Quantum technologies are evolving at a rapid pace. Spurred by the promise of exponentially faster computation and classically unachievable sensitivity, billions of dollars are being poured into the development of quantum computers and quantum sensors. However, despite their shared use of quantum phenomena, including tunneling, entanglement, and superposition, each market’s characteristics and ten-year outlook are quite distinct. Drawing on comprehensive reports covering both quantum technologies, IDTechEx separates hype from reality to compare the opportunities over the next decade.

What are quantum computers and quantum sensors?

Quantum hardware platforms enable the initiation and manipulation of quantum states. When interfaced with more established electronics, quantum phenomena enable new computing and sensing capabilities. Quantum computers require large numbers of entangled logical qubits to exponentially reduce computation times, with multiple competing modalities aiming to reduce error rates and enhance scalability.

While the sensitivity of quantum states to external factors creates challenges for quantum computer developers, the interaction of states with properties such as motion, magnetic field, and gravity facilitates quantum sensing. Similar quantum hardware platforms can be adapted into quantum sensors and quantum computers. This includes superconducting circuits, photonic systems, cold-atoms, and nitrogen-vacancy centers in diamond. More detail about these technology platforms is covered in the IDTechEx’s reports “Quantum Sensors Market 2024-2044″ and “Quantum Computing 2023-2033”.

Application specific vs vertical agnostic

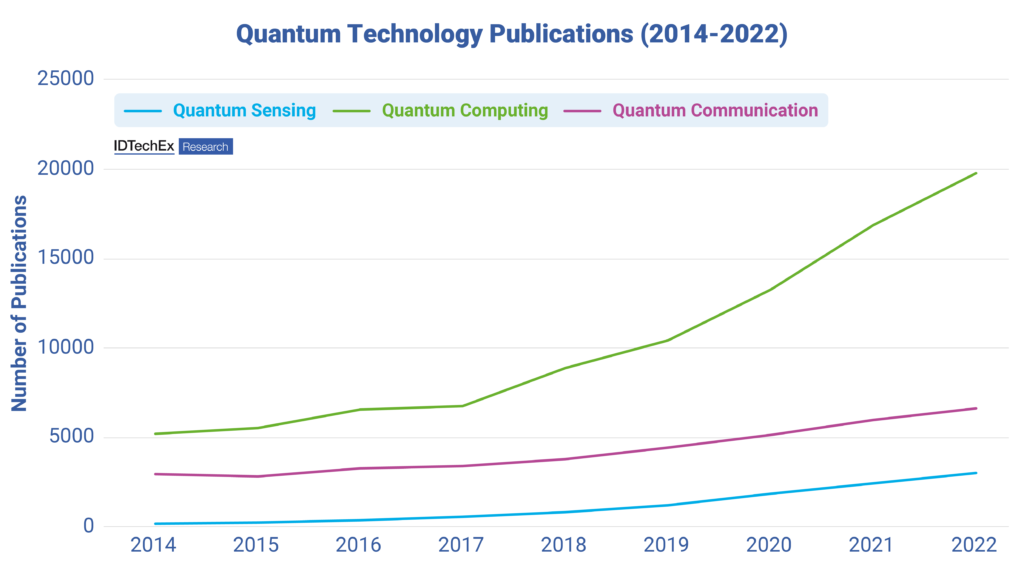

Few would deny that hype about quantum computers far outweighs that of quantum sensors. While quantum computers regularly hit the headlines while featuring in science fiction and popular culture (including a recent episode of the TV series Black Mirror), quantum sensors are yet to enter public consciousness. Even within the quantum technology community, quantum computing often overshadows interest in quantum sensing – look no further than most industry conference agendas and scientific abstracts.

Quantum computers attract most of the interest due primarily to their simple elevator pitch: an exponential reduction in computation time enabling far more complex problems to be solved than at present. Everyone uses a computer, so can easily appreciate the prospect of a much faster and more capable computer. The boom of interest in(AI) serves only to amplify interest in quantum computing. Furthermore, while the specific problems quantum computing is best suited to tackle within each industry vary, the additional processing capabilities of a quantum computer is largely market vertical agnostic.

