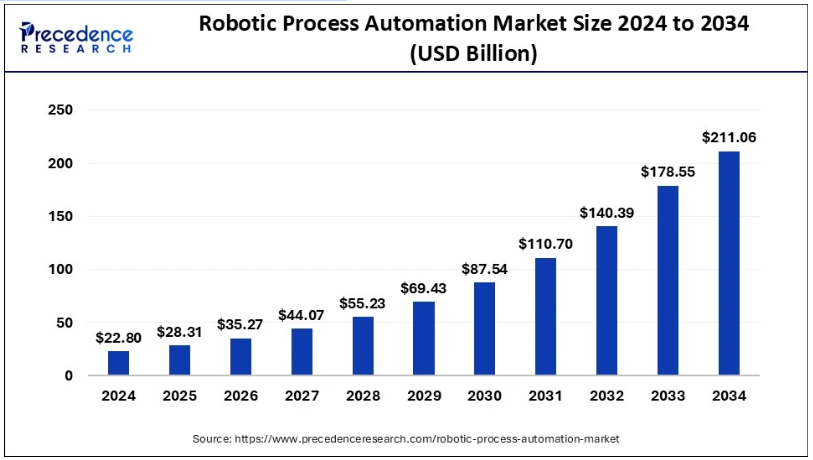

The global robotic process automation market size was valued at USD 22.80 billion in 2024 and is anticipated to reach around 211.06 billion by 2034, growing at a solid CAGR of 25.01% from 2025 to 2034.

The Robotic Process Automation (RPA) market is experiencing significant growth due to the increasing adoption of automation technologies across various industries. RPA allows organizations to automate repetitive tasks, improving operational efficiency, reducing costs, and minimizing human error. Major adopters include banking, healthcare, retail, manufacturing, and logistics. The integration of RPA with cloud computing and cognitive automation advancements is driving market expansion. As businesses continue to embrace automation, the RPA market is expected to experience robust growth, driven by increasing investments in intelligent automation solutions.

Robotic Process Automation Market Key Points

- North America dominated the global market with the largest market share of 38.92% in 2024.

- By type, the service segment contributed the highest market share of 77.21% in 2024.

- By deployment, the on-premise segment captured the biggest market share of 68.13% in 2024.

- By industry, the BFSI sector segment generated the major market share of 36.52% in 2024.

This Report is Readily Available for Immediate Delivery | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1348

Robotic Process Automation Market Trends

Increased Adoption Across Industries:

- A 2024 survey revealed that 53% of businesses have implemented RPA, with widespread adoption expected within the next two years.

Operational Efficiency and Cost Savings:

- In 2024, 52% of financial services organizations reported saving at least USD 100,000 annually through automation.

Rising Demand in the BFSI Sector:

- In 2024, the BFSI sector accounted for the largest revenue share in the RPA market.

Emergence of Cloud-Based RPA Solutions:

- In 2024, the cloud segment accounted for over 53% of the RPA market revenue, driven by benefits such as lower infrastructure costs and scalability.

Growth Among Small and Medium Enterprises (SMEs):

- The SME segment is expected to grow at a CAGR of 46.0% during the forecast period, as SMEs increasingly recognize the benefits of RPA in enhancing productivity and reducing operational costs.

Regional Market Dynamics:

- North America dominated the RPA market in 2024, while the Asia-Pacific region is projected to be the fastest-growing market, driven by adoption in industries such as pharma, healthcare, IT, retail, and manufacturing.

Challenges in Implementation:

- Many organizations tend to underestimate the time and cost required for RPA implementation, with 63% finding the implementation time longer than expected and 37% experiencing higher-than-anticipated implementation costs.

Scope of Robotic Process Automation Market

| Report Attribute | Key Statistics |

| Growth Rate From 2025 to 2034 | CAGR of 25.01% |

| Market Size in 2025 | USD 28.31 Billion |

| Market Size by 2034 | USD 211.06 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, Industry, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Analysis

North America: In 2024, North America dominated the global RPA market, accounting for 38.92% of the revenue share. The United States, a significant contributor, had a market size of USD 7.97 billion in 2024, with projections indicating growth to around USD 64.37 billion by 2034, at a CAGR of 23.32%. This leadership is attributed to the region’s early adoption of automation technologies and the presence of major RPA vendors.

Europe: Europe also plays a crucial role in the RPA market, with a market size of USD 6.37 billion in 2024. Germany stands out, with its RPA market valued at USD 2.04 billion in 2024 and anticipated to grow at a CAGR of 24.06% from 2025 to 2034. The region’s focus on industrial automation and digital transformation initiatives contributes to this growth.

