Precedence Research reports the global semiconductor foundry market size reached USD 148.49 billion in 2024 and is predicted projected to be worth around USD 259.72 billion by 2034. The remarkable upswing comes against a backdrop of surging demand for advanced chips in AI, automotive electronics, consumer devices, and industrial automation. Asia Pacific sustains its stronghold as market leader, while North America’s reshoring strategies and government incentives spark unprecedented growth.

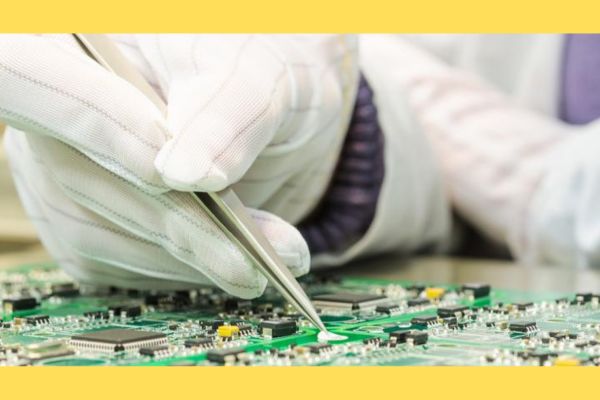

As industries digitize, and smart products permeate every sector, semiconductor foundries are not just manufacturers, they’re the cornerstone of global technology development and innovation resilience.

Semiconductor Foundry Market Key Highlights

- In terms of revenue, the global semiconductor foundry market was USD 148.49 billion in 2024.

- It is projected to hit USD 259.72 billion by 2034.

- The market is expected to grow at a CAGR of 5.75% from 2025 to 2034.

- Asia Pacific dominated the semiconductor foundry market with the largest market share of 68% in 2024.

- North America is expected to grow at the fastest CAGR between 2025 and 2034.

- By node size, the 7nm-9nm segment held the biggest market share of 21% in 2024.

- By node size, the < 5nm segment is observed to grow at the fastest CAGR during the forecast period.

- By foundry type, the pure play foundries segment captured the highest market share of 72% in 2024.

- By foundry type, the integrated device manufacturers (IDMs) with foundry services segment is expected to grow at the fastest CAGR in the upcoming period.

- By technology, the FinFET segment contributed the major market share of 38% in 2024.

- By technology, the gate all around (GAA)/nanosheet segment is emerging as the fastest growing during the forecast period.

- By wafer size, the 300mm segment held the highest market share of 84% in 2024.

- By wafer size, the 450mm segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the consumer electronics segment generated the major market share of 32% in 2024

- By application, the automotive segment is observed to grow at the fastest CAGR during the forecast period.

- By customer type, the fabless companies held the largest share of 68% in 2024.

- By customer type, the startups & R&D institutes segment is likely to expand at the highest CAGR over the projection period.

- By service type, the full-scale fabrication segment accounted for the significant market share of 55% in 2024.

- By service type, the backend integration segment is observed to grow at the fastest CAGR during the forecast period.

How Are Technology, Geopolitics, and Industry Collaboration Redefining the Semiconductor Foundry Landscape?

From 2nm logic nodes to 3D stacking and heterogeneous integration, technology innovation is relentless. Intensifying AI/ML workloads, the electrification of mobility, and demand for secure, energy-efficient devices are re-shaping design requirements and ramping up process complexity. At the same time, governments, particularly the U.S., EU, and Japan, are investing in domestic fabs to hedge against supply-chain shocks and geopolitical risks.

Breakthroughs in fab automation, smart manufacturing (Industry 4.0), and new materials like silicon carbide (SiC) and gallium nitride (GaN) are unlocking value for both leading-edge and specialty foundries.

Meanwhile, strategic alliances between foundries and customers (think Apple’s pre-payments to TSMC) and cross-border partnerships ensure that capacity, technology, and knowledge transfer keep the ecosystem competitive and robust.