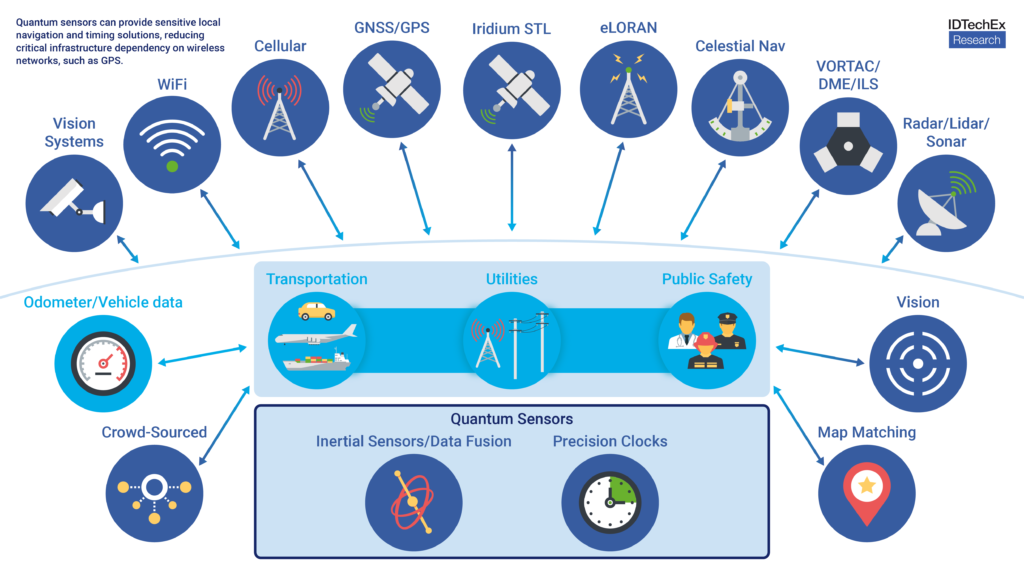

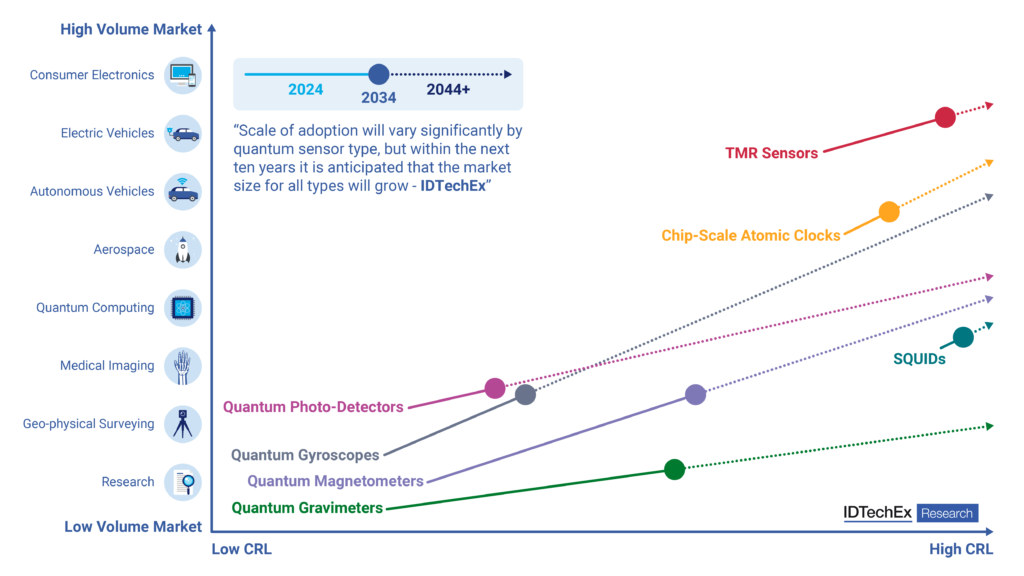

In contrast to this ‘one-to-many’ technology-to-application mapping of quantum computers, quantum sensors are far more application specific. Indeed, the ‘quantum sensing’ category represents a wide range of devices, each with a limited number of specific use cases. Device types include magnetic field sensors, gyroscopes, gravimeters, photodetectors, and even atomic clocks. Use-cases for these sensor types range from remote current sensing in electric vehicles and biomagnetic brain scanning to underground mapping and precision navigation. As such, the value offered by quantum sensing is specific within the industries for aerospace, automotive, geophysical surveying, and medical imaging. This technology-to-application specificity leads to a more fragmented ecosystem than quantum computing, diluting hype and competition.

Government funding vs private funding

Column inches dedicated to new technology and market opportunity don’t always correlate. The relative lack of hype in quantum sensing doesn’t reflect a lesser market opportunity, at least in the near and medium term – in fact, quite the opposite is more likely true. For example, one of the biggest influences on the speed at which quantum technology will come to market is funding.