Asia-Pacific: The Asia-Pacific region is experiencing rapid expansion in the RPA market, valued at USD 7.14 billion in 2024 and expected to grow at a CAGR of 27.52% from 2025 to 2034. China leads this growth, with its RPA market valued at USD 1.89 billion in 2024 and projected to grow at a CAGR of 26.30%. South Korea also shows significant potential, with a market size of USD 0.49 billion in 2024 and an anticipated CAGR of 32.43%. Factors driving this growth include increasing adoption of automation across industries such as healthcare, IT and telecom, retail, and manufacturing.

Latin America: Latin America is gradually embracing RPA technologies, with Brazil and Mexico leading the way. The region’s market growth is propelled by the need for businesses to enhance operational efficiency and reduce costs, although the adoption rate varies across countries due to differences in economic development and technological infrastructure.

Middle East and Africa: The RPA market in the Middle East and Africa is in its nascent stages but shows promise as organizations seek to improve efficiency and competitiveness. Growing awareness of automation benefits and increasing digital transformation initiatives in countries like the UAE and South Africa are expected to drive market growth in the coming years.

Type Analysis

The RPA market is primarily segmented into software and services. RPA software refers to the applications and tools designed to automate repetitive tasks within business processes. These software solutions enable organizations to streamline operations, reduce manual effort, and enhance productivity. Leading RPA software vendors offer features such as process automation, data extraction, task automation, and workflow management. On the other hand, RPA services encompass consulting, implementation, training, and support. Service providers assist businesses in deploying RPA solutions, customizing them according to specific needs, and ensuring seamless integration with existing systems. As the demand for automation grows, both software and services continue to play vital roles in enabling businesses to achieve operational efficiency.

Global Robotic Process Automation Market Revenue, by Type (USD Billion) 2022-2024

| By Type | 2022 | 2023 | 2024 |

| Software | 3.325 | 4.150 | 5.196 |

| Service | 11.593 | 14.262 | 17.600 |

Deployment Analysis

RPA solutions can be deployed through cloud-based or on-premise models. Cloud-based RPA solutions offer flexibility, scalability, and ease of integration, making them ideal for businesses seeking cost-effective and remote automation capabilities. These solutions are hosted on external servers, providing seamless updates and maintenance while minimizing infrastructure costs. In contrast, on-premise RPA solutions are hosted within the organization’s internal servers, giving companies greater control over data security and customization. On-premise deployment is often preferred by businesses with stringent data privacy requirements or regulatory constraints. The choice between cloud and on-premise deployment is typically driven by factors such as budget, data sensitivity, and IT infrastructure.

Global Robotic Process Automation Market Revenue, by Deployment (USD Billion) 2022-2024

| By Deployment | 2022 | 2023 | 2024 |

| Cloud | 4.662 | 5.810 | 7.264 |

| On-Premise | 10.255 | 12.601 | 15.531 |

By Industry Analysis

The BFSI sector is one of the leading adopters of RPA, leveraging automation to streamline processes like customer onboarding, compliance management, transaction processing, and data reconciliation. RPA helps reduce manual errors, enhance data accuracy, and improve customer experience by automating routine financial tasks.

In the pharma and healthcare sectors, RPA is utilized to automate patient data management, claims processing, appointment scheduling, and compliance reporting. Automation helps reduce administrative workload, enhance patient care, and maintain accurate medical records, thereby ensuring regulatory compliance.

RPA plays a critical role in retail and consumer goods by automating inventory management, order processing, customer support, and supply chain operations. Automation enhances efficiency, improves customer service, and ensures real-time data updates across retail operations.

The IT and telecom sectors use RPA to manage IT infrastructure, automate ticketing processes, monitor network systems, and handle routine maintenance tasks. RPA enables faster response times, reduces operational costs, and ensures smooth IT service management.

Global Robotic Process Automation Market Revenue, by Industry (USD Billion) 2022-2024

| Industry | 2022 | 2023 | 2024 |

| BFSI | 5.535 | 6.778 | 8.325 |

| Pharma & Healthcare | 3.036 | 3.823 | 4.827 |

| Manufacturing | 2.731 | 3.384 | 4.207 |

| Retail & Consumer Goods | 1.413 | 1.726 | 2.117 |

| Information Technology (IT) & Telecom | 1.064 | 1.297 | 1.588 |

| Communication and Media & Education | 0.408 | 0.499 | 0.612 |

| Logistics, and Energy & Utilities | 0.315 | 0.381 | 0.463 |

| Construction | 0.158 | 0.189 | 0.227 |

| Others | 0.258 | 0.334 | 0.429 |

Robotic Process Automation Market Key Players

- UiPath

- Automation Anywhere

- Blue Prism

- NICE

- Pegasytems

- Celaton Ltd.

- KOFAX, Inc.

- NTT Advanced Technology Corp.

- EdgeVerve Systems Ltd.

- FPT Software

- OnviSource, Inc.

- HelpSystems

- Xerox Corporation

Source: https://www.precedenceresearch.com