In an era where data is the lifeblood of businesses, Secure Digital (SD) memory cards remain a critical enabler of storage, portability, and performance across industries. From powering high-resolution content creation to supporting IoT ecosystems and enterprise-grade applications, SD cards have evolved far beyond their origins as simple camera storage. According to Persistence Market Research driven by surging demand for high-capacity, high-speed storage solutions. As businesses navigate a data-driven economy, SD cards are proving indispensable for their reliability, scalability, and cost-efficiency.

Technological Advancements Fueling Adoption

The SD card’s staying power lies in its continuous innovation. The SD Association, which governs the standard, has introduced formats like SDXC (up to 2TB) and SDUC (up to 128TB) to meet escalating storage needs. Speed enhancements, such as UHS-I, UHS-II, and the SD Express standard, deliver transfer rates up to 3940MB/s using PCIe and NVMe protocols, rivaling enterprise SSDs. These advancements position SD cards for high-performance use cases, from real-time 8K video editing to data-intensive AI applications.

For businesses, speed and capacity translate to operational efficiency. In media and entertainment, for instance, V90-rated SD cards ensure uninterrupted 8K video capture, reducing production downtime. In logistics, SD cards in IoT devices enable real-time data collection, optimizing supply chain visibility. Persistence Market Research notes that 68% of enterprises with revenues exceeding USD 1 billion have integrated flash memory solutions like SD cards into their workflows, citing their durability and cost-effectiveness. With resistance to water, dust, and extreme temperatures, SD cards are particularly suited for rugged environments, from construction sites to remote oil rigs.

Competitive Landscape and Strategic Moves

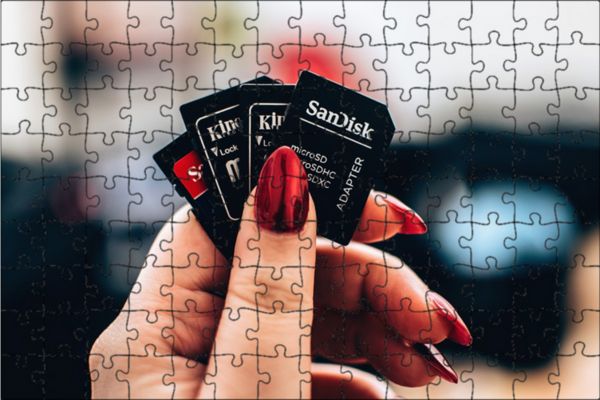

The SD card market is highly competitive, with key players like SanDisk (Western Digital), Samsung, Kingston, and Lexar dominating. SanDisk leads with its Extreme Pro series, offering 1TB microSD cards and V90 speeds tailored for professional content creators. Samsung’s PRO Plus microSD line targets mobile and gaming applications, while Kingston focuses on industrial-grade cards for IoT and automotive use. Recent strategic moves include Western Digital’s 2024 partnership with major camera manufacturers to optimize SD Express compatibility and Samsung’s launch of a 512GB microSD with enhanced encryption for enterprise clients.

Pricing remains a critical factor. While high-capacity cards (256GB and above) have become more affordable—dropping 15% in price year-over-year, per industry reports—premium high-speed models command a premium. Businesses must balance cost with performance, particularly for large-scale deployments. Persistence Market Research highlights that bulk procurement of SD cards by enterprises in Asia-Pacific, particularly China and India, has driven economies of scale, further lowering costs.

Challenges and Opportunities

Despite their strengths, SD cards face challenges. Cloud storage and embedded device memory (eMMC/UFS) are encroaching on traditional use cases, particularly in consumer electronics. A 2024 survey by Persistence Market Research found that 42% of SMEs prefer cloud-based backups over physical storage due to perceived scalability. Additionally, counterfeit SD cards remain a concern, with low-quality fakes undermining trust and performance. Data security is another hurdle, as unencrypted cards can expose sensitive information if lost or stolen.

However, these challenges present opportunities. The SD Association is exploring built-in encryption and wireless connectivity to enhance security and functionality. The rise of edge computing, where data is processed locally, plays to SD cards’ strengths, offering offline storage and low latency. Furthermore, sustainability initiatives are gaining traction, with manufacturers like Kingston investing in recyclable packaging and energy-efficient production to appeal to eco-conscious enterprises.

Strategic Implications for Businesses

For companies, SD cards offer a low-cost, high-impact solution for managing data growth. Media firms can streamline content workflows with high-speed cards, while retailers can deploy them in point-of-sale systems for reliable transaction logging. In emerging markets, where internet connectivity remains inconsistent, SD cards provide a practical alternative to cloud storage, enabling offline data access for mobile workforces.

To maximize ROI, businesses should prioritize reputable brands and align card specifications with use cases. For example, IoT deployments require high-endurance microSD cards to withstand frequent write cycles, while creative agencies need V60/V90 cards for video production. Robust data management policies, including encryption and regular backups, are critical to mitigate security risks.

A Resilient Market Player

As industries embrace digital transformation, SD cards will remain a linchpin of data storage. Their affordability, durability, and adaptability ensure relevance in a crowded market. With innovations like SD Express and growing demand from IoT, automotive, and media sectors, the SD card market is poised for steady growth. Persistence Market Research projects that by 2032, 75% of global enterprises will incorporate flash memory solutions into their infrastructure, with SD cards playing a central role.

In a business landscape defined by data, the Secure Digital memory card is more than a storage device—it’s a strategic asset. As companies race to harness the power of real-time insights and high-quality content, SD cards will continue to deliver the reliability and performance needed to stay ahead.