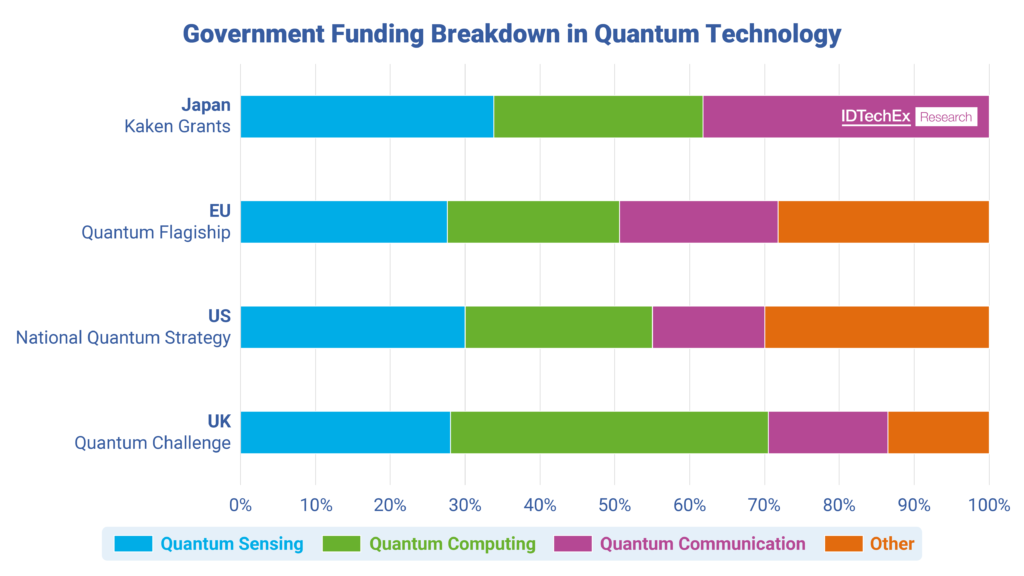

Globally, government spending is typically divided between computing, sensing (and imaging), and communications (networking). In many instances, spending committed to sensing, component manufacturer, and imaging is comparable to, if not greater than, that for quantum computing. This allocation of funding suggests that governments see societal benefits in supporting the development of quantum sensors.

On the other hand, the scale of private investment achieved by quantum computing companies in recent years has ballooned. Multiple quantum computer developers completed US$100 million dollar funding rounds – no doubt aided by the rise in public interest, as well as end-users from within the automotive, finance, chemical, and logistics industry. However, some of the most compelling business models see firms seeking to leverage quantum platforms for both computing and sensing, including established sensor companies such as Honeywell and newer players such as Infleqtion (Cold Quanta) and Qant.

Overall, the trend in quantum technology funding paints a mixed picture. While public money is broadly split equally between quantum computing and quantum sensing, the flow of private investment is far more focused on quantum computing. This could go on to limit the speed at which quantum sensing technology can be commercialized long term, as many of the challenges for component manufacture and miniaturization depend on high capital investment into specialist fabrication facilities. While significant progress is being made to miniaturize quantum sensing technology using semiconductor and MEMS fabrication techniques, many existing fabs have not invested in going quantum – instead focusing on more established, high-volume applications. Without more ‘quantum fabs, ‘ opportunities for spin-outs to operate with a fabless business model are limited, which could stall the industry.

High-volume vs high value

A crucial difference in the material opportunity for the quantum sensing and quantum computing markets is that while the former has the potential to sell high volumes of hardware, the latter depends on the shared access high-value hardware.

A quantum sensing application with the potential for high hardware sales volumes is timing and inertial navigation systems. Combinations of atomic clocks and quantum gyroscopes/accelerometers can provide precision navigation capabilities, even in GNSS (global navigation satellite systems) denied environments. Until now, chip-scale atomic clocks have remained expensive due to the complexity of manufacturing, thus limiting adoption.

However, as more quantum foundry and fabrication facilities become available and investment into component and manufacturing optimization rises, IDTechEx forecast that chip-scale atomic clocks will become mainstream. The clearest addressable market would be within autonomous vehicles, where more precise sensors improve safety and redundancy.

