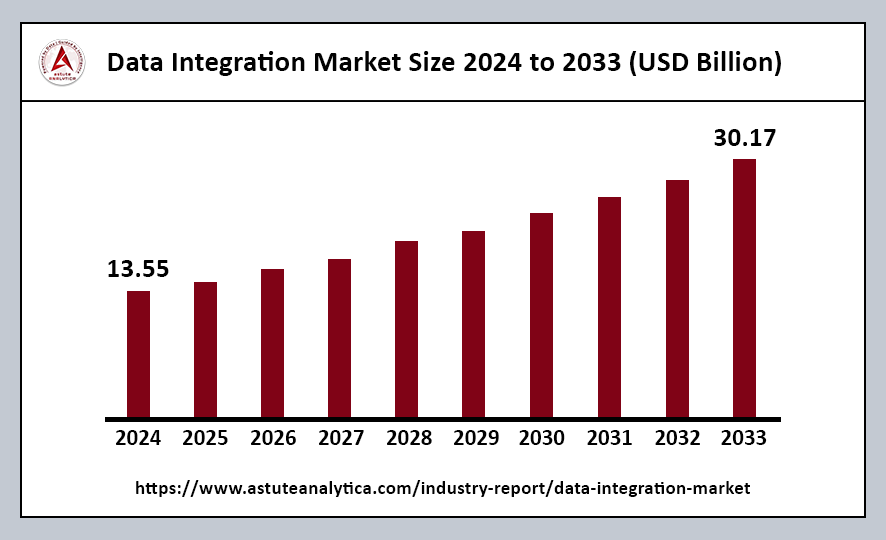

The global data integration market was valued at US$ 13.55 billion in 2024 and is projected to reach US$ 30.17 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 9.30% during the forecast period from 2025 to 2033.

The demand for data integration is rapidly increasing, driven by several key developments reshaping how organizations manage and leverage vast amounts of information. As businesses increasingly transition their workloads to the cloud, cloud-based integration tools have emerged as essential solutions. These tools offer remarkable scalability and flexibility, significantly reducing infrastructure costs while ensuring seamless connectivity across various cloud environments.

Modern enterprises are now relying on automated pipelines, swift analytics, and coordinated governance to unify their sprawling systems. This integration is crucial for insightful decision-making and supporting secure, scalable digital transformation initiatives. As organizations navigate the complexities of data management, data integration stands out as the linchpin that facilitates effective operations and drives business success in an increasingly data-driven landscape.

Data Integration Market Key Takeaways

- By Component, Tools dominates the data integration market, commanding a substantial 71% share.

- In terms of applications, more than 56% of the revenue in the data integration market is derived from marketing applications.

- When examining market share by end users, the IT & Telecom industry stands out, holding over 23% of the data integration market.

- Regarding deployment models, over 67% of data integration market deployments are reported to remain on-premises.

Regional Analysis

North America’s Dominance in the Data Integration Market

North America commands over 40% of the global data integration market, consistently establishing itself as a global trendsetter in this field. This significant market share is primarily due to the region’s dense concentration of technology giants and multinational corporations.

- Role of Venture Capital in Accelerating Technology Rollouts: North America’s robust venture capital ecosystem plays a crucial role in accelerating technology rollouts. Startups in the region are able to attract sizable investments aimed at scaling their interoperability solutions. This influx of capital allows these companies to develop and refine their technologies, ensuring they remain competitive in a fast-paced market.

- Impact on Global Best Practices: Market analysts have observed that data integration providers operating across North America, from Canada to California, play a vital role in piloting advanced fusion tools. These tools are instrumental in enhancing data orchestration processes and are often recognized as setting global best practices.

Predicted Growth in Asia Pacific

From 2025 to 2033, the Asia Pacific region is expected to witness the highest growth in the data integration market. This growth can be attributed to several key factors that are shaping the competitive landscape within the region.

- Focus on Product Portfolio Expansion: Leading competitors in the Asia Pacific data integration space are prioritizing the expansion of their product portfolios. This focus on product enhancement helps in attracting new customers and retaining existing clients who seek innovative and effective solutions.

- Increased Investments and Strategic Alliances: The top competitors are significantly increasing their investments in technology and infrastructure. This investment surge is essential for driving advancements in data integration solutions and ensuring that companies can keep pace with the rapid market evolution.

- Initiatives Supporting Industry Growth: Several initiatives have been implemented to support the anticipated growth of the data integration market in the region. As the regional e-commerce trade continues to flourish, the demand for efficient data integration solutions is expected to rise.

Top Trends Escalating the Data Integration Market

Emergence of Automated Data Harmonization Tools: The rise of automated data harmonization tools powered by AI and intelligent pipeline orchestration technologies is transforming how organizations manage their data. By leveraging AI, these systems can intelligently adapt to changing data landscapes, facilitating real-time data processing and enhancing overall data quality.

