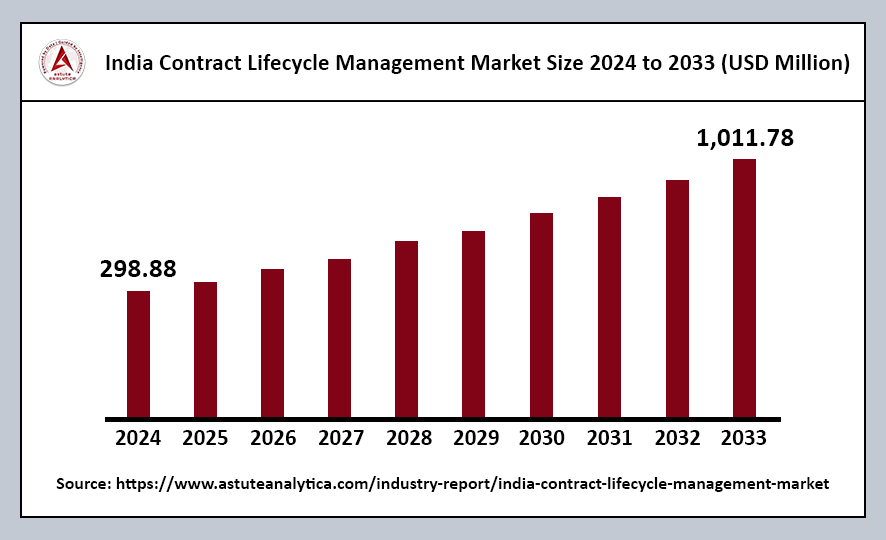

The India contract lifecycle management market was valued at US$ 298.88 million in 2024 and is projected to reach US$ 1,011.78 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 14.51% during the forecast period from 2025 to 2033.

Contract lifecycle management (CLM) refers to the comprehensive process of creating, negotiating, executing, and renewing contracts within a structured digital environment. In India, the CLM domain combines extensive legal expertise with advanced automation technologies, significantly improving the efficiency of procurement, vendor onboarding, and complex mergers and acquisitions (M&A) deals.

Service providers in this space are increasingly leveraging artificial intelligence (AI) to generate real-time risk alerts, enhancing the ability to manage and mitigate potential issues proactively. This innovative approach not only streamlines contract processes but also ensures that organizations remain compliant with various regulations. Looking ahead, it is clear that multi-lingual, compliance-centric solutions will be essential industry imperatives, as businesses strive to navigate the complexities of global contracts and regulatory environments effectively.

India Contract Lifecycle Management Market Key Takeaways

- By Deployment, in 2024, cloud deployment is anticipated to account for over 77.2% of the market share in the contract lifecycle management sector.

- By Model, in 2024, it is estimated that 81.58% of contract lifecycle management market dealings in India will involve B2B transactions.

- By Industry, Indian IT giants are embracing contract lifecycle management (CLM) as their strategic cornerstone, controlling over 22.4% of the market share.

- By Function, Contract management and analysis have emerged as India’s preferred CLM function, capturing nearly 33.9% of the market share.

Top Trends Escalating the India Contract Lifecycle Management Market

Surge in AI-Infused Contract Analytics: There is a significant surge in AI-infused contract analytics driving error-free drafting and negotiation cycles. By leveraging artificial intelligence, organizations can enhance accuracy and efficiency in their contract processes, minimizing the potential for errors during critical phases.

Integration with India-Specific eSignature and eStamping Frameworks: The widespread integration of contract management with India-specific eSignature and eStamping frameworks is gaining momentum. This integration facilitates smoother execution of contracts by ensuring compliance with local regulations while simplifying the signing and documentation processes.

Focus on Hyperlocal Data Residency Solutions: A growing focus on hyperlocal data residency solutions is emerging as businesses aim to address India’s stringent privacy legislation demands. By storing data within the country, organizations can adhere to legal requirements while enhancing trust among consumers regarding data protection.

Immediate Compliance with Evolving Digital Regulations: The Indian financial services sector is experiencing an intensified impetus for immediate compliance with evolving digital regulations. As the regulatory landscape shifts, organizations are compelled to adapt swiftly to ensure compliance and mitigate risks associated with non-compliance.

Escalation of Complex Outsourcing Contracts: In India’s vibrant technology service landscape, there is a rapid escalation of complex outsourcing contracts. As companies seek to optimize operations and tap into specialized expertise, the complexity of these contracts is increasing, necessitating robust management solutions.

