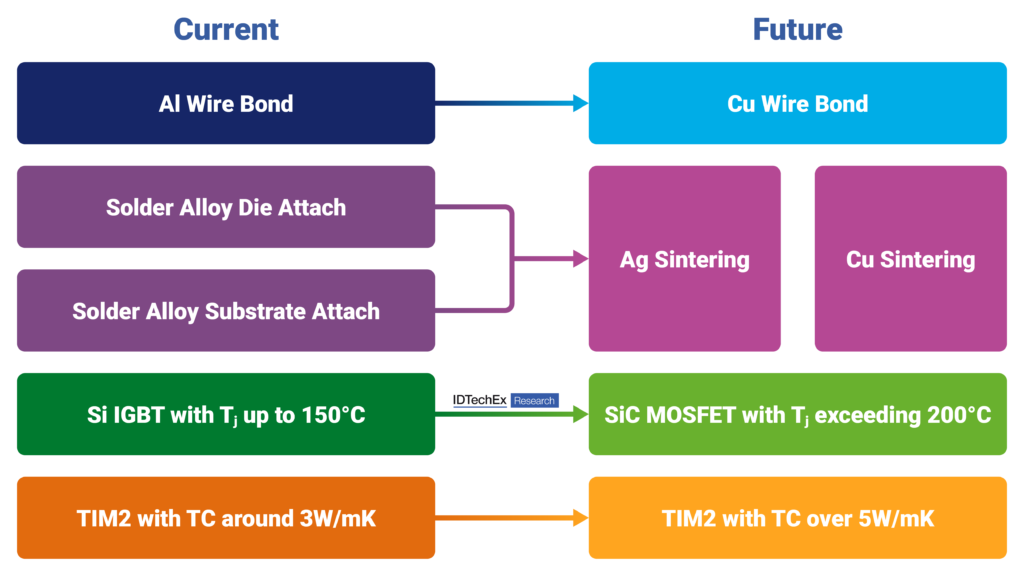

The move towards 800V and above in electric vehicles is already well underway, spearheaded by numerous automotive OEMs such as GM, Hyundai, VW, and Lucid Motors. These platforms enhance efficiency by minimizing joule losses and allowing for the downsizing of high-voltage cabling, thus reducing weight. This transition is facilitated by advancements in technologies and materials, particularly silicon carbide (SiC) MOSFETs, thanks to their improved ability to support high-frequency switching at higher voltages. In comparison to Si IGBTs, SiC MOSFETs offer smaller die areas and higher junction temperatures, necessitating more effective thermal management.

Addressing this challenge, IDTechEx has noted various emerging thermal management strategies, ranging from altering thermal architecture to utilizing different die-attach materials and thermal interface materials (TIM). This shift is anticipated to present significant opportunities in the thermal management market, propelling the annual market value of TIMs to surpass US$900 million by 2034. In its latest research titled “Thermal Management for EV Power Electronics 2024-2034: Forecasts, Technologies, Markets, and Trends”, IDTechEx conducted a comprehensive analysis of the market prospects for different TIMs concerning Si IGBT, SiC MOSFET, and GaN HEMT inverters while identifying potential market drivers.

High-performance TIMs

Thermal interface materials (TIMs) are commonly applied between the baseplate and the heatsink. IDTechEx anticipates a surge in demand for TIM with higher thermal conductivity (TC) owing to the escalating heat flux of SiC MOSFETs. As of 2024, the typical TC of this TIM ranges from 2.5 to 3W/mK, with expectations for this to exceed 5 or 6W/mK in some cases by 2034. This will correspond to a proportional rise in unit price alongside an increase in the market value of TIM. Although heightened production volumes might lead to a reduction in the average cost of TIM, IDTechEx suggests that the increase in average TC will outpace any manufacturing improvements, given the already large manufacturing capacity of TIM2 materials in 2024.

An interesting example of a higher-performance TIM2 material is Honeywell’s PTM7000, boasting a TC of 6.5W/mK, which has already been utilized in onsemi’s VE-Trac family. IDTechEx’s latest research, “Thermal Management for EV Power Electronics 2024-2034: Forecasts, Technologies, Markets, and Trends”, provides a comprehensive overview of properties such as TC, density, etc., of TIMs used in EV power electronics.

Die-attach and substrate-attach materials

Conventional die-attach and substrate-attach materials typically consist of solder alloys featuring bondline thicknesses ranging from 50 to 100µm for die-attach and 100 to 150µm for substrate-attach materials. Despite their satisfactory performance, IDTechEx has observed a growing preference for Ag sintering, led by major automotive OEMs such as Tesla, BYD, and Hyundai. Ag sintering, in comparison to traditional solder alloys, offers superior thermal and electrical conductivity, enhanced bond strength, and various other benefits. However, due to its higher costs and processing times, Ag sintering is likely to see primary adoption in applications that really require its benefits, such as wide bandgap-based inverters.

The cost of Ag sintering can vary significantly based on factors like customer relationships, order volumes, and suppliers. IDTechEx suggests that the cost of Ag sintered paste can easily be five to ten times higher than that of solder alloys. For instance, IDTechEx learned of an Ag sintered paste developed by a Japanese company costing around US$2/g, though this price has the potential to decrease significantly with increased volume. Overall, driven by leading automotive players, there is a discernible trend toward replacing solder alloys with Ag sintering pastes, creating market opportunities for material suppliers.

To address the cost factor, Cu sintering is proposed as an alternative approach. Compared to Ag sintering, Cu sintering aims to offer similar performance at a lower cost. A supplier informed IDTechEx that Cu sinter can cost as little as half as much as Ag sinter. However, as of 2024, IDTechEx has not observed widespread commercialization of Cu sintering technology in EV power modules. Due to limited volume and technical challenges, the cost of Cu sintering currently often surpasses that of Ag sintering. The IDTechEx report, “Thermal Management for EV Power Electronics 2024-2034: Forecasts, Technologies, Markets, and Trends”, provides a comprehensive overview of the market opportunities in Ag and Cu sintering technologies, highlights the competitive landscape and supply chain, and analyzes the key players in the substrate-attach and die-attach sectors.