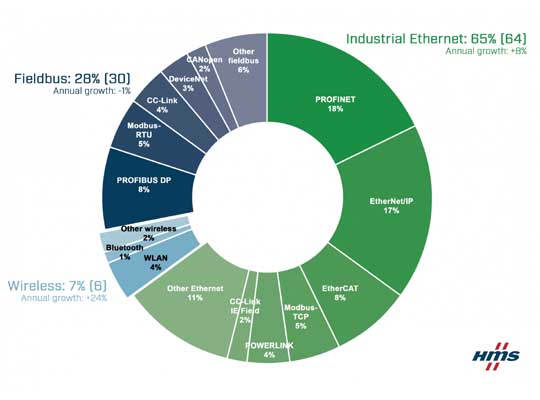

Every year, HMS Networks carries out a study of the industrial network market to analyze the distribution of new connected nodes in factory automation. This year’s study shows that, despite the Corona pandemic, the industrial network market is expected it to grow by 6% in 2021. Industrial Ethernet still shows the highest growth and now has 65% of new installed nodes (64% last year), while fieldbuses are at 28% (30). Wireless networks continue to climb and are now at 7%. PROFINET passes EtherNet/IP at the top of the network rankings with 18% market share compared to 17%.

HMS Networks now presents their annual analysis of the industrial network market, focusing on new installed nodes within factory automation globally. As an independent supplier of solutions within Industrial ICT (Information and Communication Technology), HMS has a substantial insight into the industrial network market. The 2021 study includes estimated market shares and growth rates for fieldbuses, industrial Ethernet and Wireless technologies.

The study concludes that the industrial network market is showing signs of regained stability and HMS expects the total market to grow by 6% in 2021.

Industrial Ethernet is growing steadily

Growing by 8%, Industrial Ethernet continues to take market share. Industrial Ethernet now makes up for 65% of the global market of new installed nodes in Factory Automation (compared to 64% last year). EtherNet/IP and PROFINET are fighting for first place, but this year PROFINET passes EtherNet/IP at the top of the network rankings with 18% market share compared to 17%. EtherCAT continues to perform well globally and now matches the leading fieldbus PROFIBUS at 8% market share. Modbus TCP is next at 5% market share and together with fieldbus brother Modbus RTU, these Modbus technologies now account for 10% of the market, confirming their continued importance in factory installations globally.

Fieldbus decline halted

The ongoing fieldbus decline reported by HMS in recent years is almost halted with a fieldbus decrease of only -1% in 2021, as factories tend to stick to existing technologies to a higher degree in uncertain times, such as during the pandemic. Fieldbuses are now at 28% market share of the total amount of new installed nodes (30% last year). PROFIBUS is still the clear fieldbus leader at 8% followed by Modbus-RTU at 5% share and CC-Link at 4%.

Wireless is here to stay

Wireless continues to grow rapidly at a rate of 24%. Wireless now has 7% market share but the market still awaits the full impact of 5G in factories. With ongoing global activities about wireless cellular technologies as enablers for next level smart manufacturing, HMS expects that market demand will increase for wirelessly connected devices and machines to be included in the less cabled and flexible automation architectures of the future.

Smart and sustainable manufacturing requires networking

“Industrial network connectivity for devices and machines is key to obtain smart and sustainable manufacturing, and this is the main driver for the growth we see in the industrial networking market,” says Anders Hansson, Chief Marketing Officer at HMS Networks. “Factories are constantly working to optimize productivity, sustainability, quality, flexibility and security. Solid industrial networking is key to achieving these objectives.”

Regional network variations

EtherNet/IP and PROFINET are leading in Europe and the Middle East with PROFIBUS and EtherCAT as runners up. Other popular networks are Modbus (RTU/TCP) and Ethernet POWERLINK. The U.S. market is dominated by EtherNet/IP with EtherCAT gaining some market share. PROFINET and EtherNet/IP lead a fragmented Asian market, followed by strong contenders CC-Link/CC-Link IE Field, PROFIBUS, EtherCAT and Modbus (RTU/TCP).

Scope:

The study includes HMS’ estimation for 2021 based on number of new installed nodes within Factory Automation. A node is defined as a machine or device connected to an industrial field network. The presented figures represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and overall perception of the market.