According to Cervicorn Consulting, the global silicon carbide (SiC) MOSFET market is expected to grow around USD 29.17 billion by 2034, up from USD 2.34 billion in 2024 and expanding at a CAGR of 28.69% from 2025 to 2034.

The growing use of silicon carbide (SiC) MOSFETs in a variety of applications, including electric vehicle (EV) on-board chargers (OBC), solar inverters, server power supply units (PSU), telecommunications, and uninterruptible power supplies (UPS), is one of the key drivers of market growth. This rise in SiC MOSFET deployment has significantly increased demand for SiC-based devices.

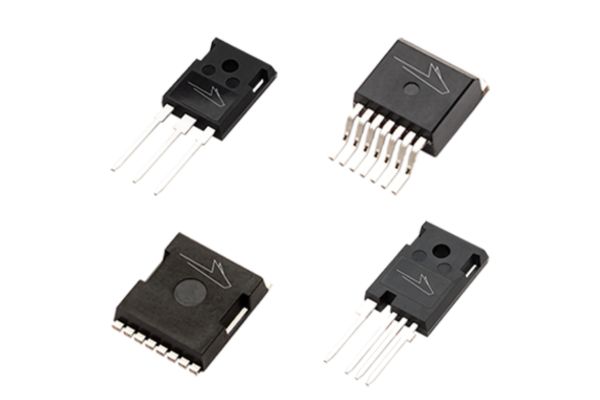

The future of power semiconductors is focused on wide bandgap (WBG) materials like silicon carbide (SiC) and gallium nitride (GaN). These materials offer superior performance, going beyond the capabilities of traditional silicon-based devices. Among these, SiC MOSFETs have become a leading technology, offering advantages like greater performance, mature technology, and lower costs, thanks to increased production and competition.

Key players in the SiC MOSFET market are actively creating new products to meet the growing demand for power density, efficiency, and reliability across a wide range of applications. Asia Pacific is a major contributor to the SiC MOSFETs market, holding a dominant share in terms of revenue and volume. This is largely due to the rapid growth of electric vehicle adoption and the increasing focus on renewable energy in countries like China, India, and Japan.

SiC MOSFETs use silicon carbide as their semiconductor material, providing several advantages over traditional silicon MOSFETs. These include the ability to operate at higher temperatures—up to 250°C compared to 175°C for silicon MOSFETs—along with higher breakdown voltage, enabling use in higher voltage applications. SiC MOSFETs also have lower switching losses, improving efficiency in power electronics. Despite being a newer technology, SiC MOSFETs are rapidly gaining market share over conventional silicon MOSFETs, with declining costs expected to further boost adoption.

Growing Electric Vehicle Adoption to Drive SiC MOSFETs Market Growth

SiC MOSFETs, along with other automotive power semiconductors such as SiC diodes, silicon Super-Junction (SJ) MOSFETs, hybrid IGBTs, and automotive power modules (APMs), help optimize power density, efficiency, and reliability in on-board charger (OBC) designs. Hybrid electric vehicles (PHEVs), battery electric vehicles (BEVs), and fuel cell electric vehicles (FCEVs) all rely on OBCs to charge their high-voltage battery packs, with SiC MOSFETs playing a key role in boosting power density, efficiency, EMI performance, and reducing system size.

Electric vehicle sales worldwide have seen a significant increase. According to the International Energy Agency (IEA), China led the world in EV sales in 2021 with 3.3 million units, followed by Europe at 2.3 million and the United States at 630,000 units. This surge in EV sales is expected to drive further demand for SiC MOSFETs in OBCs, boosting the market for SiC MOSFETs globally.

Focus on Renewable Energy, Especially Solar Power

As the cost of solar panels continues to decrease and stricter zero-carbon energy regulations are introduced, global solar power installations have surged. This includes utility-scale, commercial-scale, and residential solar PV installations. The integration of SiC MOSFETs into solar inverters and power optimizers provides notable improvements in power density, efficiency, and system size, while also reducing costs. SiC MOSFETs are particularly important in utility-scale string inverters and central inverters, where they enhance efficiency and contribute to smaller, lighter systems.

In 2022, China installed around 87 gigawatts (GW) of solar photovoltaic (PV) capacity, a 59% increase from the previous year, with other countries like India and Germany also seeing significant growth in solar PV installations. Similarly, the U.S. added 11.1 gigawatt-hours (GWh) of energy storage to the grid in 2022, contributing to a rise in residential and grid-scale solar deployments. As the adoption of solar PV systems grows, it is expected to further fuel the demand for SiC MOSFETs.

Rising Demand for 1200V to 1700V SiC MOSFETs

The 1200V to 1700V SiC MOSFETs segment led the market in 2024. These high-voltage SiC MOSFETs are widely used in solar PVs, HVAC power supplies, on-board chargers, inverters, EV charging stations, and industrial motor drives, among other applications. SiC MOSFETs with high breakdown voltages offer superior switching performance, increased reliability, and enhanced efficiency compared to traditional silicon power switches.

Increasing Use of SiC MOSFETs in Inverters

Inverters were a major segment of the SiC MOSFETs market in 2024. This category includes electric traction inverters, solar inverters, and industrial inverters. Electric traction inverters are crucial in electric vehicles, controlling the energy flow between the high-voltage battery pack and the motor, which impacts vehicle performance, driving range, and reliability. The size and weight of these components are also important for EV performance.

Regional Market Overview for SiC MOSFETs

Asia Pacific dominated the global SiC MOSFETs market in 2024, accounting for 33.40% of the market share. Governments across the region are promoting electric vehicle adoption and renewable energy deployment, with China leading the way in solar PV and wind energy installations. This is driving strong demand for SiC MOSFETs in EVs and solar PV systems, boosting market growth in the region.

North America is the second-largest market for SiC MOSFETs. Federal tax incentives, state-level policies, and reduced costs have led to significant growth in solar installations across residential, commercial, and utility-scale projects, especially in states like California, Texas, and Florida. The expansion of solar PV installations is expected to offer considerable opportunities for SiC MOSFETs in the region.

Read more details@ https://www.cervicornconsulting.com/silicon-carbide-mosfet-market