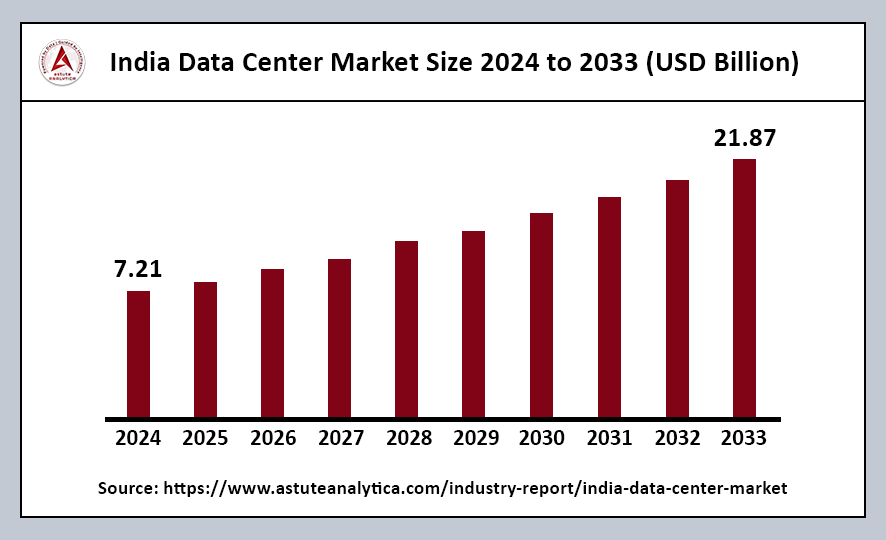

The India data center market was valued at US$ 7.21 billion in 2023 and is projected to reach US$ 21.87 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 13.37% during the forecast period from 2025 to 2033.

Over the next ten years, India’s data center market is anticipated to undergo significant growth driven by rapid digitalization and enhanced internet access. The market is projected to achieve substantial value in the coming years, with major cities such as Mumbai and Chennai at the forefront of capacity expansion. Key players in India’s data center landscape include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, CtrlS, Sify, and Yotta Infrastructure, all contributing to the dynamic development of the industry.

India Data Center Market Key Takeaways

- By Hardware, in 2023, servers comprised over 37.05% of the total revenue in India’s data center market for hardware. Their dominant share highlights their critical role in managing and processing vast data within these facilities.

- In terms of end users, the Banking, Financial Services, and Insurance (BFSI) sector emerged as the largest segment in India’s data center market, accounting for more than 32.80% of the market share.

Top Trends Escalating the India Data Center Market

Adoption of Cloud Computing: The widespread adoption of cloud computing is significantly driving the demand for advanced data centers. As businesses increasingly migrate to cloud-based solutions, robust infrastructure supporting these services becomes paramount.

Emergence of Edge Computing: The rise of edge computing, fueled by the proliferation of the Internet of Things (IoT), is reshaping the data center landscape. Edge computing allows data processing to occur closer to the source, enhancing performance and reducing latency, which is essential for IoT applications.

Focus on Sustainability, Renewable Resources, and Energy Efficiency: There is a growing emphasis on sustainability within the data center industry, with a focus on utilizing renewable resources and improving energy efficiency. Companies are increasingly investing in green technologies to minimize their environmental footprint while maintaining operational effectiveness.

Growing Digitalization of Businesses and Reliance on Technology: As businesses continue to digitalize, their reliance on technology intensifies. This trend drives the demand for data centers that can support the necessary infrastructure for various digital initiatives, from cloud services to data analytics.

Rise of E-Commerce and Online Services: The surge in e-commerce and online services is significantly expanding data needs. As more consumers turn to digital platforms for shopping and services, businesses require scalable data solutions to handle increased traffic and transaction volumes.

Data Localization Mandates: Data localization mandates are prompting increased investments in local data centers. These regulations require businesses to store data within specific geographical boundaries, leading to a surge in the establishment of data centers that comply with local laws and regulations.

