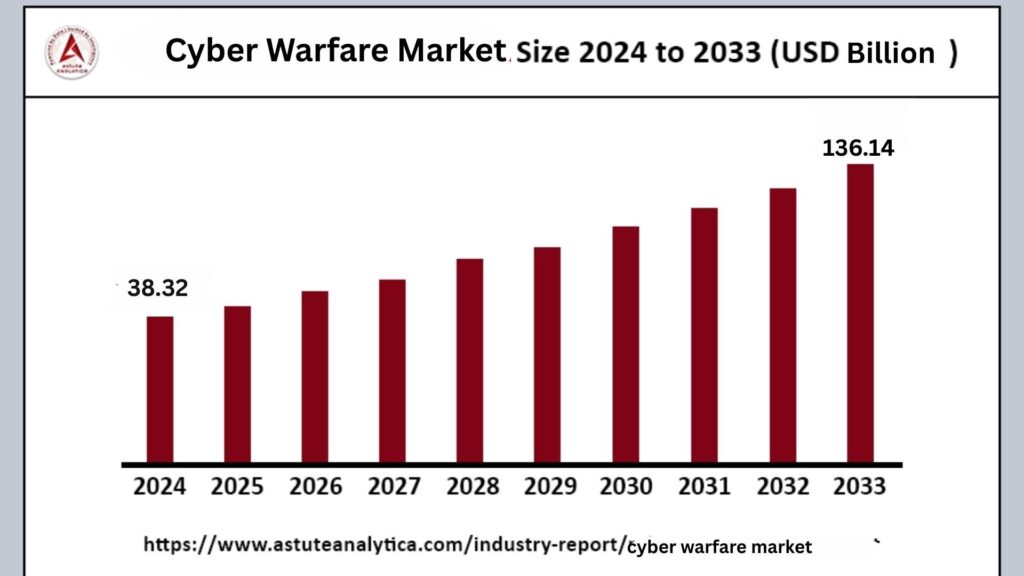

The global cyber warfare market was valued at US$ 38.32 billion in 2024 and is projected to reach US$ 136.14 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 16.06% during the forecast period from 2025 to 2033.

Cyber warfare is becoming increasingly prevalent and influential, largely driven by the growing interconnectedness of global infrastructure and the emergence of sophisticated cyber threats. As the digital landscape expands, the potential for cyber conflicts escalates, leading to a significant transformation within the market. A striking indication of this trend shows global cyberattacks surged by 30% in the second quarter of 2024 compared to the same period in 2023. This alarming increase highlights the urgency for enhanced cybersecurity protocols. On average, 30,000 websites were compromised daily, illustrating the extensive impact of cyber threats on organizations worldwide. As these attacks become more frequent and sophisticated, the need for comprehensive strategies to combat cyber warfare has never been more pressing.

Cyber Warfare Market Key Takeaways

- By Component, the solution segment of the cyber warfare market holds a commanding 64.71% share, underscoring its critical role in the overall landscape.

- Within the different types of cyber warfare, cyber-attacks are the most dominant, accounting for 47% of warfare types.

- In applications, the defense application sector controls 28.22% of the cyber warfare market revenue.

Regional Analysis

Growth and Transformation of the Cyber Warfare Market in Japan

The North America cyber warfare market has undergone significant growth and transformation across various regions, influenced by several key factors.

- North America’s Cybersecurity Landscape: In North America, the cybersecurity market is projected to control over 39.74% of the global market share by 2024. This substantial share reflects the region’s commitment to addressing the challenges posed by cyber threats. The United States, in particular, is a major player in this landscape, accounting for 59% of all ransomware attacks globally. This alarming statistic underscores the urgency for enhanced cybersecurity measures and proactive strategies to mitigate threats.

- United States Focus on Cyber Warfare: In light of the rising threat landscape, the United States has intensified its focus on cyber warfare by making significant investments in advanced cyber defense systems. These investments are aimed at fortifying the nation’s cybersecurity infrastructure, enabling federal agencies to protect sensitive information and critical infrastructure from malicious actors.

Proactive Measures in Europe’s Cyber Warfare Market

The Europe cyber warfare market has adopted a proactive stance in strengthening its cybersecurity infrastructure. This coordinated approach aims to create a more resilient cybersecurity ecosystem capable of addressing the complex challenges posed by cyber adversaries.

