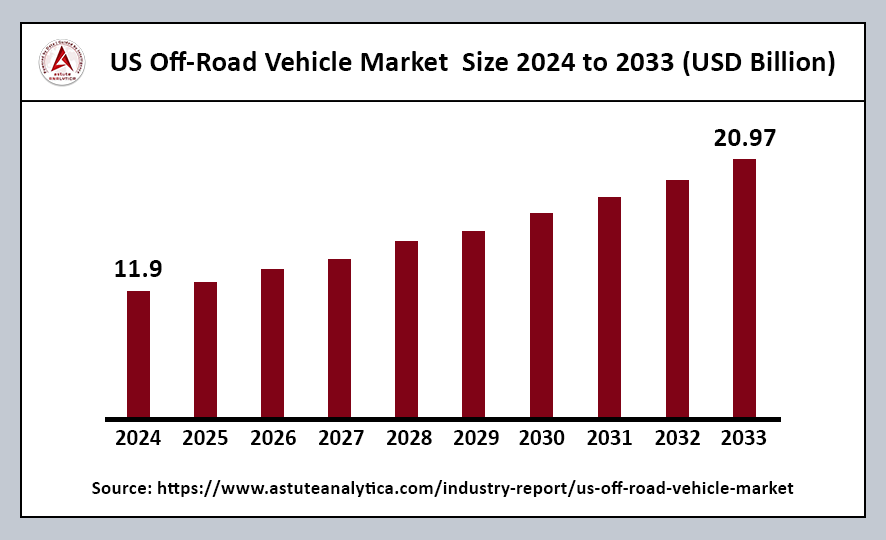

The US off-road vehicle market was valued at US$ 11.9 billion in 2024 and is projected to reach US$ 20.97 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2025 to 2033.

An off-road vehicle (ORV), commonly referred to as an off-highway vehicle (OHV), is specifically designed to traverse unpaved roads and challenging terrains. These vehicles are engineered to withstand the rigors of off-road environments, equipped with features such as robust suspension systems, specialized tires, and reinforced components. These design elements enable ORVs to handle a variety of off-road conditions, from rocky trails to muddy paths, ensuring that they can provide safe and reliable performance in diverse settings.

The US off-road vehicle market has witnessed significant growth due to a combination of factors, including robust manufacturing capabilities and an expansive network of trails available for recreational use. Manufacturers are continually innovating to improve performance, safety, and comfort, resulting in a wide range of models that cater to the preferences and needs of different consumers. This commitment to innovation is reflected in the development of advanced technologies and features that enhance the overall off-roading experience, making these vehicles more appealing to a broad audience.

US Off-Road Vehicle Market Key Takeaways

- By product type, three-wheelers have established themselves as a significant segment within the US off-road vehicle market, generating over $8.9 billion in annual revenue.

- In terms of propulsion type, diesel-powered vehicles lead the US off-road vehicle market, with annual sales reaching an impressive $9.1 billion. Nearly 1.3 million diesel units are currently in operation.

- When evaluating the market by application, sports applications stand out as the largest and fastest-growing segment in the US off-road vehicle market. Generating over $7.5 billion in new vehicle sales in 2023.

Top Trends Escalating the US Off-Road Vehicle Market

Expansion of Smart Technology Integration: The integration of smart technologies, including GPS and app-based diagnostics, is set to significantly drive growth in the US off-road vehicle market. As consumers increasingly seek enhanced connectivity and convenience, manufacturers are responding by equipping vehicles with advanced features that improve the user experience. GPS technology allows for real-time navigation and tracking, enabling off-road enthusiasts to explore unfamiliar terrains with confidence.

Manufacturer Investment in Lightweight and Electric Models: Manufacturers are making significant investments in the development of lightweight, high-performance, and electric off-road models, which will play a crucial role in driving the US off-road vehicle market. The focus on lightweight designs not only enhances fuel efficiency and maneuverability but also improves overall performance, making off-road vehicles more accessible to a wider range of consumers. Additionally, the push towards electric models reflects a growing consumer interest in sustainability and environmentally friendly options.

Rising Recreational Participation: The rising participation in recreational off-roading, motorsports, and adventure tourism activities is another vital driver of growth in the US off-road vehicle market. As more individuals seek outdoor adventures and unique experiences, off-roading has become an increasingly popular recreational pursuit. Events such as off-road races and adventure tours are attracting a diverse range of participants, further promoting the thrill and excitement of off-road vehicles.

Increased Agricultural Sector Adoption: The agricultural sector’s adoption of off-road vehicles for efficiency in farm and ranch operations is also contributing to market growth. Farmers and ranchers are turning to off-road vehicles to improve productivity and streamline operations, taking advantage of the versatility and durability, these vehicles offer. Off-road vehicles can be employed for various tasks, including transporting goods, navigating rough terrains, and conducting maintenance on expansive properties.

