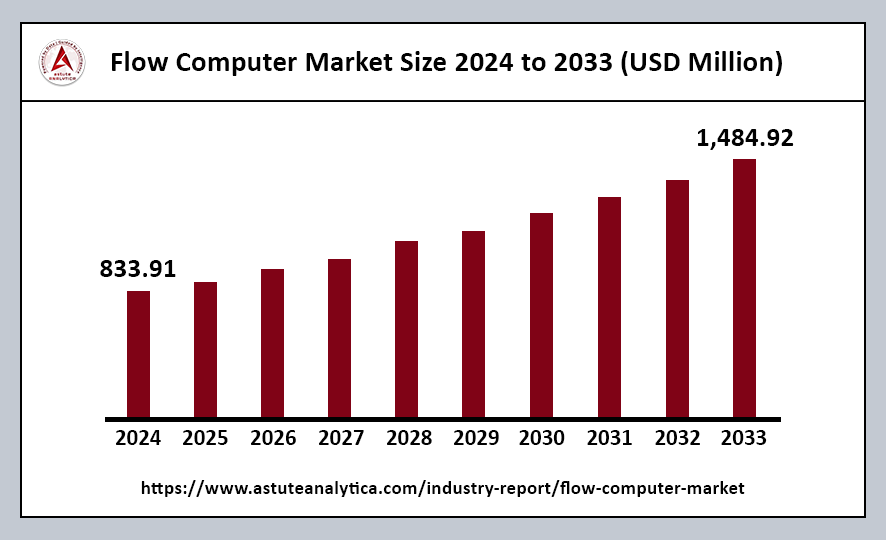

The global flow computer market was valued at US$ 833.91 million in 2024 and is projected to reach US$ 1,484.92 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 6.80% during the forecast period from 2025 to 2033.

The adoption of flow computers is rapidly accelerating, driven by factors such as pipeline modernizations, challenges associated with multiphase measurement, and the evolving demands of end users. This trend reflects the industry’s need for improved efficiency and accuracy in fluid management. A flow computer is a specialized device designed to measure and compute fluid or gas flow in real time. It ensures precise data capture and control for various industrial processes, playing a vital role in operational effectiveness.

Among the most prominent types of flow computers are single-run, multi-run, and hybrid systems. These systems are often integrated with advanced software solutions that enable accurate volumetric or mass-based calculations, enhancing their functionality and reliability in different applications. The integration of AI-enhanced capabilities further bolsters this growth, allowing for smarter, more efficient management of fluid flows and contributing to improved operational outcomes.

Flow Computer Market Key Takeaways

- By Application, Custody transfer constitutes the primary application area for flow computer systems, accounting for over 38% of all deployments.

- In terms of end use, the oil and gas sector remains the leading consumer of flow computers, representing over 32% of usage.

- When examining components, hardware dominates the landscape of modern flow computing, accounting for over 55% of deployments.

- In the realm of product types, wired flow computers continue to hold a commanding position with over 70% market share.

Regional Analysis

North America’s Market Share

North America commands over 35% of the flow computer market, a position driven by a long-established industrial base, stringent regulations, and a vigorous push toward digitalization.

- Infrastructure and Opportunities: Several infrastructure reports indicate that pipeline networks in the United States span over 3 million kilometers, presenting significant opportunities for the implementation of flow computing technologies. This extensive network facilitates the efficient transport of fluids, making accurate flow measurement essential for operational success.

- U.S. Leadership in Flow Computing: The United States plays a crucial role in leading the flow computer market, hosting numerous exploration ventures, refineries, and midstream storage facilities that all require consistent flow validations. As industrial facilities increasingly automate their operations and environmental regulations continue to tighten, North America’s dominance in the flow computer market is expected to persist.

- Comprehensive Ecosystem: This comprehensive ecosystem—encompassing pipelines, refineries, data centers, and water treatment plants—supports the region’s enduring lead in both new installations and upgrades. The combination of established infrastructure and a commitment to technological advancement positions North America as a key player in the ongoing evolution of flow computing solutions.

European Flow Computer Market Overview

The flow computers market in Europe emerged as a dominant force in 2024, largely due to the region’s stringent regulatory environment.

- Importance of Regulatory Compliance: European regulations require precise measurement and monitoring of fluid flows to ensure both environmental compliance and operational safety. As a result, flow computers play a critical role in helping companies meet these regulatory demands. They provide accurate and reliable flow rate and volume data, which is essential for maintaining compliance and ensuring safe operations.

- Role of Flow Computers: By offering precise measurements, flow computers not only assist companies in fulfilling legal obligations but also contribute to improving overall efficiency and reducing potential risks associated with fluid management. This reliance on accurate data underscores the importance of flow computers in the European market as a vital component for regulatory adherence and operational excellence.

APAC Flow Computer Market Overview

The Asia Pacific (APAC) flow computer market secured the highest revenue share of the global market in 2024, primarily driven by rapid industrialization across the region.

- Demand Driven by Oil and Gas Reserves: The APAC region is home to some of the world’s largest oil and gas reserves, which has resulted in a continuous push for exploration and production activities. Flow computers are essential in these operations, as they play a crucial role in accurately measuring and controlling fluid flows. This capability is vital for ensuring operational efficiency and compliance with industry standards.