“Semiconductor foundries are now at the vanguard of digital transformation. The velocity of change, from advanced node development to global supply chain restructuring, means success will depend on agility, partnership, and sustained capital commitment. Our research shows that those investing today in automation, specialty processes, and regional capacity will shape tomorrow’s industry winners.”

— Nisha Batra, Principal Consultant, Precedence Research

Semiconductor Foundry Market Coverage

| Report Attribute | Key Statistics |

| Market Size by 2034 | USD 259.72 Billion |

| Market Size in 2025 | USD 157.03 Billion |

| Market Size in 2024 | USD 148.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.75% |

| Dominating Region | Asia Pacific with share of 68% |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Node Size, Foundry Type, Technology, Wafer Size, Application, Customer Type, Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Af |

What’s Powering the Foundry Boom?

Structural Shifts & New Demand Frontiers

Chiplet and AI Boom: AI workloads require specialized processors (e.g., GPUs, NPUs, TPUs) built on advanced process nodes. Foundries are essential for producing high-throughput compute engines and integrating them with memory and connectivity subsystems via 2.5D/3D packaging.

Vehicle Electrification: EVs are becoming the next big market for chips, requiring high-performance MCUs, sensors, power semiconductors, and infotainment processors. Automotive foundry orders grew over 25% in 2024 alone, with Bosch, Infineon, and Tesla becoming high-volume fab clients.

Supply Chain Localization: The CHIPS Act (U.S.), EU Chips Act, and China’s Made in China 2025 strategy are pouring billions into domestic fab development. India’s Design-Linked Incentive (DLI) and Modified Program for Semiconductors are also attracting global players to set up foundries and OSAT units.

Segmentation Breakdown:

- By Node Size: The 7nm-9nm node size held the largest market share in 2024, reflecting its widespread adoption in current-generation devices. However, the <5nm segment is projected to exhibit the fastest growth, underscoring the industry’s relentless pursuit of miniaturization and increased transistor density for cutting-edge applications.

- By Foundry Type: Pure-play foundries, which specialize exclusively in manufacturing for third-party chip designers, captured the largest market share, highlighting the industry’s reliance on their dedicated expertise and advanced facilities.

- By Technology: FinFET (Fin Field-Effect Transistor) technology remained dominant in 2024, a testament to its proven performance and efficiency. Nevertheless, Gate-All-Around (GAA)/nanosheet technology is rapidly gaining traction and is expected to be the fastest-growing segment, paving the way for future generations of chips.

- By Wafer Size: The 300mm wafer size segment dominated the market, primarily due to its superior cost-effectiveness and higher production efficiency compared to smaller wafer sizes.

- By Application: The consumer electronics segment generated the major market share, driven by the sheer volume and continuous innovation in devices like smartphones, tablets, and smart home appliances. The automotive segment is anticipated to be the fastest-growing application, propelled by the increasing integration of semiconductors in electric vehicles, advanced driver-assistance systems (ADAS), and infotainment.

- By Customer Type: Fabless companies held the largest share by customer type, reinforcing the trend of design-focused companies outsourcing their manufacturing needs.

- By Service Type: Full-scale fabrication services accounted for the significant market share, indicating the preference for comprehensive manufacturing solutions from foundries. Backend integration services are expected to be the fastest-growing segment, driven by the increasing complexity of chip packaging and testing.

Breakthroughs from Leading Companies

- TSMC: Remains dominant with >35% share of Q1 2025 foundry revenues, powered by leadership in 3nm/4nm and advanced packaging.

- Intel Foundry Services: Under new leadership, may scale back its 14A node plans if large external customers are not secured, focusing instead on in-house and proven 18A capabilities.

- Samsung Foundry: Recently underwent leadership overhaul to recapture AI chip development momentum after falling behind in memory and foundry performance.

Why Asia Pacific Leads the Semiconductor Foundry Market

Asia Pacific semiconductor foundry market size was at USD 100.97 billion in 2024 and is expected to expand around USD 177.91 billion by 2034, at a CAGR of 5.83% from 2025 to 2034.

