According to Cervicorn Consulting, the global quantum sensor market was valued at USD 420.32 million in 2024 and is projected to reach approximately USD 1,907.46 million by 2034, expanding at a robust compound annual growth rate (CAGR) of 16.32% from 2025 to 2034.

The growing demand for ultra-sensitive detection technologies across sectors such as healthcare, automotive, defense, and environmental monitoring is driving the expansion of the quantum sensor market. These sensors are increasingly being utilized in applications like GPS-denied navigation, magnetic resonance imaging (MRI), and precision agriculture. Quantum technologies are enabling the development of next-generation sensors with unparalleled levels of sensitivity, accuracy, and miniaturization.

Advancements in quantum computing, atomic clocks, and cryogenic systems are further enhancing sensor performance and real-world applicability. Market growth is also being accelerated by supportive government initiatives, academic-industrial collaborations, and a growing focus on commercialization. Key industry players are emphasizing R&D, prototype scalability, and strategic partnerships to maintain competitiveness. As a result, industries are witnessing a transformation driven by high-precision, quantum-enabled solutions, positioning the quantum sensor market for significant evolution.

Report Highlights

- By Region: North America led the market with the highest revenue share of approximately 36.5% in 2024, driven by strong investment and adoption across defense and research sectors.

- By Type: Atomic clocks accounted for about 40.01% of the revenue share in 2024, owing to their essential role in applications such as aerospace, telecommunications, and precision navigation.

- By Platform: Neutral atoms dominated the segment with a 36.5% revenue share in 2024, largely due to their use in ultraprecise gravimeters and high-accuracy timing devices.

- By End Use: The aerospace & defense sector led with a revenue share of around 37.5% in 2024, supported by rising implementation of GPS-independent navigation and advanced surveillance systems.

- By Application: The precision measurement segment captured approximately 36.01% of the market in 2024, driven by its foundational role in metrology, defense operations, and infrastructure monitoring.

What are the trends of Quantum Sensor Market?

1. AI Integration:

Quantum sensors generate complex and voluminous data that require real-time interpretation, making artificial intelligence (AI) a critical component in their operation. AI algorithms significantly enhance the signal-to-noise ratio in quantum measurements, improving overall sensor performance. In January 2025, SandboxAQ introduced AQNav, an AI-powered quantum sensor designed for GPS-independent navigation. The system is currently undergoing military trials, underscoring the growing importance of AI-quantum convergence. This integration boosts operational resilience in dynamic and noisy environments, while also easing the stringent technical requirements of next-generation sensing platforms.

2. Transition from Lab to Field:

Cold atom sensors, once confined to academic research, are now moving towards real-world deployment. Their ability to deliver highly accurate measurements is proving vital for navigation and geospatial applications. In April 2024, Australia’s Defence Science and Technology Group (DSTG) tested cold atom clocks for real-time navigation during naval exercises. The Humewood Marshals’ cold atom system demonstrated excellent performance in challenging marine environments—marking a significant field validation milestone. Companies are also investing in miniaturization efforts, with early results showing strong potential for widespread adoption.

3. Application in Autonomous Vehicles:

Autonomous systems, including self-driving cars and unmanned vehicles, often operate in environments where GPS signals are unreliable or unavailable. Quantum inertial sensors offer a highly precise alternative, enabling accurate positioning and orientation without GPS. In March 2025, Lockheed Martin received a U.S. military contract to develop QuINS—a quantum inertial navigation prototype intended for use in drones and submarines. This development highlights the growing focus on GPS-independent navigation for both defense and commercial autonomous platforms. As vehicle autonomy continues to evolve, quantum sensors are expected to become integral components in both the automotive and defense industries.

Quantum Sensor Market Dynamics

Market Drivers

1. Rising Demand for Advanced Inertial Systems

Quantum inertial sensors are gaining traction in the aerospace and defense sectors due to increasing threats of GPS jamming, spoofing, and signal degradation in contested environments. In December 2024, DARPA launched a flagship initiative aimed at developing deployable quantum navigation systems for GPS-denied regions. These autonomous systems offer strategic advantages, and allied nations are pursuing parallel developments to reinforce navigational independence. As geopolitical tensions rise, the emphasis on secure, satellite-independent positioning technologies is reshaping defense spending priorities worldwide.

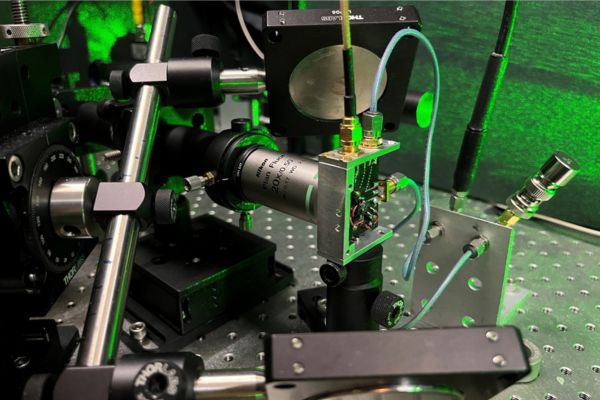

2. Breakthroughs in Laser and Photonic Technologies

Progress in laser cooling, nanofabrication, and photonic integration is making quantum sensors smaller, cheaper, and more energy-efficient. In February 2024, Sandia Labs unveiled a chip-scale quantum compass using integrated photonics, designed for room-temperature operation. This breakthrough reduces reliance on cryogenic systems and highlights the practical potential of compact photonic sensors across various industries.

