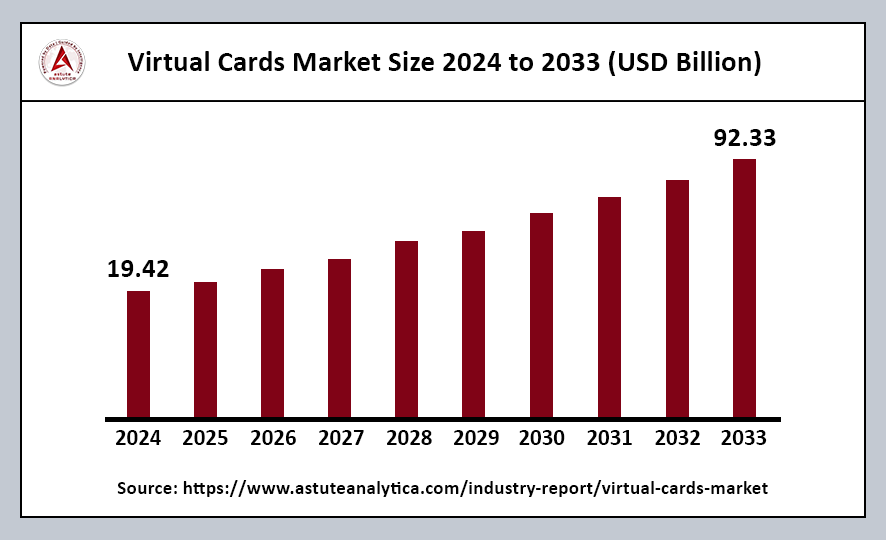

The global virtual cards market was valued at US$ 19.42 billion in 2024 and is projected to reach US$ 92.33 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period from 2025 to 2033.

Virtual card adoption is growing rapidly, particularly among businesses seeking enhanced security, streamlined financial operations, and improved cash flow management. This trend is largely driven by the ability to generate virtual cards on-demand for specific transactions, which helps to reduce fraud and integrate seamlessly with existing financial systems.

Market players are responding to the rising demand by expanding their offerings and forming strategic partnerships. This proactive approach allows companies to better meet the needs of businesses looking for secure and efficient payment solutions. Key players in the virtual cards market include Visa, Mastercard, American Express, PayPal, and Stripe. These companies are actively investing in technology and partnerships to enhance their virtual card solutions and improve security measures, ensuring they remain competitive in a rapidly evolving landscape.

Virtual Cards Market Key Takeaways

- By card type, B2B virtual cards have captured over 60% of the virtual cards market, driven by their ability to streamline corporate payment processes and enhance financial control. This significant market share reflects the growing preference among businesses for efficient and secure payment solutions.

- By product type, single-use virtual cards account for 55% of the virtual cards market, primarily due to their unmatched security and convenience. These cards are particularly favored for one-time transactions, reducing the risk of fraud and simplifying payment processes.

- By industry, the E-commerce & Retail sector is the most dominant end user of virtual cards, capturing 35% of revenue share. This dominance is attributed to the sector’s need for secure and efficient payment methods that facilitate online transactions.

- By payment method, credit-based virtual cards account for over 55% of the virtual cards market, largely due to their flexibility and rewards offerings. These features make them an attractive option for consumers and businesses, enhancing their popularity in the digital payment landscape.

Regional Analysis

North American Virtual Cards Market Dominance

The North American virtual cards market holds a dominant position with over 38% market share, particularly in the United States. This dominance is characterized by robust adoption in the B2B sector, driven by the need for enhanced security and streamlined payment processes.

- Shift Towards Digital Payment Solutions: The region has witnessed a significant shift towards digital payment solutions, with virtual cards emerging as a cornerstone of modern financial operations. This transition reflects the growing demand for efficient and secure payment methods in a rapidly evolving economic landscape.

- Popularity of Virtual Cards: During this period, virtual cards, which can be used for online and contactless payments without the need for a physical counterpart, became a popular option. As consumers have grown accustomed to these forms of payment, their usage continues to expand in the post-pandemic environment.