- Investments in Infrastructure: The increasing investments in pipeline infrastructure and the development of new oil and gas projects have further bolstered the demand for flow computers in the region. As companies expand their operations and enhance their infrastructure, the need for reliable flow measurement technology becomes even more critical, solidifying the position of flow computers as indispensable tools in the APAC market.

Top Trends Escalating the Flow Computer Market

Rapid Emergence of Integrated IoT Solutions: The integration of IoT solutions is rapidly enhancing the interoperability of flow computer systems. As industries increasingly adopt connected devices, the ability to communicate and share data across various platforms becomes essential.

Accelerated Adoption of Edge Computing Architectures: There is a notable acceleration in the adoption of edge computing architectures within critical flow applications. By processing data closer to the source, edge computing reduces latency and enhances the speed of data analysis. This shift allows organizations to make quicker, data-driven decisions, which is particularly beneficial in environments where timely responses are crucial.

Rising Interest in Customized Firmware Updates: Another trend is the growing interest in customized firmware updates that offer specialized measurement functionalities. These updates allow flow computer systems to adapt to specific operational needs, enhancing their measurement capabilities.

Growing Integration of Sensors and Software: The integration of sensors and software is increasingly recognized for its role in advanced flow optimization. By combining sophisticated sensors with intelligent software algorithms, companies can achieve a more comprehensive understanding of flow dynamics.

Increasing Focus on Multiphase Measurement Accuracy: There is also an increasing focus on multiphase measurement accuracy in complex industrial pipelines. As industries deal with various fluids and phases, ensuring accurate measurements becomes more challenging yet critical. Enhanced measurement technologies are being developed to address these complexities, ensuring that flow computers can provide reliable data across diverse conditions.

High Demand for Real-Time Data Analytics: The high demand for real-time data analytics is driving significant gains in operational performance. Organizations are leveraging real-time data to optimize processes, reduce downtime, and improve overall efficiency. The ability to analyze data as it is generated allows for immediate adjustments and proactive management, which is essential in today’s fast-paced industrial environments.

Flow Computer Market Segmentation

By Application

Custody transfer is the primary application area for flow computer systems, accounting for over 38% of all deployments. This prominence is largely driven by the stringent requirements for accurate and auditable measurements that are essential in this context. In custody transfer scenarios, precision is paramount, as it directly impacts financial transactions and regulatory compliance. The robust design of flow computer systems is a direct response to the demands of contractual frameworks in the industry.

In such agreements, even minor inaccuracies in measurement can lead to substantial monetary liabilities. As a result, these devices are engineered to ensure high accuracy and reliability, safeguarding the interests of all parties involved in the custody transfer process. By prioritizing precision, flow computers help mitigate risks associated with financial discrepancies and maintain trust in commercial relationships.

By End Use Industry

The oil and gas sector stands out as the leading end user of flow computers, accounting for over 32% of usage. This prominence is largely due to the industry’s unwavering commitment to precise measurement throughout the entire process, from extraction to final distribution. Accurate flow measurement is essential for ensuring efficiency and compliance in operations, which is why flow computers are integral to the sector.

Industry literature reveals that at least five major standards—AGA-3, AGA-7, AGA-8, API MPMS, and ISO 5167—govern flow measurement practices across various stages, including production, pipeline transportation, and refining. These standards are not merely guidelines; they are intrinsically embedded in flow computer programming. This integration ensures that the data collected is consistent and reliable, which is crucial for effective allocation, reservoir management, and custody transfer. By adhering to these standards, flow computers help maintain the integrity of operations in the oil and gas industry.

By Component

Hardware plays a crucial role in modern flow computing, accounting for over 55% of deployments. This dominance is largely due to the specialized and rugged designs that these systems offer, enabling them to handle real-time measurements in various environments. Field documentation highlights that top-tier flow computer assemblies typically consist of at least five core modules.

These include CPU boards equipped with built-in math libraries, which enhance computational efficiency. Additionally, the assemblies feature analog and digital I/O cards for versatile data input and output, isolated power supplies to ensure stable operation, robust enclosures that protect the components, and communication interfaces that facilitate seamless data transmission.

By Product Type

Wired flow computers maintain a market share of over 70% due to their robust connectivity and reduced susceptibility to interference compared to wireless systems. In recent industrial audits, at least 11 recognized solution providers have launched updated wired models featuring multiple communication protocols, including advanced serial and Ethernet interfaces. Many field engineers agree that wired units can reliably transmit data in extreme ambient temperatures ranging from −40°C to 85°C without compromising signal integrity.

Top Companies in the Flow Computer Market

- ABB

- Honeywell International, Inc.

- SICK AG

- Emerson Electric Co.

- SLB

- Yokogawa Corporation of America

- OMNI Flow Computers, Inc.

- Schneider Electric

- Thermo Fisher Scientific Inc.

- Dynamic Flow Computers, Inc.

- KROHNE Group

- Kessler-Ellis Products (KEP)

- TechnipFMC plc

- FLOWMETRICS

- Other Prominent Players

Market Segmentation Overview:

By Component

- Hardware

- Software

- Services

- Consulting Services

- Integration Services

- Support & Maintenance Services

By Product Type

- Wired Flow Computers

- Wireless Flow Computers

By Application

- Custody Transfer

- Pipeline Flow Monitoring

- Wellhead Monitoring

- Others

By End-Use Industry

- Oil & Gas

- Energy & Power

- Water & Wastewater

- Chemical

- Food & Beverage

- Pulp & Paper

- Metal & Mining

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/flow-computer-market