The old Internet-of-Things adage: ‘you can’t improve what you can’t measure’ couldn’t be more relevant to the industrial sector. With technology adoption in mining, manufacturing, and logistics industries driven by the need to maximize productivity and minimize operating costs, IoT sensors play a critical role in collecting data and insight to optimize industrial operations.

Industrial IoT sensor technology (IIoT) seeks to enable greater industrial automation, improved worker safety, and streamlined maintenance planning. From cameras, LiDAR, and radar for machine vision in robotics, to skin patches and miniaturized gas sensors in smart personal protection equipment, emerging IIoT applications present growth opportunities for a variety of sensor technologies. IDTechEx’s report, “Sensor Market 2025-2035: Technologies, Trends, Players, Forecasts”, predicts that the global sensor market will exceed US$250B by 2035, with industrial sensor technology remaining central to growth over the next decade.

Vision, touch, and key senses for industrial robots

Rising labor expenses and the expansion of e-commerce are propelling mobile robot technologies across warehouses, factories, and fulfillment centers, where they are utilized for a wide range of logistical tasks. Intralogistics, material handling, case picking, and last-mile delivery are growing application markets for IIoT sensor technology in mobile robotics.

Sensors in robots can be used for various tasks ranging from measuring force, detecting objects, navigation and localization, to collision detection and mapping. Recent advances in sensor technologies and data fusion software enable many sensors to be used for multiple purposes. For instance, cameras, together with computer vision systems, can be used for collision detection as well as navigation and localization.

Collision detection sensors are essential for safety and are needed for many types of industrial robots functioning around human operators, such as autonomous mobile robots (AMRs) to collaborative robots. Autonomous mobility in industrial robotics has been popular for a few years, with many AMRs capable of driving themselves with minimal risks. IDTechEx predicts collision detection and autonomous driving sensors used in industrial robotics applications will be key sensor market growth segments.

Augmenting personal protection equipment for greater worker safety

Workplace safety incidents are reported to cost around US$167B every year in the US alone. Manufacturing, construction, transportation, and storage industries experience the highest level of work-related accidents, representing greater than 20% of all incidents. A large portion of this cost is lost productivity, with 103 million and 35 million working days lost each year due to injury in the USA and UK, respectively.

IIoT sensor technology can potentially mitigate these costs through the measurement and proactive monitoring of key indicators relevant to common industrial workplace incidents. Smart personal protection equipment (PPE), for example helmets, integrated with wearable gas and motion sensors detect hazardous working conditions (dangerously high air quality index) and anomalous activity behavior (changes in motion indicative of an accident).

Wearable skin patches for hydration and sweat analysis are emerging within mining, and oil and gas industries. In these industries, the risks of not rehydrating can include cognitive impairment which leads to injury, as well as the physiological effects of dehydration itself. Wearable hydration sensors provide workers with personalised alerts to help them rehydrate more proactively. For example, Epicore Biosystems, an emerging leader in the industrial wearable sensors market, provides ‘skin-like’ wearable microfluidic solutions for sweat analysis in industrial safety applications.

Workplace safety can potentially be a high-volume market for emerging IIoT sensor technology. Integration of wearable IIoT sensors into PPE will require affordable products supplied with an accompanying data monitoring platform and demonstrate tangible risk mitigation in related use cases. One route to market for sensors in smart PPE could be offering worker monitoring as a service instead of hardware solutions alone – offering a ready-to-use product solution with an accompanying risk management platform would reduce the barriers to adoption for industrial customers.