- Key Legislative Initiatives: To bolster its cybersecurity posture, the EU has introduced several key legislative initiatives, including the NIS2 Directive, the Cyber Resilience Act, and the Cyber Solidarity Act, all set to be implemented between 2024 and 2025.

- NIS2 Directive: This directive aims to enhance the overall level of cybersecurity across the Union by establishing stringent security requirements for essential entities.

- Cyber Resilience Act: Focused on ensuring that products and services are designed with security in mind, this act mandates that organizations implement cybersecurity measures throughout the lifecycle of their offerings.

- Cyber Solidarity Act: This initiative promotes cooperation among member states, facilitating the sharing of information and resources to strengthen collective cybersecurity efforts. It aims to foster solidarity in responding to cyber incidents, ensuring that no member state is left to navigate threats alone.

- Impact on Cybersecurity Landscape: The implementation of these regulatory measures has led to significant improvements in the cybersecurity landscape across Europe. Notably, these initiatives have contributed to a 49% decline in ransomware attacks in the EMEA (Europe, Middle East, and Africa) region. This reduction underscores the effectiveness of coordinated mitigation strategies and highlights the importance of collaborative efforts in tackling cyber threats.

Asia-Pacific: A Critical Battleground in Cyber Warfare

The Asia-Pacific region, accounting for 31% of all reported cyber incidents globally, has emerged as a critical battleground in the cyber warfare market landscape.

- China’s Dominance in Cyber Warfare: China stands at the forefront of regional cyber capabilities, characterized by its aggressive stance in cyber warfare. The nation has made substantial investments in advanced technologies, particularly in artificial intelligence (AI) and 5G technologies. China’s focus on developing a sophisticated cyber warfare infrastructure enables it to engage in both offensive operations and defensive measures, making it a key player in global cyber dynamics.

- Japan’s Focus on International Collaborations: In response to the growing cyber threats, Japan has taken significant steps to strengthen its cybersecurity infrastructure. The country is emphasizing international collaborations to enhance its cyber defense capabilities. By partnering with other nations and sharing best practices, Japan aims to create a more resilient cyber environment.

- India’s Comprehensive Cyber Defense Strategies: India is also actively developing its cyber defense strategies to counter threats from both state and non-state actors. The government has recognized the importance of a comprehensive approach to cybersecurity, focusing on enhancing capabilities across various sectors.

Top Trends Escalating the Cyber Warfare Market

Integration of Artificial Intelligence for Predictive Threat Detection and Response: The integration of artificial intelligence (AI) in cybersecurity represents a significant advancement in predictive threat detection and response. Additionally, AI-powered tools facilitate automated responses to incidents, allowing for quicker remediation and minimizing the impact of cyber attacks on critical infrastructure and sensitive information.

Adoption of Quantum-Resistant Cryptography: With the advent of quantum computing approaches, organizations are increasingly adopting quantum-resistant cryptography to counter potential future threats. Quantum computers possess the capability to break traditional encryption methods, which could jeopardize the security of sensitive data. In response, cybersecurity experts are developing new cryptographic algorithms designed to be secure against quantum attacks.

Shift Towards Cloud-Native Security Solutions: There is a noticeable shift towards cloud-native security solutions as businesses seek scalable and flexible protection against cyber threats. This transition facilitates easier management of security policies and enhances the agility of companies in responding to emerging threats.

Escalating Geopolitical Tensions: The current landscape of escalating geopolitical tensions is fueling significant investment in offensive and defensive cyber capabilities. Countries are increasingly recognizing the strategic importance of cyber warfare in modern conflicts, leading to heightened funding for cyber defense mechanisms and offensive cyber operations.

Digital Transformation Expanding Attack Surfaces: The ongoing digital transformation across various industries is significantly expanding attack surfaces and security needs. As organizations adopt new technologies and move towards more interconnected systems, they create new entry points for cyber adversaries. This transformation necessitates a comprehensive approach to cybersecurity that encompasses traditional defenses and modern solutions tailored to address the challenges posed by an evolving digital landscape.