Growing Demand for Electric Off-Road Vehicles: Finally, the growing demand for electric off-road vehicles, particularly in environmentally regulated states, is poised to drive significant market growth. As consumers become more environmentally conscious and regulations surrounding emissions become stricter, the appeal of electric vehicles is on the rise. States with robust environmental policies are fostering an environment conducive to the adoption of electric off-road models, encouraging manufacturers to invest in the development of these vehicles.

US Off-Road Vehicle Market Segmentation

Product Type

Three-wheelers have emerged as a significant force in the US off-road vehicle market, generating over $8.9 billion in annual revenue. This impressive figure highlights their popularity, as three-wheelers have outpaced four-wheelers, dirt bikes, and side-by-sides in terms of unit sales and overall usage. Their unique design and versatility make them particularly appealing to a wide range of consumers, from recreational riders to those needing practical vehicles for work on farms and ranches.

Today, three-wheelers are especially prevalent in the Midwest and rural Southeast regions of the United States. In these areas, they have become a staple on ranches and recreational trails, where their maneuverability and ease of use are highly valued. The ability to navigate various terrains with stability and comfort makes three-wheelers an ideal choice for both work-related tasks and leisure activities.

By Propulsion Type

Diesel-powered vehicles continue to lead the US off-road vehicle market, showcasing impressive annual sales figures that reached $9.1 billion. This robust performance is underscored by the presence of nearly 1.3 million diesel units currently in operation across various applications, from agriculture to construction. The dominance of diesel engines in this sector can be attributed to their exceptional low-end torque capabilities, which are crucial for off-road performance.

For instance, mid-size utility task vehicles (UTVs) equipped with diesel engines typically produce an average torque of 70 lb-ft, significantly outpacing the 50 lb-ft average found in gasoline models. This advantage makes diesel engines particularly well-suited for heavy towing and consistent operation under demanding conditions, such as those encountered on job sites.

By Application

Sports applications continue to dominate the US off-road vehicle market, emerging as both the largest and fastest-growing segment within this dynamic industry. In 2023, this segment generated over $7.5 billion in new vehicle sales, reflecting a significant surge in consumer interest and participation in off-road motorsports. The increasing popularity of high-profile events such as King of the Hammers and the GNCC Racing Series has played a crucial role in elevating the visibility and appeal of sport-model all-terrain vehicles (ATVs), utility task vehicles (UTVs), and dirt bikes. These events showcase the thrilling capabilities and rugged performance of these vehicles, capturing the attention of enthusiasts and attracting a wider audience to the sport.

Recent Developments in the US Off-Road Vehicle Market

- Toyota’s Baby Land Cruiser FJ Debut Pushed Back to 2026: In April 2025, Toyota announced a delay in the debut of its eagerly anticipated compact Land Cruiser FJ, which is now set to make its official appearance in the first half of 2026. This new model aims to cater to the growing demand for compact SUVs, combining the traditional ruggedness associated with the Land Cruiser brand with modern design and technology.

- Collaboration Between pfit UTV and OMI for Off-Highway Vehicles: In April 2025, pfit UTV, a subsidiary of Fox Factory known for its innovations in purpose-built custom vehicles, partnered with OMI, a leader in electric powertrain engineering. Together, they are set to introduce a new line of off-highway vehicles powered by OMI’s advanced Fusion-Drive hybrid system.

- Volkswagen’s Plans for Electric Off-Roader: In March 2025, Volkswagen hinted at the possibility of reviving plans to launch a highly capable electric off-roader. This initiative would leverage a new platform currently being developed by Scout Motors, an American brand that was introduced by the Volkswagen Group in 2022. The Scout brand draws inspiration from the iconic Scout range of off-road vehicles produced by International Harvester during the 1960s and 1970s.

- Honda Celebrates Production Start of the 2026 Passport: In February 2025, associates at the Honda Alabama Auto Plant (AAP) celebrated a significant milestone with the commencement of production for the all-new 2026 Honda Passport and Passport TrailSport. This latest iteration of the Passport is being touted as the most off-road capable Honda SUV to date, designed specifically to tackle rugged terrains while providing a comfortable driving experience.

Top Companies in the US Off-road Vehicle Market

- American Landmaster

- Arctic Cat Inc.

- Can-Am (BRP)

- CFMOTO

- Honda Motor Co., Ltd.

- John Deere

- Kawasaki Motors Corp., U.S.A.

- Kubota Corporation

- Kymco

- Mahindra & Mahindra Limited

- Massimo Motor

- Polaris Inc.

- Suzuki Motor Corporation

- Textron Inc.

- Yamaha Motor Corporation

- Other Prominent Players

Market Segmentation Overview

By Product Type

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

By Propulsion Type

- Gasoline

- Diesel

- Electric

By Application

- Utility

- Sports

- Recreation

- Military