According to the Graphical Research new growth forecast report titled North America SD-WAN Market By Component (Solution [Physical Appliance, Virtual Appliance], Service [Training & Consulting, Integration & Maintenance, Managed Service]), By Deployment Model (On-premise, Cloud, Hybrid), By Application (IT & Telecom, BFSI, Healthcare, Retail & Consumer Goods, Government, Manufacturing), is set to exceed USD 5 billion by 2025.

The rising demand for the next-generation 5G network is supporting the SD-WAN market growth in the region. The dependency of 5G on network performance will enable the efficient allocation of network resources to satisfy users’ demands, increasing the demand for SD-WAN solutions. The region is witnessing huge investments for trials of the 5G network. For instance, in February 2018, the Federal Communications Commission (FCC) planned to launch new auctions of high band spectrum to speed up 5G networks. According to FCC, carriers in the region have made huge investments to develop & test 5G networks.

The managed solution is expected to hold the major share over the forecast period due to the demand for outsourced implementation of the WAN to minimize the complexities associated with in-house deployment. The enterprises are shifting to managed SD-WAN services as they are not able to match the rapidly changing technological landscape. The managed solution helps enterprises to solve challenges such as enhancement in hardware platforms and upgrading of software licenses. SD-WAN technology providers, such as Cisco, VMWare, and Citrix, are adding SD-WAN technologies to their service portfolios through strategic partnerships with other companies in the ecosystem. In October 2018, CenturyLink, a telecommunication service provider, partnered with Cisco on SD-WAN service. The company added Cisco’s Viptela technology to broaden its SD-WAN portfolio.

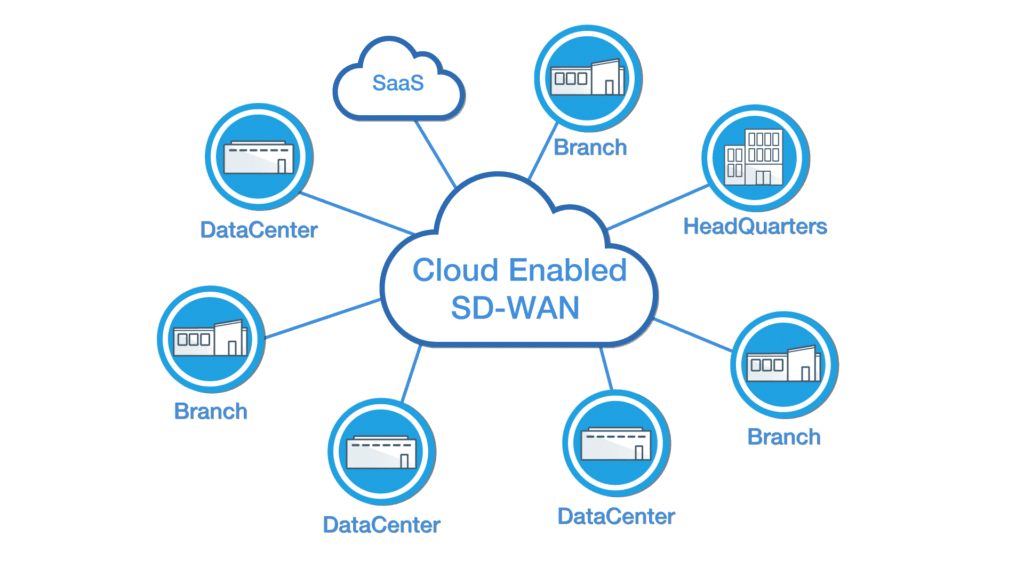

The hybrid cloud deployment model is expected to show the highest growth rate of over the forecast period as it enables enterprises to deploy on-premise cloud to host critical workloads and makes use of the third-party public cloud to host less-critical resources. Enterprises are deploying hybrid WAN as it provides efficiency to select route and improve the business application performance by enabling path selection for traffic movement.

The hybrid cloud deployment model is expected to show the highest growth rate of over the forecast period as it enables enterprises to deploy on-premise cloud to host critical workloads and makes use of the third-party public cloud to host less-critical resources. Enterprises are deploying hybrid WAN as it provides efficiency to select route and improve the business application performance by enabling path selection for traffic movement.

The U.S. expected to show the growth rate of more than 55% over the forecast period due to the increase in investments in the broadband infrastructure in the country. For instance, in January 2017, the Federal Communications Commission (FCC) allocated USD 1.5 billion to be used over the next 10 years to expand rural broadband service in around 45 states. The funding provided internet service providers with the flexibility to adopt any broadband technology to meet FCCs’ performance standards for fixed services. The increase in the adoption of cloud services and the growing Bring Your Own Device (BYOD) trend across SMEs are contributing significantly to market growth.

Some of the key vendors in the North America SD-WAN market are Aryaka Networks, Inc., Barracuda Networks, Inc., Masergy Communications, Cato Networks Ltd., Cisco Systems, Inc., Citrix Systems, Inc, CloudGenix Inc., Ecessa Corporation, Elfiq Networks, FatPipe Networks Inc., Huawei Technologies Co., Ltd., Infovista, Nuage Networks, Oracle Corporation, Peplink, Riverbed Technology, Inc., Silver Peak, Versa Networks, Inc., Dell Technologies, and ZTE Corporation.

The North America SD-WAN market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue in USD million from 2014 to 2025 for the following segments:

North America SD-WAN Market Forecast, By Component

- Solution

- Physical Appliance

- Virtual Appliance

- Service

- Training & Consulting

- Maintenance & Updates

- Managed Service

North America SD-WAN Market Share, By Deployment Model

- On-premise

- Cloud

- Hybrid

North America SD-WAN Market Size, By Application

- Telecom & IT

- BFSI

- Healthcare

- Retail and Consumer Goods

- Government

- Manufacturing

- Others