Asia Pacific stands as the central force in the global semiconductor foundry market, maintaining the largest market share both in value and in technological capabilities. Countries such as Taiwan, South Korea, and China form the backbone of this regional leadership, with world-renowned enterprises like TSMC, Samsung Electronics, and SMIC headquartered here. The competitive edge enjoyed by Asia Pacific arises from its unparalleled scale, deep supplier networks, and active government support for both established and emerging manufacturing facilities. Notably, governmental investment and close-knit industrial ecosystems have enabled the region to execute rapid technology adoption and innovation, especially in advanced logic nodes and specialty chip production. Chinese initiatives focused on supply chain resilience and domestic self-sufficiency are narrowing the historical gap in both mature and specialty fabrication processes.

Key Drivers of Asia Pacific’s Dominance

| Factor | Details / Statistics |

| Major Players | TSMC (Taiwan), Samsung Foundry (Korea), SMIC (China), UMC (Taiwan) |

| Global Foundry Market Share | TSMC alone holds ~55%, most of which is based in Asia Pacific |

| Government Funding (China) | Over $150 billion in semiconductors via state-backed funds and subsidies |

| Korean Incentive Scheme | $450 billion by 2030 for “K-Semiconductor Belt” |

| India’s Semiconductor Plan | $10 billion with 50% capital expenditure support for fabs and design houses |

| Consumption Share (China) | 35–38% of global semiconductor demand |

| R&D Hubs | Hsinchu, Suwon, Shenzhen, Bengaluru |

| Skilled Engineering Workforce | Taiwan: ~250,000+, Korea: 300,000+, China: 1M+ in chip and electronics sector |

| Leading Tech | 3nm production, EUV lithography, chiplets, heterogeneous integration |

Taiwan stands at the forefront of the global semiconductor foundry market, thanks to Taiwan Semiconductor Manufacturing Company (TSMC), which alone commands over 50% of the global foundry revenue. Taiwan’s ecosystem is deeply integrated, with chip design, wafer fabrication, testing, and packaging all located within a few hours’ drive. The government has consistently supported the sector through infrastructure, talent development, and favorable taxation policies. Hsinchu Science Park, home to TSMC, UMC, and other tech firms, is a prime example of a high-tech cluster. Taiwan’s leadership in 3nm and 5nm process nodes, as well as its early adoption of EUV lithography, makes it a technological trailblazer. The country’s stable political environment and close ties with U.S. tech firms like Apple further strengthen its position.

uth Korea: Memory Powerhouse and Advanced Foundry Challenger

South Korea is a critical player in both memory and logic semiconductor markets. Samsung Foundry, part of Samsung Electronics, is the only company besides TSMC producing 3nm chips using gate-all-around (GAA) transistors. The government has launched an ambitious “K-Semiconductor Belt” strategy, pledging $450 billion (510 trillion won) by 2030. This mega-plan includes R&D support, tax incentives, workforce training, and infrastructure development for fab clusters around Pyeongtaek and Yongin. SK Hynix further bolsters Korea’s memory capabilities. South Korea also houses major materials and equipment companies, enabling end-to-end local production. Its close alignment with global tech supply chains ensures rapid prototyping and delivery cycles.

China: Rapid Scaling with Strategic Self-Reliance

China is aggressively building its domestic semiconductor capabilities as part of its national strategy to reduce import dependence, especially amid rising geopolitical tensions. Through the National Integrated Circuit Industry Investment Fund (commonly known as the “Big Fund”), the Chinese government has invested over $150 billion to support chip fabrication, EDA tools, materials, and talent development. Companies like SMIC, Hua Hong, and Cambricon are central to this growth. While China still lags in cutting-edge nodes (sub-7nm), it dominates mature process nodes, which are vital for automotive, IoT, and consumer electronics. Regional governments in cities like Shanghai, Wuxi, and Shenzhen provide additional subsidies, land grants, and tax relief. The massive domestic demand , China consumes over 35% of the world’s semiconductors, serves as a powerful engine for expansion.