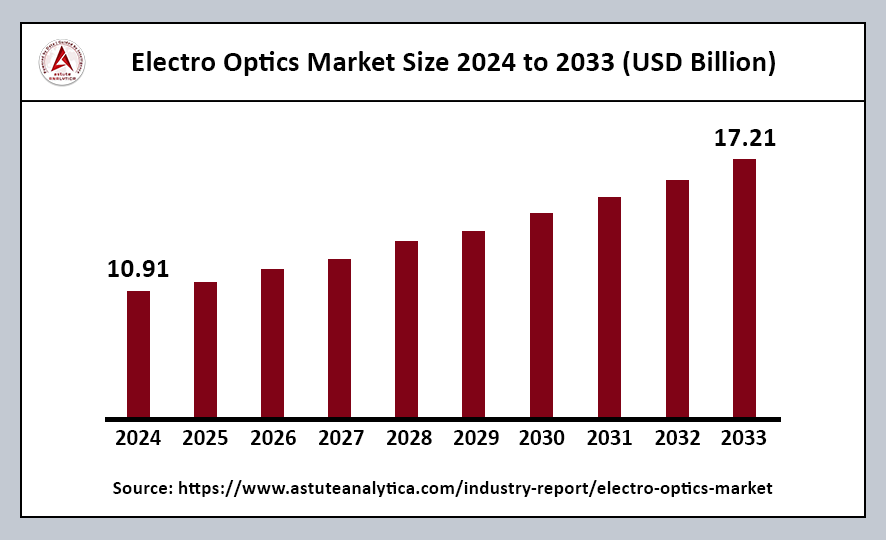

The global electro optics market was valued at US$ 10.91 billion in 2024 and is projected to reach US$ 17.21 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 5.20% during the forecast period from 2025 to 2033.

Electro optics is the integration of optical engineering and electronics, resulting in devices that can detect, image, or process signals at remarkable speeds. This fusion has led to significant advancements in various fields, particularly defense, autonomous vehicles, and medical diagnostics. As these sectors grow, the demand for electro-optic technologies is expanding globally.

The rapid miniaturization of components and the emphasis on robust testing are key factors driving the growth of electro optics. These advancements are not only enhancing the performance of existing devices but also unveiling vast opportunities for collaborative research and development (R&D). Continuous improvements in manufacturing processes further contribute to the evolution of this field, allowing for the creation of more sophisticated and efficient electro-optic systems.

Electro Optics Market Key Takeaways

- By Product Type, Laser systems have solidified their status as the centerpiece of the electro-optics market, commanding over 30% market share.

- By End Users, the defense and aerospace sector has rapidly emerged as the principal consumer of the electro-optics market.

- In terms of application, air-based applications have emerged as the strongest segment of the electro-optics market, holding over 40% market share.

Regional Analysis

North America’s Dominance in the Electro-Optics Market

North America maintains a leadership position in the electro-optics market, holding over 35% of the market share. This dominance is attributed to the region’s robust industrial ecosystems and extensive research capabilities, which foster innovation and development in electro-optical technologies.

- Heavy Investment in Defense and Aerospace: The region invests heavily in both air-based and land-based systems to remain at the forefront of applications in defense, aerospace, and homeland security. This commitment to investment ensures that North America continues to advance its technological capabilities, addressing the evolving needs of various sectors, including national defense and public safety.

- Rise in Production Through Advanced Fabrication: Production within the North American electro-optics market is experiencing a swift rise, driven by advanced fabrication methods. These methods enhance efficiency and quality, enabling companies to meet the growing demand for electro-optical products. Many firms are also sourcing components locally, which helps ensure shorter lead times and facilitates rapid prototyping, further streamlining the development process.

- Regulatory Support for Research and Development: Regulatory support plays a crucial role in propelling regional dominance in the electro-optics market. U.S. agencies are dedicating funds to specialized research labs investigating emergent laser and infrared systems. This investment in research not only promotes innovation but also strengthens the competitive edge of North American companies in the global electro-optics landscape.

Rapid Growth in the Asia Pacific Region

The Asia Pacific region is anticipated to experience the fastest compound annual growth rate (CAGR) in the electro-optics market during the forecast period.

- Dominance of China and Emerging Potential of India: Within Asia Pacific, China holds a dominant position in the electro-optics market, leveraging its advanced manufacturing capabilities and technological advancements. Meanwhile, India is expected to emerge as a significant player in the near future, capitalizing on its growing defense sector and increasing focus on modernization.

- Focus on Defense Sector Investment and Modern Technology: Companies in the Asia Pacific region are placing a strong emphasis on investing in the defense sector and increasing the adoption of modern technology for safety purposes. This focus is driven by the need for enhanced security measures and the desire to stay competitive in the global market.

Top Trends Escalating the Electro Optics Market

Miniaturization of High-Precision Optical Components: The miniaturization of high-precision optical components has become a key trend in the development of wearable consumer devices. This advancement allows for the integration of sophisticated optical technologies into compact formats, enhancing the functionality and performance of various devices. As a result, consumers can benefit from improved features in smartwatches, fitness trackers, and augmented reality glasses, among others.