Rapid Uptake of Low-Code Integration Platforms: There is a significant shift towards low-code integration platforms, which promote citizen development and scalable enterprise collaboration. This democratization of data integration fosters innovation and allows organizations to respond more swiftly to evolving business needs.

Expansion of Edge-Based Data Processing Frameworks: The expansion of edge-based data processing frameworks is crucial for reducing latency and improving data quality. By processing data closer to its source, organizations can achieve faster response times and minimize the delays associated with sending data to centralized cloud servers.

Growing Demand for Real-Time Analytics: As businesses navigate constantly shifting and ever-evolving ecosystems, there is a growing demand for real-time analytics and seamless interoperability. Organizations are increasingly seeking solutions that enable them to analyze data as it flows in, allowing for timely decision-making and agile responses to market changes.

Increased Adoption of Hybrid Cloud Architectures: The adoption of hybrid cloud architectures is on the rise, providing organizations with the agility needed for effective data processing and operational efficiency. By combining on-premises infrastructure with cloud services, businesses can optimize their data management strategies, balancing the benefits of both environments.

Surging Focus on AI-Powered Data Governance Solutions: There is a surging focus on AI-powered data governance solutions aimed at enhancing reliability and trustworthiness. These solutions leverage artificial intelligence to automate compliance processes, monitor data usage, and ensure data integrity.

Data Integration Market Segmentation

By Component

Tools highlight their pivotal role in streamlining enterprise-level data flows. These tools provide advanced functionalities that centralize, transform, and synchronize information across various systems. This capability results in faster analytics and enhances data governance significantly.

By Application

Marketing applications generate maximum revenue, underscoring the mission-critical importance of unified customer insights. Marketers are increasingly dependent on consolidated platforms that gather, cleanse, and harmonize data from various sources, including social media feeds, CRM databases, and content management systems.

By End Users

The IT & Telecom industry holds a significant position in the data integration market. This prominence highlights the need for continuous, real-time visibility across extensive data streams within telecom networks and IT services. In this sector, data integration plays a crucial role in fostering consistent customer experiences by consolidating subscriber details, usage patterns, and technical support logs into unified dashboards.

By Deployment

Over 67% of data integration market deployments are reportedly on-premises, indicating a strong preference for in-house control over sensitive business assets. This on-premises approach is particularly prevalent in highly regulated sectors that manage extensive repositories of transactional records. Moreover, many enterprises in the data integration market opt for on-premises deployments as a strategy to future-proof their existing data architectures.

Data Integration Market Recent Developments

- Pentagon’s New Data Integration Experiments: In April 2025, the Pentagon Department of Defense (DoD) Chief Data and AI Office (CDAO) launched a new series of experiments aimed at enhancing data integration. This initiative is designed to ensure operators can fully leverage advanced command-and-control (C2) capabilities, as noted by a senior Pentagon tech official.

- Precisely’s Data Link Program: In March 2025, Precisely introduced the Data Link program, which aims to simplify the integration of its data portfolio with datasets from trusted partners through pre-linked connections. This program provides access to a robust ecosystem of datasets linked via unique identifiers utilized by Precisely and its partners.

- IDeaS and API Data Integration: In March 2025, IDeaS, a SAS company, announced the launch of its API data integration developer portal. This platform is designed to facilitate efficient data integrations and promote collaboration among technology providers within the ecosystem.

- archTIS’s Progress in Data Protection: In February 2025, archTIS Ltd reported significant advancements in commercializing its data protection and integration solutions over the past six months. The company secured a $2.3 million contract with the Australian Department of Defence and expanded its partnerships.

- Launch of Databasin by Technology Partners: In February 2025, Technology Partners announced the launch of Databasin, a next-generation data integration and automation platform. This platform is designed to help enterprises streamline data management and accelerate AI adoption.

- ARN Data Match for Marketing Enhancement: In February 2025, ARN introduced ARN Data Match, a new capability aimed at assisting clients in enhancing their marketing strategies through first-party data matching. This solution allows brands to integrate their customer data with ARN’s audience insights, improving targeting and campaign effectiveness.

Top Players in Data Integration Market

- Denodo Technologies

- IBM

- Informatica Inc.

- Microsoft

- Oracle

- QlikTech International ABs

- SAP

- SAS Institute Inc.

- Talend

- TIBCO Software Inc.

- Other Prominent Players

Market Segmentation Overview:

By Component

- Tools

- Services

By Deployment

- On-Premise

- Cloud

By Organization Size

- Large Enterprises

- Small & Mid-Size Enterprises

By Business Application

- Marketing

- Operations & Supply Chain

- Finance

- Sales

- HR

By End-user

- Healthcare

- IT & Telecom

- BFSI

- Manufacturing

- Retail & E-commerce

- Government & Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/data-integration-market