Government Mandates on Electronic Documentation: Government mandates are encouraging electronic documentation to streamline procurement, taxation, and vendor governance processes. By promoting digital documentation, these initiatives aim to enhance efficiency and transparency in administrative operations across various sectors.

India Contract Lifecycle Management Market Segmentation

By Function

Contract Management & Analysis has emerged as the preferred function within India’s contract lifecycle management (CLM) landscape, capturing nearly 33.9% of the market share. Businesses that implement active CLM solutions tend to prioritize this function above other modules, such as contract authoring or repository services. This emphasis reflects a growing recognition of effectively managing and analyzing contracts to maximize their value.

A significant factor driving this focus on contract management and analysis is the capability to handle multiple contract variations. Organizations are increasingly dealing with diverse agreements, necessitating sophisticated tools that can accommodate these complexities. This adaptability is crucial for ensuring compliance and optimizing contract performance across various scenarios.

By Deployment

In 2024, cloud deployment is expected to account for over 77.2% of the market share in the contract lifecycle management (CLM) sector. This significant figure reflects the growing preference among businesses for cloud-based solutions, which offer numerous advantages pivotal for modern operations.

One of the primary reasons businesses are adopting cloud-based CLM is the ease of scaling and the convenience of software updates. Organizations appreciate the flexibility that cloud solutions provide, allowing them to adapt quickly to changing business needs without the complications associated with traditional software installations.

By Model

B2B transactions held around 81.58% of the contract lifecycle management market in India in 2024, highlighting its enterprise-centric focus. This significant percentage underscores the importance of tailored solutions that cater specifically to the needs of businesses engaged in complex contractual relationships.

A key driver of this trend is the reliance of large corporations on specialized contract terms rather than standardized templates. As these organizations navigate intricate agreements, they require robust contract lifecycle management (CLM) solutions that effectively address their unique requirements. This demand for customization is crucial for ensuring compliance and minimizing risks associated with contract management.

By Industry

Indian IT giants are increasingly adopting Contract Lifecycle Management (CLM) as a strategic cornerstone, controlling over 22.4% of the market share. These organizations frequently manage contractual obligations for international clients, making multi-jurisdictional compliance a significant driver behind the adoption of CLM solutions.

The contract lifecycle management market within IT companies is fueled by a unique combination of global reach, complex project structures, and rapid development cycles. This blend of factors necessitates efficient management of contracts to ensure compliance and optimize operational efficiency, solidifying CLM’s role as an essential tool for these organizations.

Recent Developments in the India Contract Lifecycle Management Market

- Ironclad Enhances Contract Management Features: In April 2025, Ironclad, the leading AI-powered contract lifecycle management platform, announced the introduction of new features designed to help procurement and legal teams maximize the value derived from their contracts. These enhancements aim to streamline processes and improve overall contract management efficiency.

- Workday Unveils AI-Powered Contract Solutions: In March 2025, Workday, Inc., a prominent player in the software industry with a market capitalization of $66.8 billion, announced the availability of new artificial intelligence (AI)-powered contract management solutions. This initiative reflects Workday’s commitment to integrating advanced technology into its offerings, enhancing contract management for its users.

- SpotDraft Secures Series B Funding: In February 2025, SpotDraft, an AI-driven contract lifecycle management (CLM) platform tailored for in-house legal teams in India, successfully raised $54 million in its Series B funding round. This round was led by Vertex Growth Singapore and Trident Partners, positioning SpotDraft for further growth and innovation in the legal tech space.

Top Players in India Contract Lifecycle Management Market

- Agiloft

- Docusign, Inc.

- Icertis

- Ironclad

- Conga

- Capricorn Identity Services Pvt. Ltd.

- Certinal Inc.

- SirionLabs, Inc.

- ContractPodAi

- CobbleStoneSoftware

- SpotDraft

- Others

Market Segmentation Overview:

By Function

- Contract Management & Analysis

- Contract Review

- Workflow

- Contract Negotiation

- Contract Approval

- Contract Execution

- Others

By Deployment

- Cloud Based

- On-Premises

By Model

- B2B

- B2C

By Industry

- Information Technology

- Healthcare

- Finance

- Real Estate

- Manufacturing

- Others

Source: https://www.astuteanalytica.com/industry-report/india-contract-lifecycle-management-market