Integration of Fiber-Laser Modules: The integration of fiber-laser modules is significantly enhancing remote sensing and mapping capabilities. These modules provide high accuracy and efficiency, making them valuable tools for applications that require precise measurements and detailed environmental assessments. The adoption of fiber lasers in these areas is driving innovation and improving the quality of data collected for various industries.

Convergence with Artificial Intelligence: The convergence of electro-optical arrays with artificial intelligence is playing a transformative role in advanced robotics. By combining these technologies, robotic systems can achieve improved perception and decision-making abilities. This integration enables robots to interpret visual information more effectively, enhancing their functionality in tasks such as autonomous navigation and complex object manipulation.

Accelerating Adoption of Multispectral Sensors: There is a growing trend toward the adoption of multispectral sensors within next-generation advanced defense solutions. These sensors enable comprehensive analysis by capturing data across multiple wavelengths, providing critical insights for surveillance, reconnaissance, and targeting applications. Their enhanced capabilities are becoming increasingly essential for modern defense operations.

Growing Reliance on LiDAR-Based Object Detection: The reliance on LiDAR-based object detection is accelerating in automated industrial processes. This technology allows for precise mapping and identification of objects in various environments, improving safety and efficiency in operations such as warehouse management and autonomous vehicles. As industries continue to seek automation solutions, LiDAR technology is becoming a vital component of their strategies.

Heightened Demand for IR-Guided Equipment: There is a heightened demand for IR-guided equipment in a diverse range of commercial imaging applications. This equipment is invaluable for tasks that require thermal imaging and night vision capabilities, such as surveillance, security, and industrial inspections.

Electro Optics Market Segmentation

By Product Type

Laser systems have solidified their status as the centerpiece of the electro-optics market, commanding over 30% market share. This dominance is largely due to the unmatched precision, energy efficiency, and versatility that laser systems offer across various industries. Their ability to deliver highly accurate results makes them indispensable in applications that require meticulous attention to detail.

A significant driver behind the prominence of laser systems in the electro-optics market is their expanding role in emerging sectors such as LiDAR-based navigation and 3D printing. These innovative applications leverage the unique capabilities of laser technology to enhance performance and efficiency.

By End Users

The defense and aerospace sector has quickly established itself as the principal consumer of the electro-optics market, largely driven by a surge in advanced imaging and targeting requirements. This sector’s unwavering dominance can be attributed to several critical factors that highlight its reliance on cutting-edge technology for operational effectiveness.

One of the key aspects of this dominance is the necessity for real-time reconnaissance missions, which depend heavily on high-resolution cameras. These cameras are capable of capturing up to 1,000 frames per second, providing essential data that aids in immediate threat analysis. As a result, the demand for sophisticated electro-optical systems continues to grow, ensuring that the defense and aerospace sectors remain at the forefront of the electro-optics market.

By Application

Air-based applications have emerged as the strongest segment of the electro-optics market, commanding over 40% market share. This dominance can be attributed to the increasing usage of electro-optical systems in various critical areas, including surveillance, remote sensing, and high-altitude data transmission. The versatility and effectiveness of these applications make them essential tools for modern operations across multiple sectors.

A significant driver of this trend is the rising demand for drone-mounted electro-optical payloads. Various industries, particularly agriculture and disaster management, are increasingly seeking real-time mapping solutions to enhance their decision-making processes. These drone-mounted systems provide valuable data that can improve efficiency and responsiveness in operations, whether it’s monitoring crop health or assessing damage during disaster responses.

Recent Developments in the Electro Optics Market

- EDGE Unveils Advanced Systems at IDEX 2025: In February 2025, EDGE, one of the world’s leading advanced technology and defense groups, unveiled an impressive range of next-level electronic warfare (EW), radar, and electro-optical/infrared (EO/IR) systems at the International Defence Exhibition & Conference 2025 (IDEX 2025). This showcase highlights EDGE’s commitment to innovation in the defense sector and its role as a key player in advancing military technology.

- Pakistan Launches Indigenous Electro Optical Satellite: In January 2025, the Pakistan Space and Upper Atmosphere Research Commission (Suparco) successfully launched the country’s first Indigenous Electro Optical Satellite (EOS) from the Jiuquan Satellite Launch Centre (JSLC) in China. This significant achievement marks a milestone for Pakistan in its efforts to enhance its space capabilities and strengthen its technological infrastructure.

- Aselsan Expands Production Capacity: In January 2025, Aselsan, a prominent Turkish defense company, inaugurated its new electro-optic FLIR manufacturing facility. This facility represents a substantial milestone with a USD 40 million investment aimed at expanding the company’s production capacity. The inauguration signifies Aselsan’s dedication to advancing its technological capabilities and meeting the growing demands of the defense industry.

Top Players in Electro Optics Market

- Lockheed Martin

- BAE Systems plc

- Elbit Systems Ltd.

- Thales S.A.

- Teledyne FLIR LLC

- Raytheon Technologies Corporation

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Laser Systems

- Optical Coatings

- Imaging Systems

- Optical Components

- Display Technologies

- Electro-Optical Devices

By Application

- Air-based

- Land Based

- Naval based

By End User

- Consumer Electronics

- Healthcare

- Telecommunications

- Automotive

- Defense & Aerospace

- Industrial

- Research & Development

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/electro-optics-market