In today’s rapidly evolving technological landscape, the convergence of the Internet of Things (IoT) and fintech is setting the stage for extraordinary transformation in the financial services industry. This synergy between IoT and fintech is not just an improvement but a revolutionary shift that promises to redefine how financial services are delivered and consumed.

IoT, with its extensive network of interconnected devices, is generating enormous amounts of data in real-time. Fintech, on the other hand, is leveraging advanced technologies such as AI, blockchain, and big data analytics to create innovative financial solutions. The merging of these two domains offers fertile ground for the development of next-gen financial services that are more personalized and efficient.

One of the most significant benefits of integrating IoT with fintech is the ability to harness real-time data for better decision-making. IoT devices generate a continuous stream of data about users’ behaviors, the environment they are in, and their activities. Fintechs can leverage this data to gain deeper insights into customer needs and preferences, enabling them to offer highly personalized financial products and services.

Security, a major concern in the financial services industry, can be significantly enhanced by integrating IoT and fintech. This can significantly enhance security measures, making financial transactions more secure and reducing the risk of fraud. In India, where digital payment systems are on the rise, enhancing security is paramount. The RBI has introduced several regulations to strengthen cybersecurity in the financial sector, including guidelines for secure transactions.

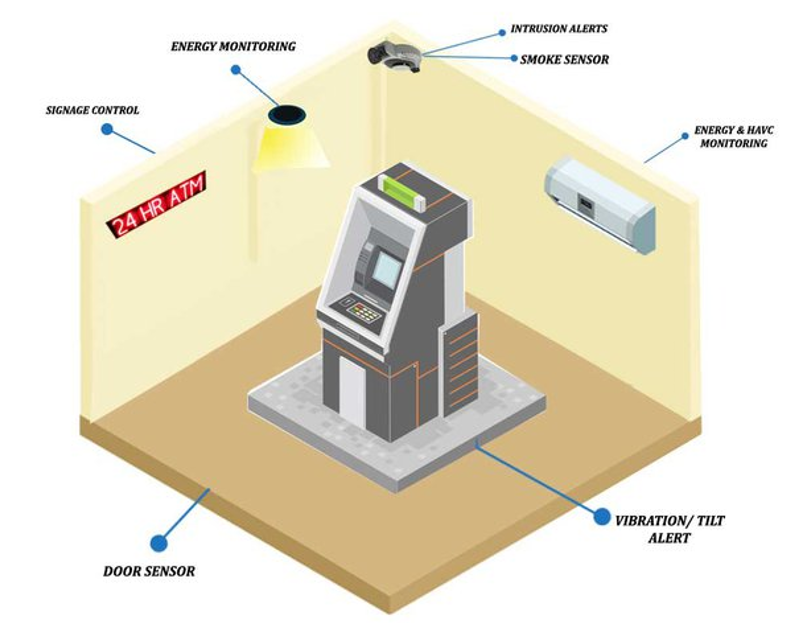

IoT-enabled ATMs enhance security and efficiency by enabling real-time monitoring and maintenance, reducing downtime, and providing personalized services based on user data. They can also offer features such as biometric authentication and predictive maintenance to prevent fraud and improve the customer experience.

Moreover, the IoT also opens up numerous possibilities in the lending sector. Since NPAs are a significant challenge for lending institutions, IoT data, combined with AI and machine learning algorithms, can predict potential defaults before they happen. This allows lenders to intervene early, providing support or restructuring options to borrowers, thereby reducing the risk of loans becoming NPAs.

The amalgamation of IoT and fintech also holds promise for improving financial inclusion in India. Despite significant progress in recent years, a large portion of the Indian population remains unbanked or underbanked. IoT-enabled fintech solutions can help bridge this gap by providing affordable and accessible financial services to underserved communities.

Not only that, but continuous data collection from IoT devices allows for real-time credit score updates, reflecting the most current financial behavior of the borrower. This dynamic approach enables lenders to make better-informed lending decisions and manage risks more effectively. IoT device data can also help identify consumers’ financial needs, and this, combined with the credit score and the use of AI, can determine a potential borrower.

Borrowers can receive real-time notifications and reminders about upcoming payments, potential late fees, or account status updates through their connected devices. This can help reduce the chances of default by maintaining a proactive approach to loan repayment.

Furthermore, IoT devices can help in the identification and management of collection cases. Proactively monitoring the financial behaviors and patterns of borrowers through connected devices enables more efficient collection strategies. This can help minimize losses and improve recovery rates.

Challenges and Considerations

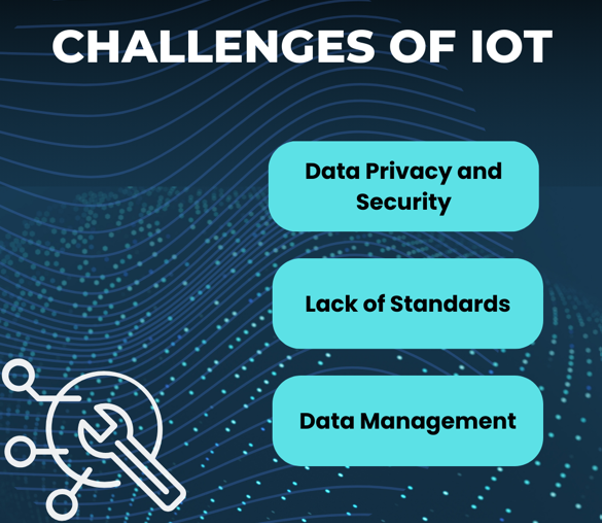

While this union presents numerous opportunities, it also comes with its own set of challenges. Privacy and data security are major concerns, as the vast amount of data generated by IoT devices can fall prey to cyberattacks. It is crucial to ensure that robust data protection measures are in place and compliance with regulatory requirements is maintained. This can help improve customer trust and safeguard sensitive information.

Interoperability is another challenge, as the seamless integration of IoT devices with existing fintech infrastructure needs standardized protocols and communication frameworks. It is essential that industry stakeholders, including technology providers, financial institutions, and regulatory bodies, work together to address these challenges.

The Future of Financial Services

The integration of IoT and fintech is poised to revolutionize the financial services industry, creating a more connected, efficient, and customer-centric ecosystem. As IoT devices become more prevalent and advanced fintech solutions continue to emerge, the possibilities for innovation are limitless.

By leveraging real-time data, enhancing security measures, and offering personalized services, financial institutions can create a competitive advantage and deliver exceptional value to their customers. Several Indian fintech companies are already leveraging the power of the IoT to transform financial services.

As we move forward, the collaboration between these two domains will unlock new opportunities, drive innovation, and ultimately transform how we interact with financial services. The future of finance is here, and it is more connected and intelligent than ever before.