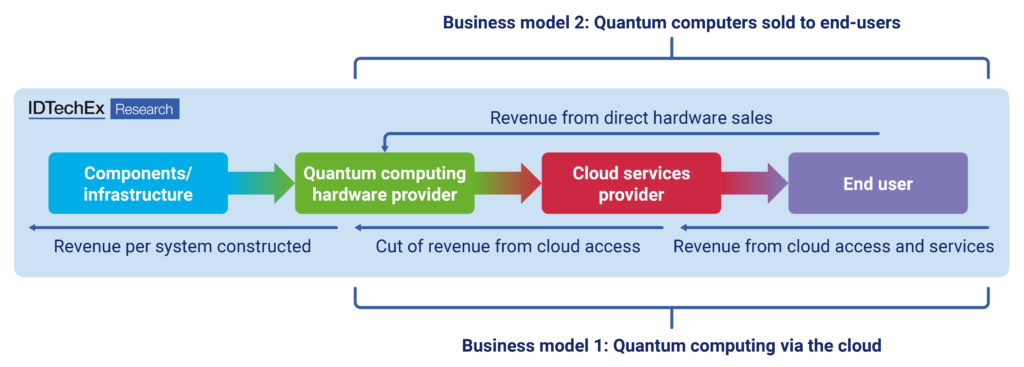

As for quantum computing, most players are confident that for the next decade, most users will access the hardware via the cloud. Unlike some quantum sensors, particularly with chip-scale architectures, many quantum computers require large cooling infrastructure and space for readout electronics. As such, hardware providers will offer access through public and private clouds, often installing a limited number of systems into co-located data centers. Longer term, the install base for quantum computers ‘on-premises’ is expected to rise, but not until the tech is clearly out-performing classical hardware for value-generating problems.

Market size vs. CAGR

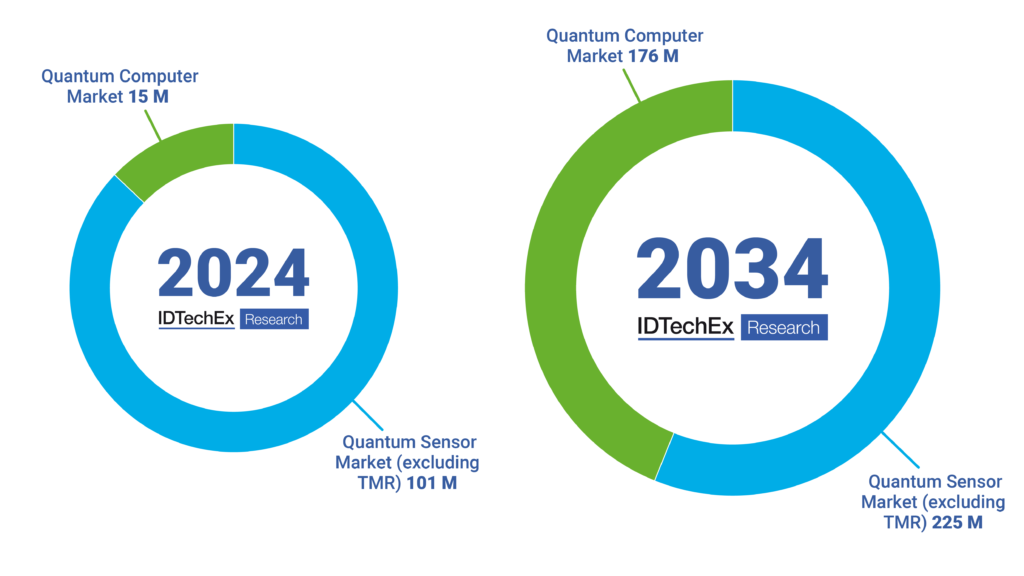

Overall, while the value of quantum computer hardware will remain high (in some instances, millions of dollars per system), the high-volume markets for quantum sensors are expected to give this category the edge in market size for the next ten years. Even excluding tunneling magneto resistance (TMR) sensors, which have been rapidly adopted for remote current sensing within electric vehicles, by 2024 IDTechEx forecasts the quantum sensor market will generate more than six times the revenue of quantum computing hardware.

Looking further to 2034, and the market share achieved by both technologies is expected to begin equaling out. By 2034, users finding value in quantum computer use is expected to have grown significantly, increasing the demand on install base. Moreover, many quantum sensing markets outside navigation and timing could even begin to saturate – as new applications in gravity sensing and medical imaging remain relatively niche. The result would be a faster-growing quantum computer hardware market.

The caveat to these conclusions is the strong dependence on how quantum technology will be priced. Many players admit that pricing models for quantum computing are very challenging to produce while the quantum commercial readiness level remains low – and the price point required for quantum sensors to compete with others in the automotive and consumer markets is also up for debate. Finally, it would be naive to ignore the interplay between the quantum sensor market and the quantum computer market. Often quantum sensors are required to readout-out qubits in quantum computers, and the optimization of fundamental components such as lasers, gas cells, and photodetectors will be crucial to the success of both markets.

More technical and commercial details and twenty-year market forecasts can be found in IDTechEx’s comprehensive reports “Quantum Sensors Market 2024-2044” and “Quantum Computing 2023-2033”. The quantum sensors market report includes 17 individual forecast lines with technology categories, including: atomic clocks, magnetic field sensors, gyroscopes, gravimeters, and image sensors – covering superconducting, photonic, diamond, cold-atom, atomic vapor, and other key hardware platforms. The quantum computing report includes eight different technology categories, including: superconducting, photonic, trapped-ion, neutral atom, silicon spin, topological, diamond defect, and annealers