First came the electric vertical take-off and landing (eVTOL) aircraft hype, followed by startups, investments, prototypes, and vertiport planning. Now, designs are being refined, and type certification is progressing. Battery and hydrogen fuel cell R&D are at their peak. eVTOL pilot training plans are forming, and vertiport construction is starting worldwide.

With AAM’s arrival imminent and industry scale-up five to ten years away, a big question remains: How will companies profit early on? eVTOL companies are strategizing to make air taxi flights affordable and profitable from the start. Some are pursuing military partnerships, while others focus on cargo transport.

IDTechEx’s new report “Air Taxis: Electric Vertical Take-Off and Landing (eVTOL) Aircraft 2024-2044: Technologies, Players” predicts that the market size for public transport eVTOLs in 2025 will be around US$200 million (aircraft alone, not including service). IDTechEx’s research also indicates applications where eVTOL aircraft could provide a faster, more direct, and flexible journey at a lower cost than competing transport modes.

Utilization and load factors

Aircraft utilization is crucial for profitability. Initially, most eVTOL passengers will use them as substitutes for other transport modes, known as substituted demand. For maximum profit, eVTOL operators should focus on high-utilization markets with the highest willingness to pay. This means targeting large metropolitan areas and major transportation hubs where travelers can afford to pay for time savings.

Most eVTOLs have a layout for four passengers and one pilot. While filling up during a one-way shuttle is feasible, the same number of passengers returning is not guaranteed, especially for travelers with high variability in travel times. This challenge becomes more pronounced in on-demand air taxi services, where the average passenger load factor is lower.

The FAA’s latest Aerospace Forecast (2024-2044) supports this view, noting a lower average load factor for air taxis compared to shuttle trips. It anticipates challenges in pooling multiple passengers for on-demand trips due to passenger preferences for direct, immediate service. This underscores the suitability of four-passenger eVTOLs like Archer’s Midnight for scheduled shuttle services but suggests that smaller aircraft like Volocopter’s VoloCity may be more viable for on-demand air taxi operations.

Air taxi fares

IDTechEx’s TCO analysis finds that eVTOL operations work out at around 45% cheaper than the per-hour cost of helicopter operations. The biggest savings are maintenance, upfront cost, and fuel. For a four-passenger plus one pilot eVTOL configuration, IDTechEx finds an operational price point of US$3.5 per passenger per km. However, this requires an eVTOL network operating at scale which will rely on years of operations and the realization of a range of associated factors, such as a huge production ramp-up to establish. With gradual scale-up, volume can be built up over time, resulting in lower operating costs and increased load factors.

The obvious solution is to keep price points low. At US$1.5 per passenger per km, analysis published in an Eve and MIT paper found passenger demand would increase 97% from a price point of US$3.5 per passenger per km. Autonomous flight will be vital in making air taxi services more competitive, and all eVTOL OEMs are looking to add this functionality.

There are two options to increase the affordability of fares for eVTOL flights in the short term: subsidies and bundling — but there are substantial risks with the first option. Subsidies are an easy way to reduce fares, but they are dangerous as they will eat into the company’s profitability and might push startups into needing to raise more capital. On the other hand, bundling is an option available to airlines, for example, that can make the price of the air taxi trip disappear as an add-on to a premium fare.

Business models

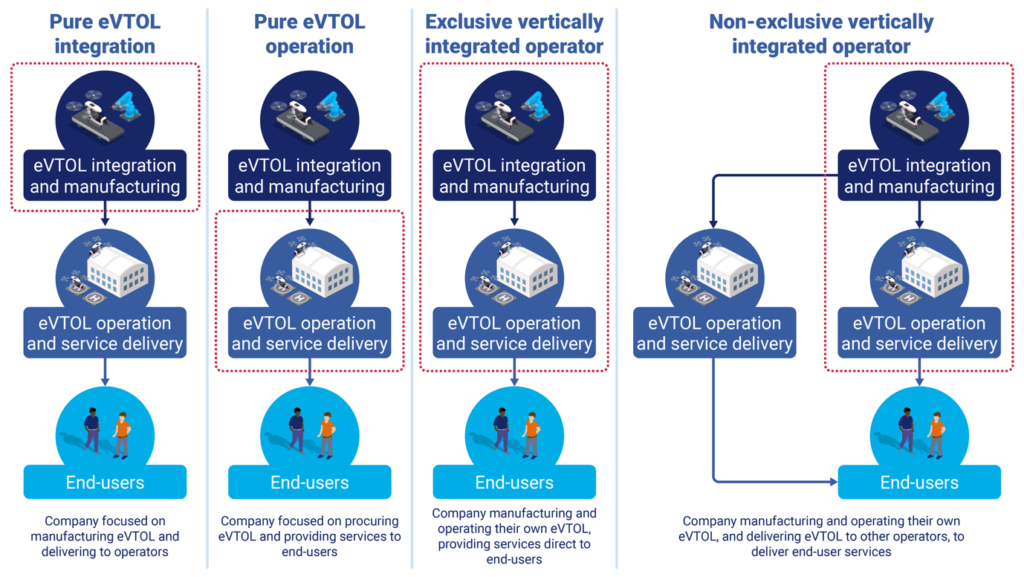

eVTOL OEMs can employ various business models. One common approach is the direct sale of aircraft to operators. In this model, OEMs design and manufacture eVTOLs, selling them outright to customers. This strategy provides upfront revenue and allows OEMs to retain control over product development and customization. However, it also entails risks such as fluctuating market demand and the challenge of scaling production efficiently. Ensuring robust after-sales support and service infrastructure is crucial to maintaining customer satisfaction and fostering long-term relationships.

Another strategy gaining traction is the leasing or subscription model. Here, operators pay regular fees to use eVTOLs without the upfront cost of ownership. This approach lowers barriers to entry for operators and establishes a steady revenue stream for OEMs through leasing agreements. Effectively managing asset depreciation and logistics, alongside competitive pricing, is essential to attract operators while ensuring profitability. IDTechEx research finds this approach to be the most common.

Alternatively, some OEMs adopt a comprehensive service provider model, not only manufacturing but also operating eVTOLs as part of mobility services. This integrated approach allows OEMs to capture revenue from both hardware sales or leasing and transportation services. By operating the aircraft themselves, OEMs can optimize fleet utilization and service quality, although it requires significant investment in operational infrastructure and entails higher operational risks.

An urban air transportation ecosystem will only be successful with the participation of multiple parties – OEMs, city and national officials, regulators, users, and communities – all keen to interact with one another to understand how the future mobility ecosystem can be shaped.

IDTechEx certainly agrees. It is within those micro-environments (regions, like the UAE, where all parties are willing to work together, and government and regulator are particularly willing to make things happen) where initial operations will have the best chance of gaining a foothold in the public transport ecosystem. IDTechEx research finds that it is within such regions that an initial stronghold can be created before eVTOLs can enter the broader market.