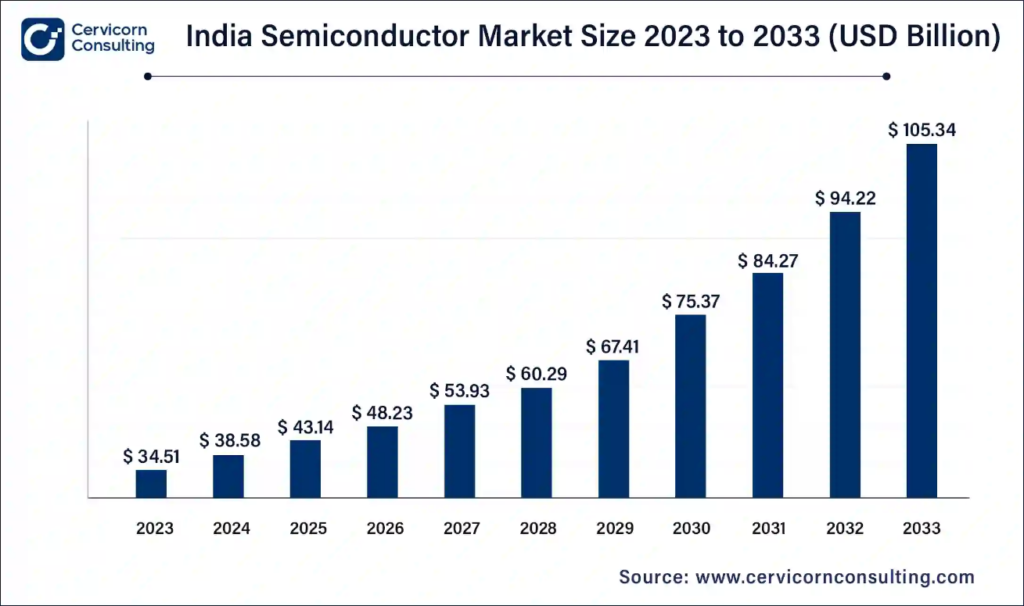

According to Cervicorn Consulting, the India semiconductor market size is anticipated to exceed around USD 105.34 billion by 2033 and is expanding at a CAGR of 20.70% from 2024 to 2033.

The semiconductor market in India is experiencing rapid growth, driven by increasing digital adoption and the rise of technology-focused industries. The Indian government has recognized the potential of this sector and is creating a supportive environment through policies aimed at promoting local manufacturing and innovation. Global companies are increasingly setting up operations in India, attracted by the country’s rising demand for electronics, especially in sectors like smartphones, consumer electronics, and electric vehicles (EVs). These investments are aimed at expanding semiconductor production capacity and reducing import dependence. India’s large and expanding population also contributes to a growing consumer base, making it an attractive market for semiconductor-powered products. The country’s burgeoning tech start-up ecosystem, which relies heavily on advanced semiconductor solutions for developing next-generation products, further strengthens the market.

A semiconductor is a material that has electrical conductivity between that of a conductor and an insulator, enabling it to control the flow of electric current. Common semiconductor materials include silicon, germanium, and gallium arsenide. Semiconductors are crucial components in modern electronics like computers, smartphones, televisions, and solar cells. Their ability to conduct electricity under specific conditions and insulate under others makes them essential in the creation of transistors and integrated circuits (ICs), which are vital for digital systems. Essentially, semiconductors serve as the “brain” of electronic devices, allowing for computation, communication, and data processing. As technology continues to evolve, the demand for semiconductors is growing, with advancements in AI, IoT, and 5G driving further development.

India’s semiconductor market includes the production and sale of semiconductors, which are vital for electronic devices. The sector is growing due to factors such as the rapid expansion of the electronics and automotive industries, government initiatives like “Make in India” and the Production Linked Incentive (PLI) scheme, increased investment in research and development, and rising demand for technologies like IoT, 5G, and AI. The demand for localized semiconductor manufacturing is rising as India seeks to reduce import dependency.

Prime Minister Narendra Modi has approved the establishment of the country’s first semiconductor fabrication facility, a joint venture between Tata and Powerchip Taiwan, set to be built in Dholera, Gujarat. With an investment of INR 270 billion, this plant is expected to produce 48 million chips daily.