India Data Center Market Segmentation

By Hardware

In 2023, servers contributed to over 37.05% of the total revenue in India’s data center market for hardware. Other components, such as storage systems, power supply and cooling systems, and racks, are comparatively less costly than data center servers. This cost disparity arises because servers serve as the backbone of data centers, managing large volumes of information and performing crucial processing tasks. Their central role in data operations underscores their significance in the overall infrastructure of data centers.

By End Users

The Banking, Financial Services, and Insurance (BFSI) sector is the largest end user in India’s data center market, accounting for over 32.80% of the market share. This growth has been propelled by rapid digitalization and strategic investments within the industry. The increasing reliance on advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain for various BFSI operations has created a heightened demand for storage facilities, further driving the need for data centers. As these complex systems become integral to operations, the sector’s requirement for robust data infrastructure continues to expand.

Recent Developments in the India Data Center Market

- New Data Center Launch by ST Telemedia Global Data Centres: In April 2025, ST Telemedia Global Data Centres announced the launch of a new data center in Kolkata, India. Spanning 5.59 acres, the campus is designed to support up to 25MW of power. The first phase, known as STT Kolkata 2, features a two-story facility that totals 6MW across 243,500 sq ft (22,620 sqm), marking a significant addition to the region’s data infrastructure.

- Adani Group’s Investment in Data Centers: In April 2025, the Adani Group revealed plans to invest an additional $10 billion (Rs 1000 crore) to establish data centers in India. This investment is driven by the surging demand for artificial intelligence and business process-led services, positioning the Adani Group to capitalize on the growing digital landscape.

- Neon Cloud’s Launch in Gurgaon: In March 2025, Neon Cloud made its debut in India with a new data center located in Gurgaon, just southwest of New Delhi. The platform offers a range of cloud services, including virtual machines and Kubernetes, with plans to soon introduce access to GPUs. Additional services include block storage, object storage, secure backups, virtual private cloud, cloud firewall, and load balancing, catering to diverse business needs.

- NetSuite Expands to India: In February 2025, NetSuite announced the opening of data centers in the Oracle Cloud Mumbai Region and the Oracle Cloud Hyderabad Region. This marks the first time NetSuite will operate data centers within India, significantly enhancing its service offerings in the region.

- Blackstone Group’s Hyperscale Data Center Project: In another major development in February 2025, the Blackstone Group, the world’s largest alternative asset manager, along with its development partner Panchshil Realty, is planning to construct India’s largest hyperscale data center in Navi Mumbai. With a capacity of 500 MW, this ambitious project involves an investment of over Rs 20,000 crore, underscoring the growing importance of data center infrastructure in India.

Top Players in India Data Center Market

- Tata Communications Ltd

- STT GDC INDIA Pvt Ltd

- CtrlS Datacenters Ltd

- Sify Technologies

- Netmagic Solutions Pvt Ltd

- Web Werks India Pvt Ltd

- ESDS Software Solutions Ltd

- NxtGen Datacenter and Cloud Technologies Pvt Ltd

- GPX India Pvt Ltd

- Yotta Data Services Pvt. Ltd

Market Segmentation Overview:

By Hardware

- Servers

- Blade servers

- Rack servers

- Tower servers

- Micro servers

- Storage Systems

- Storage Area Network (SAN)

- Network-Attached Storage (NAS)

- Direct-Attached Storage (DAS)

- Cloud storage

- Power and Cooling Systems

- Power Supply

- Uninterruptible Power Supply (UPS) systems

- Generators

- Power distribution units (PDUs)

- Cooling Solutions

- Air conditioning units

- Liquid Cooling Systems

- Advanced Cooling Technologies

- Racks and Enclosures

- Open frame racks

- Enclosed Racks

- Customized Enclosures

By End Users

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Government

- Manufacturing

- Others

Source: https://www.astuteanalytica.com/industry-report/india-data-center-market