Minimizing downtime with machine health monitoring and predictive maintenance

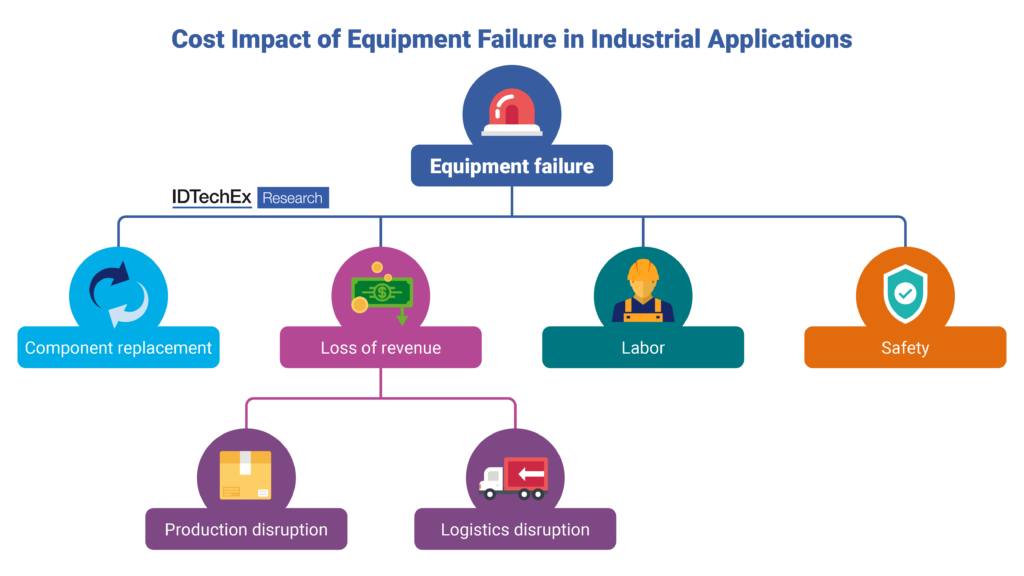

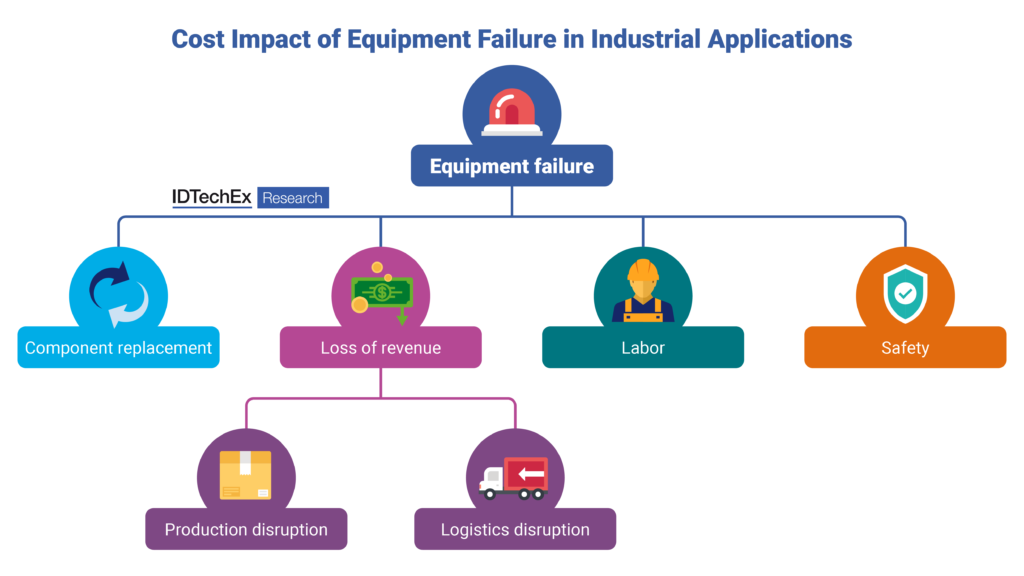

Equipment failure is a major time and money sink in industry, with the impact of disruption on operations reported to represent up to 15% of total production costs. The biggest cost impact is lost revenue due to production downtime and logistics disruption. Labor is another major factor, in addition to the cost of replacing defunct components or equipment.

IIoT sensor technology promises to reduce equipment failure, and thus downtime, through machine health monitoring solutions. Gyroscopic sensors attached to machines can measure up to 2 kHz vibrational frequencies, characteristic of imbalance, looseness or misalignment issues. MEMS accelerometers are suitable for higher frequency measurement, identifying issues with gearing and lubrication (3-10 kHz), as well as fan bearings and cooling failures (10-100 kHz). Diagnosing machine health issues through anomalous vibration profiles of equipment can identify problems proactively, enabling scheduled maintenance of aging and failing parts before failure.

The rise of edge computing technology sees sensor manufacturers increasingly integrate edge AI into industrial IoT sensors. Analog Devices, STMicroelectronics, and TDK are amongst several OEMs in the sensor market integrating pre-trained machine learning models onto sensors to provide predictive maintenance functionality. As these technologies emerge, reducing the total cost of ownership will be a key challenge. Maintenance costs are low when equipment is operating as usual, therefore there is limited capital available for investment in predictive maintenance solutions.

Conclusions and outlook

Future industrial IoT solutions will rely on an ecosystem of industrial intelligence to marry sensor data and insight with actionable improvement and optimization of operations. Sensors in industrial robotics are streamlining manufacturing and logistics industries through greater automation. Industrial worker safety is rapidly emerging as a growth market for wearable sensors, offering environmental condition and activity monitoring to manage risk in hazardous work environments. Global trends in edge computing and AI are renewing interest in machine health monitoring, where smart vibration sensors are being deployed to enable predictive equipment maintenance.

The industrial IoT sensor market remains key to established and emerging technology providers, although growth is historically slow to materialize. The absence of one-size-fits-all solutions applicable to a broad range of industries lengthens product development and implementation time, posing a persistent barrier to demonstrating value to customers. This challenge is often compounded by the complexities of integrating new sensor technology into aging legacy infrastructure. In the face of this, sensor success in industrial IoT will require a reduction in total cost of ownership and the long return on investment periods of IoT solutions.

IDTechEx’s report, “Sensor Market 2025-2035: Technologies, Trends, Players, Forecasts”, critically evaluates key sensor applications in industrial IoT, environmental IoT, and consumer IoT markets. The report provides a comprehensive overview of the global sensor market, with insights and critical analysis of emerging sensor application markets in future mobility, IoT, wearable technology, printed electronics, and edge computing. The report contains ten-year global sensor market forecasts from 2025-2035, segmented by sensor technology, including semiconductor sensors, gas sensors, automotive and aerospace sensors, biosensors, sensors for future mobility, quantum sensors, image sensors, and silicon photonic sensors.