands.

- Demand from Consumer Electronics: The rapid expansion of the consumer electronics market in Asia Pacific further amplifies the demand for conductive polymer capacitors. As consumers increasingly seek advanced electronic devices, manufacturers are compelled to integrate high-performance components that can enhance device functionality and reliability.

- Research and Development Efforts: Asia Pacific is home to some of the world’s top suppliers, including Nippon Chemi-Con from Japan and Samsung Electro-Mechanics from South Korea. These companies anchor their research and development efforts within the region, driving continuous advancements in polymer capacitor technologies.

North America’s Dominance in the Conductive Polymer Capacitor Market

North America has established itself as the dominant region in the global conductive polymer capacitor market over the past decade. This leadership is largely due to the strong presence of original equipment manufacturers (OEMs) within the region.

- Dominance of United States: The United States, in particular, is home to several leading companies, including Panasonic Corporation, AVX Corporation, and KEMET Corporation. These firms have significantly contributed to the growth of the regional market through extensive investments in research and development (R&D) and the introduction of new products tailored to various industrial applications.

- Contributions of Major Manufacturers: The commitment of these manufacturers to innovation has played a crucial role in advancing the capabilities and applications of conductive polymer capacitors. By focusing on R&D, they have been able to develop products that meet the evolving demands of the electronics industry.

- Impact on the Aerospace and Defense Industry: The aerospace and defense industry in the U.S. is a significant driver of demand for conductive polymer capacitors. This sector invests heavily in technological advancements, utilizing these capacitors for their superior performance characteristics. The rigorous requirements of aerospace and defense applications necessitate components that can withstand extreme conditions while maintaining reliability.

Top Trends Escalating the Conductive Polymer Capacitor Market

Growing Integration with Multi-Layer Substrates: The integration of multi-layer substrates is significantly driving the growth of the conductive polymer capacitor market. As manufacturers seek to optimize space and enhance performance, the ability to incorporate conductive polymer capacitors into multi-layer configurations becomes increasingly valuable.

Adoption of High-Frequency Power Modules: The rising adoption of high-frequency power modules is another key factor propelling the conductive polymer capacitor market. As industries push for more efficient power management solutions, these modules require capacitors that can handle high-frequency operations without compromising performance.

Increasing Preference for Individual Components: There is a growing preference for individual components in electronic designs, which is further escalating the demand for conductive polymer capacitors. As manufacturers aim for greater customization and flexibility in their products, the ability to select specific components that meet precise performance criteria becomes crucial.

Emergence of the IoT Industry: The emergence of the Internet of Things (IoT) industry is significantly influencing the conductive polymer capacitor market. Conductive polymer capacitors, with their compact size and reliable performance, are well-suited for use in a variety of IoT applications, from smart home devices to industrial sensors.

Rising Miniaturization Trends: Miniaturization in electronics is a major factor contributing to the growth of the conductive polymer capacitor market. As devices become smaller and more portable, the demand for compact, high-capacitance components increases. Conductive polymer capacitors excel in this area, providing high performance in a reduced size.

Conductive Polymer Capacitor Market Segmentation

By Type

Conductive polymer aluminum capacitors maintain a strong lead in the global market due to their superior reliability, low equivalent series resistance (ESR), and stable performance at high frequencies. This performance advantage is particularly notable when compared to alternatives such as polymer tantalum or polymer multi-layer ceramic capacitors.

These capacitors utilize an aluminum cathode paired with a solid polymer electrolyte, which allows them to provide consistent capacitance over a wide temperature range. Additionally, this design minimizes the risk of dry-out, a common issue that affects liquid electrolytes, further enhancing their reliability in various applications.

By Shape

The chip type shape has emerged as the preferred standard in many electronic assemblies due to its streamlined profile and compatibility with automated pick-and-place systems. This compact design provides significant advantages for manufacturers.

Companies like Rubycon and KEMET can deliver capacitors that are easily soldered onto printed circuit boards (PCBs) during high-volume production runs. This capability not only reduces the need for manual intervention but also significantly shortens overall assembly time, allowing manufacturers to improve efficiency and productivity in their operations.

By Applications

Consumer electronics account for a substantial 40% share of the conductive polymer capacitor market. This is primarily because these devices require compact, high-capacitance components that can reliably support rapid charge-discharge cycles.

Leading manufacturers like Apple, Xiaomi, and Sony incorporate aluminum-based polymer capacitors into tens of millions of smartphones, tablets, and gaming consoles sold each year. By using these capacitors, they aim to achieve stable power regulation and enhance product longevity, ensuring that their devices meet the high performance and reliability expectations of consumers.

By Anode Material

Aluminum’s dominance in the conductive polymer capacitor market, with over 70% market share, is due to its exceptional balance of mechanical durability, electrical conductivity, and economic viability. This makes aluminum a preferred choice for manufacturers and consumers. In contrast to tantalum, which has a more fragile supply chain and comes at a higher cost, aluminum is sourced in vast quantities.

This abundance simplifies mass manufacturing processes, allowing producers to efficiently meet demand. Companies such as Nichicon and Nippon Chemi-Con can ramp up production volumes to satisfy the needs of major electronics giants like Samsung or Huawei, who require millions of capacitors per quarter for their smartphones and networking gear.

Conductive Polymer Capacitor Market Recent Developments

- TTI Europe and Panasonic’s ZV Series Capacitors: In January 2025, TTI Europe offered Panasonic’s ZV series electrolytic polymer hybrid capacitors. The AEC-Q200-compliant range sets new performance standards with high ripple current and low Equivalent Series Resistance (ESR).

- Kyocera AVX’s TCD Series Capacitors: In February 2024, electronic component manufacturer Kyocera AVX introduced the new TCD Series DLA 04051 and COTS-Plus conductive polymer capacitors. These high-reliability conductive polymer capacitors are engineered for demanding military, aerospace, defense, and industrial applications.

- Panasonic’s ZL Series Capacitors: In February 2024, Panasonic Industry Co., Ltd. announced the commencement of commercial production of its ZL series conductive polymer hybrid aluminum electrolytic capacitors.

Top Players in the Conductive Polymer Capacitor Market

- Panasonic Corporation

- Nippon Chemi-Con Corporation

- Rubycon Corporation

- United Chemi-Con (UCC)

- Vishay Intertechnology

- Kemet Corporation

- Hitachi AIC Inc.

- Taiyo Yuden Co., Ltd.

- Murata Manufacturing

- Samsung Electro-Mechanics

- Nichicon Corporation

- Others

Market Segmentation Overview:

By Type

- Conductive Polymer Aluminum Capacitor

- Solid Capacitor

- Electrolytic Capacitor

- Hybrid Aluminum Electrolytic Capacitor

- Conductive Polymer Tantalum Solid Capacitor

- Conductive Polymer Niobium Capacitors

- Solid Capacitor

- Electrolytic Capacitor

By Anode Material

- Aluminum

- Tantalum

By Capacitor Shape

- Chip Type

- Lead Type

- Large Can Type

By Application

- Automotive

- Consumer Electronics

- Industrial Electronics

- IT and Telecommunication

- Aerospace and Defense

- Power and Energy

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/conductive-polymer-capacitor-market