3. Growing Need for Remote Sensing

Industries such as mining, energy, and environmental monitoring require highly accurate subsurface data. Quantum gravimeters and magnetometers provide unmatched precision for terrain and geospatial profiling. Since March 2025, the Defense Innovation Unit (DIU) has been piloting these sensors across diverse landscapes—deserts, forests, and urban zones—to guide commercial deployment. These quantum tools are becoming essential for data-driven exploration and environmental modeling.

Market Restraints

1. Prolonged Approval Timelines in Healthcare

Quantum diagnostic tools face significant regulatory hurdles and lengthy clinical validation processes. Despite grant funding in June 2024, quantum MRI systems remain in early testing stages without regulatory clearance. Safety concerns and skepticism within healthcare institutions further delay their integration. These barriers, along with the lack of proven use cases, extend time-to-market and restrict adoption.

2. Fragmented Industry Landscape

The quantum sensor ecosystem suffers from fragmented technological approaches and siloed R&D. While initiatives such as the UK’s quantum hubs (established in July 2024) aim to bridge academia and industry, diverse sensor modalities continue to limit interoperability. The absence of universal standards hampers system integration and scalability. Consolidation and standardization are crucial for market momentum.

3. Disjointed Research Ecosystem

Global quantum sensor development is spread across uncoordinated institutions, resulting in duplicated efforts and inefficiencies. Canada’s National Quantum Strategy (February 2025) seeks to align academic, industrial, and government priorities to boost productivity and reduce redundancy. However, without similar international coordination, commercialization remains uneven. Global collaboration is necessary to accelerate scalable innovation.

Market Opportunities

1. Military and Defense Navigation Systems

Quantum gyroscopes and accelerometers are becoming vital for stealth operations in GPS-denied zones. In April 2024, Australia’s DSTG successfully trialed quantum inertial sensors aboard naval vessels during conflict simulations, maintaining accurate navigation without satellite input. Following positive outcomes, multiple defense agencies are now negotiating procurement, signifying a pivotal moment in quantum adoption for strategic navigation.

2. Industrial Quality Control

Quantum sensors enable early-stage detection of structural defects in high-value manufacturing, offering a significant upgrade to quality assurance and predictive maintenance. In March 2025, DIU deployed quantum magnetometers to inspect aerospace components for hidden flaws. The sensors accurately detected micro-defects that traditional methods missed, leading to pilot testing across production lines and signaling future demand growth in industrial applications.

3. Plasma Diagnostics and EM Field Monitoring

Fusion energy research requires precise diagnostics for plasma behavior and electromagnetic field fluctuations—areas where quantum sensors excel. Since January 2025, ITER and its partners have integrated quantum diagnostic tools for plasma confinement. These sensors outperform legacy systems and are poised to play a central role as fusion reactors scale. This represents a long-term growth opportunity in high-energy physics and energy security.

Market Challenges

1. Cooling Limitations

Most quantum sensors require cryogenic or ultra-cold operating environments, which limit portability and increase energy demand. This restricts their use in field-based and mobile platforms. In December 2024, DARPA initiated a program targeting compact, low-power cooling systems suitable for near-room-temperature operation. Until these challenges are resolved, rugged and mobile deployment will remain difficult and costly.

2. Resistance from Legacy Industries

Conservative industries such as utilities and infrastructure face difficulties integrating quantum sensors due to high upfront costs and uncertain ROI. For example, utility companies tested quantum gravimeters for mapping but postponed further investment due to the need for infrastructure adjustments. These sectors require validated long-term case studies to justify adoption, delaying market traction.

3. Global Research Redundancy

Lack of harmonized research agendas and infrastructure coordination impedes commercialization. Canada’s 2025 quantum roadmap identified this fragmentation as a core challenge. Interstate collaboration remains limited due to competitive national priorities, which obstruct the formation of unified global platforms. Without integration, quantum sensor monetization will continue to face significant hurdles.

Quantum Sensor Market: Regional Analysis

North America

- Market Size (2024): USD 153.42 million

- Forecast (2034): USD 696.22 million

North America leads the market due to robust R&D capabilities, substantial defense budgets, and early adoption in aerospace, healthcare, and industrial sectors. The U.S. Department of Defense committed USD 70 million in June 2023 to enhance GPS-denied navigation. Canada is pushing magnetometer commercialization for geological surveys, while Mexico is investing in academic research to support future deployments. The region is expected to maintain its leadership through sustained government funding and private sector innovation.

Europe

- Market Size (2024): USD 136.18 million

- Forecast (2034): USD 618.02 million

Europe’s growth is underpinned by EU-backed initiatives, strong national strategies, and industrial demand. The UK allocated USD 130 million to quantum technologies, including aerospace and agricultural sensors. Germany’s Fraunhofer Institute is piloting tunnel detection systems, and France launched a dedicated center for quantum navigation. Pan-European collaborations, including Russo-Italian and Dutch initiatives, ensure that Europe remains highly competitive and research-focused.

Asia-Pacific

- Market Size (2024): USD 97.93 million

- Forecast (2034): USD 444.44 million

The Asia-Pacific region is expanding rapidly due to major government investments and multi-sectoral research. China leads in sensor usage and is investing USD 90 million in metro infrastructure using quantum gravimeters. India’s national quantum accelerator and Japan’s military magnetometer tests mark significant progress. South Korea and Australia are exploring applications in naval systems and industrial automation, reinforcing the region’s strategic focus.

LAMEA (Latin America, Middle East, and Africa)

- Market Size (2024): USD 32.78 million

- Forecast (2034): USD 148.78 million

LAMEA is emerging as a promising market through strategic research investments. Brazil is deploying quantum magnetometers for offshore oil mapping with USD 12 million in funding. The UAE has committed USD 15 million toward building a quantum sensor lab focused on defense and autonomy. South Africa is advancing academic pilot programs in gravimetry. While still nascent, the region is positioning itself for long-term growth in quantum sensing.