Samsung Semiconductor India Research (SSIR) has also set up an R&D facility in Bengaluru. The Ministry of Electronics and Information Technology (MeitY) recently announced that two semiconductor firms based in Karnataka, Saankhya Labs (a subsidiary of Tejas Network) and Sensesemi Technologies, have been approved as beneficiaries of the Design-Linked Incentive (DLI) Scheme.

Latest Investments in India Semiconductor Market

India’s semiconductor market has seen significant investments in recent years, driven by the country’s growing demand for electronic goods and the government’s strategic initiatives to boost local manufacturing. Here are some key investments and developments in India’s semiconductor sector:

1. Tata and Powerchip Taiwan Semiconductor Fabrication Facility

- Investment: INR 270 billion

- Details: In July 2022, Prime Minister Narendra Modi approved the establishment of India’s first semiconductor fabrication facility, a joint venture between Tata and Powerchip Taiwan. Located in Dholera, Gujarat, this facility is set to produce 48 million chips daily, marking a significant milestone in the country’s push to build a robust semiconductor manufacturing ecosystem.

2. Samsung Semiconductor India Research (SSIR) R&D Facility

- Investment: Undisclosed

- Details: Samsung launched a semiconductor research and development facility in Bengaluru. This investment supports the company’s commitment to advancing semiconductor technologies in India and positions the country as a key hub for semiconductor research and development in Asia.

3. Intel’s Investment in India

- Investment: $100 million (for R&D)

- Details: In 2020, Intel announced an investment of $100 million in India, focusing on R&D to strengthen its presence in the country and develop solutions for the global market. The investment will also aid in India’s semiconductor design and innovation ecosystem.

4. India Semiconductor Mission (ISM)

- Investment: INR 76,000 crore ($10 billion)

- Details: The Indian government has allocated INR 76,000 crore as part of its India Semiconductor Mission (ISM) to incentivize semiconductor manufacturing and design in India. Under the ISM, the government aims to establish semiconductor manufacturing plants, design and testing labs, and provide financial support to global companies to set up operations in the country.

5. Foxconn Investment in India

- Investment: $1 billion (for electronics manufacturing)

- Details: Foxconn, a major Taiwanese electronics manufacturer, is investing around $1 billion in India to build semiconductor manufacturing capabilities. This investment will support the Indian government’s “Make in India” initiative and position India as a major player in the global electronics manufacturing supply chain.

6. Saankhya Labs and Sensesemi Technologies

- Investment: Undisclosed (through Design-Linked Incentive (DLI) Scheme)

- Details: The Ministry of Electronics and Information Technology (MeitY) announced that two Karnataka-based semiconductor firms, Saankhya Labs (a subsidiary of Tejas Networks) and Sensesemi Technologies, were approved for financial assistance under the Design-Linked Incentive (DLI) Scheme. This initiative encourages local design and innovation in semiconductor technologies and strengthens India’s capabilities in chip development.

7. Micron Technology Investment

- Investment: $1.5 billion

- Details: Micron Technology has committed to investing $1.5 billion in India to expand its presence in the country. This includes R&D facilities and a focus on enhancing semiconductor memory and storage technologies, contributing to India’s growing semiconductor ecosystem.

8. Taiwan Semiconductor Manufacturing Company (TSMC)

- Investment: Undisclosed (Potential investment plans)

- Details: TSMC, the world’s largest contract semiconductor manufacturer, is reportedly in discussions with the Indian government regarding potential investments in semiconductor manufacturing facilities in India. While no official announcements have been made, India is positioning itself as an attractive location for such high-value investments.

9. Global Semiconductor Companies Expanding Operations in India

- Investment: Various undisclosed amounts

- Details: Several global semiconductor companies, including Qualcomm, Nvidia, and Broadcom, have been expanding their operations and R&D capabilities in India, drawn by the country’s growing digital adoption and tech-driven sectors. These companies are making investments in both semiconductor design and development as well as in supporting infrastructure.

Government Initiatives and Funding:

- The Indian government has set up initiatives such as the Production Linked Incentive (PLI) scheme for electronics manufacturing, which also includes semiconductor manufacturing.

- The India Semiconductor Mission (ISM) aims to attract both domestic and international investments to develop the semiconductor manufacturing ecosystem.

- The government is also looking to boost the electronics manufacturing ecosystem, with a focus on creating semiconductor manufacturing hubs to cater to both domestic and international markets.

India Semiconductor Market Segmental Analysis

Type Analysis:

- Discrete Semiconductors: The market for discrete semiconductors in India is growing due to their use in power management, LED lighting, and automotive electronics. Advancements in packaging technology and the demand for energy-efficient components across industries are key trends.