Regulatory Compliance Requirements: Regulatory compliance requirements are mandating robust cybersecurity measures for organizations globally. As cyber threats become more prevalent, governments and regulatory bodies are establishing stricter guidelines and standards to protect sensitive data and critical infrastructure.

Cyber Warfare Market Segmentation

By Component

The solution segment’s dominance in the cyber warfare market, which controls over 64.71% of the market share, is primarily driven by the escalating sophistication and frequency of cyber threats targeting critical infrastructure and sensitive data across various sectors. As organizations increasingly rely on digital systems and networks, the need for effective cybersecurity solutions has become paramount. This dominance is further reflected in the substantial investments made by organizations to protect their digital assets.

Companies are recognizing the critical importance of safeguarding their information and infrastructure from malicious attacks, leading to heightened spending on advanced cybersecurity measures. These investments are essential not only for compliance with regulations but also for ensuring the resilience and operational continuity of businesses in the face of evolving cyber threats. As a result, the solution segment continues to play a crucial role in the overall landscape of cyber warfare defenses.

By Cyber Warfare Type

The dominance of cyber-attacks, which account for more than 47% of the cyber warfare market, is a testament to the evolving nature of modern conflict and the strategic advantages that cyber warfare provides. As warfare increasingly moves into the digital realm, the significance of cyber operations has become more pronounced.

Several factors drive this shift toward cyber warfare. One major aspect is the cost-effectiveness of cyber operations compared to traditional military engagements. Conducting cyber-attacks typically requires fewer resources and can achieve substantial impacts without physical deployments. Additionally, cyber warfare allows for the execution of covert operations with plausible deniability, making it an attractive option for state and non-state actors.

By Application

The defense application’s control of 28.22% of the cyber warfare market revenue is largely driven by the critical need to protect national security interests and military assets from increasingly sophisticated cyber threats. As cyber threats continue to evolve and become more complex, the importance of robust cybersecurity measures in the defense sector has never been more apparent.

This dominance in the market is further reflected in the substantial investments made by governments and defense organizations in cybersecurity. These investments are aimed at enhancing their capabilities to thwart potential attacks, ensuring the safety and integrity of sensitive information and infrastructure. As a result, the defense sector plays a pivotal role in shaping the landscape of cyber warfare readiness and resilience.

Recent Developments in the Cyber Warfare Market

- North Korea’s Cyber Warfare Advancements: In March 2025, North Korea took a significant step in enhancing its cyber warfare capabilities by establishing a new research center, Research Center 227, under the military’s Reconnaissance General Bureau (RGB).

- Mastercard’s Strategic Acquisition: In March 2025, Mastercard acquired Recorded Future, a leading threat intelligence company, for $2.65 billion. This acquisition significantly enhances Mastercard’s cybersecurity capabilities, particularly in threat intelligence, which is crucial for anticipating and mitigating cyber warfare threats.

- Sophos Strengthens Security Services: In March 2025, Sophos acquired SecureWorks for $825 million, bolstering its managed security services offerings. This acquisition strengthens Sophos’ position in providing comprehensive cybersecurity solutions, including those needed for cyber warfare defense.

- SecureOps and DataDefend Merger: In March 2025, SecureOps and DataDefend merged to form a combined entity valued at $1.5 billion. This merger aims to deliver end-to-end security solutions, focusing on small and medium-sized businesses, which are often targets in cyber warfare.

- Alphabet’s Cloud Security Acquisition: In February 2025, Alphabet announced its intention to acquire Wiz for $32 billion. Wiz’s cloud security solutions are expected to significantly enhance Alphabet’s cybersecurity offerings, particularly in protecting cloud infrastructures from cyber warfare threats.

Cyber Warfare Market Key Players:

- AIRBUS

- BAE Systems

- Booz Allen Hamilton Inc

- DXC Technology Company

- General Dynamics Corporation

- Intel Corporation

- IBM Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman

- Raytheon Technologies Corporation

- L3Harris Technologies Inc

- Other Prominent Players

Market Segmentation Overview

By Components

- Solution

- Services

By Cyber Warfare Type

- Cyber Attacks

- Espionage

- Sabotage

- Others

By Application

- Defense

- Government Agencies

- Aerospace

- Homeland Security

- Enterprise

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/cyber-warfare-market