- Optoelectronics: The demand for optoelectronics is driven by expanding applications in telecommunications, healthcare, and consumer electronics. Adoption of LEDs for lighting and displays, as well as advances in optical sensors and photovoltaic devices for renewable energy, are driving growth.

- Sensors: The demand for sensors in India is rising in sectors like automotive, industrial automation, and consumer electronics. Key trends include the integration of sensors with IoT platforms, advancements in MEMS technology, and the development of smart sensors for healthcare and environmental monitoring.

- Integrated Circuits (ICs): ICs dominate the Indian semiconductor market, particularly in telecommunications, computing, and automotive industries. Trends include the shift to smaller node sizes, demand for system-on-chip (SoC) designs, and innovations in semiconductor materials and architectures.

- Others: Other segments include power management ICs, analog ICs, and memory devices. These are driven by IoT device proliferation, AI applications, and specialized semiconductor solutions for emerging technologies like 5G and autonomous vehicles.

Application Analysis:

- Networking and Communication: The demand for semiconductors is growing due to the adoption of 5G and the expansion of telecommunications networks. IoT devices, data traffic growth, and smart city initiatives further increase the need for advanced networking and communication semiconductor solutions.

- Data Processing: As digital transformation accelerates, the demand for semiconductors in data centers, servers, and computing devices is rising. Efficient data processing capabilities are becoming increasingly important in India’s semiconductor market.

- Consumer Electronics: The expanding middle class and rising disposable income in India are driving demand for consumer electronics like smartphones, laptops, and smart TVs. Advanced semiconductor chips enabling AI, augmented reality (AR), and high-speed connectivity are fueling innovation and adoption.

- Power Generation: Renewable energy integration and smart grid technologies are driving semiconductor demand in power generation, distribution, and energy management. Semiconductors play a critical role in efficient power conversion and control systems in the energy sector.

- Electronic Components: The demand for discrete semiconductors, ICs, and sensors is growing in sectors like automotive, industrial automation, and healthcare. Digitization and automation further increase the need for reliable, high-performance electronic components.

- Others: Other segments include automotive electronics, defense and aerospace, and medical electronics, each requiring specialized semiconductor solutions for applications such as autonomous vehicles, secure communications, and advanced medical diagnostics.

End-User Analysis:

- Telecommunication: The expansion of 4G and 5G networks in India is driving demand for semiconductors. Trends include integrating RF components, high-speed data processing ICs, and optical communication technologies to support increasing data traffic.

- Energy: The energy sector is benefiting from innovations in power management ICs, renewable energy technologies, and smart grid solutions. Energy-efficient semiconductors are increasingly used in solar inverters, battery management systems, and IoT-enabled energy monitoring devices.

- Electrical and Electronics: Demand from the consumer electronics, home appliances, and industrial automation sectors is boosting semiconductor growth. Trends include IoT device proliferation, the demand for high-performance processors and memory chips, and advancements in display technologies.

- Medical and Healthcare: In the medical sector, semiconductors are essential for diagnostic imaging, patient monitoring, and wearable health devices. Trends include the development of miniaturized sensors, IoT-enabled devices, and AI-driven diagnostics powered by high-performance computing and data analytics.

- Automotive: The automotive sector is being driven by advancements in electric vehicles (EVs), connected cars, and autonomous driving technologies. Semiconductor components are critical for ADAS systems, infotainment systems, and vehicle electrification, helping meet stringent safety and emissions standards.

- Aerospace: The aerospace sector’s demand for semiconductors includes avionics, satellite communications, and defense systems. Trends include a need for ruggedized components, high-speed data converters, and radiation-hardened ICs for space missions and military aircraft.

- Defense and Military: In defense and military applications, semiconductors are used in radar systems, communications equipment, and electronic warfare systems. The focus is on secure, reliable semiconductor solutions, FPGA-based systems, and advances in sensor technologies and encryption.

- Government: Government projects, such as those related to smart cities, digital governance, and national security, are driving semiconductor demand. Investments in cybersecurity, IoT infrastructure, and public service initiatives aimed at resource management further support this growth.

- Others: Other sectors driving semiconductor demand include industrial automation, agriculture technology, and education. Trends include the use of IoT-enabled industrial sensors, robotics systems, and educational electronics kits to foster STEM education and innovation.