- Integration with Mobile Wallets: The convenience of integrating virtual cards into mobile wallets and other digital platforms further enhances their appeal. This integration not only simplifies transactions but also provides users with a seamless payment experience, reinforcing the trend toward digital financial solutions.

Growth of the European Virtual Cards Market

The European virtual cards market is experiencing significant growth, especially in facilitating secure and efficient cross-border transactions. This growth reflects the increasing demand for reliable payment solutions in an interconnected economy.

- Regulatory Compliance and Innovation: The region’s focus on regulatory compliance, particularly with frameworks like PSD2 and the Interchange Fee Regulation (IFR), has shaped the market landscape. These regulations encourage innovation while ensuring robust data protection, fostering a secure environment for digital transactions.

- Adoption in the Travel Sector: The travel sector stands out as a major adopter of virtual cards, utilizing them for booking and expense management across different currencies. This use of virtual cards helps streamline financial processes and enhances the overall travel experience.

- Media and Entertainment Industry Usage: The media and entertainment industry has also seen an increase in virtual card usage, particularly for freelancer and vendor payments. This trend highlights the industry’s shift towards more efficient payment methods in managing diverse financial relationships.

Rapid Growth of the Virtual Cards Market in Asia Pacific

The Asia Pacific region is experiencing the fastest growth in the virtual card market, driven by technological innovation and the rapid expansion of digital payment infrastructures.

- Leading Sectors: Media and Entertainment: The media and entertainment sector is leading the charge, reporting an increase in virtual card usage for content-related payments. This trend reflects the industry’s broader shift towards digital solutions, as businesses seek more efficient methods for managing transactions.

- Focus on Advanced Security Features: Advanced security features are a key focus in the region, with 90% of virtual cards now featuring dynamic CVV codes. This enhancement is aimed at improving protection against fraud, ensuring that consumers feel safe when using virtual cards for their transactions.

- Integration with Mobile Payment Platforms: Additionally, the integration of virtual cards with mobile payment platforms has increased over the past year. This trend highlights the region’s commitment to leveraging mobile technology for financial innovation, making payments more accessible and convenient for users.

Top Trends Escalating the Virtual Cards Market

Rise of Contactless and Mobile Payment Integration: The rise of contactless and mobile payment integration has significantly improved the convenience of transactions. Consumers are increasingly opting for these technologies, as they allow for quick and easy payments without the need for physical cash or card swipes.

Increased Use in B2B Transactions: There has been an increased use of virtual cards in B2B transactions to streamline processes and enhance security. Businesses are leveraging these cards to automate payments, reducing the complexity of financial transactions and minimizing the risk of fraud.

Technological Advancements in Payment Systems: Technological advancements in payment systems, including the integration of AI and blockchain technologies, are transforming the landscape of digital payments. These innovations are enhancing transaction efficiency and providing businesses with better tools for financial management.

Enhanced Security Measures in Digital Payments: With the growing reliance on digital payments, enhanced security measures have been implemented to reduce fraud and unauthorized access. These measures help to protect sensitive financial information and build consumer trust in digital payment solutions.

Growing Adoption of Digital Payment Solutions: The growing adoption of digital payment solutions is largely driven by increased smartphone and internet penetration. As more people gain access to mobile devices and online services, the demand for digital payment options continues to rise.

Integration with Mobile Wallets and Contactless Payments: Finally, the integration of virtual cards with mobile wallets and contactless payments is facilitating seamless transactions. This integration allows users to make quick and secure payments, enhancing the overall payment experience.

Virtual Cards Market Segmentation

By Card Type

B2B virtual cards have captured over 60% of the virtual card market, primarily due to their ability to streamline corporate payment processes and enhance financial control. These cards are becoming increasingly popular among businesses as they automate accounts payable, helping to reduce manual errors and processing times. The rise of B2B e-commerce has further fueled the adoption of virtual cards, as companies actively seek secure and efficient payment solutions for cross-border transactions. This demand for reliable payment methods is driving businesses to leverage virtual cards, allowing them to conduct transactions smoothly and with greater confidence, while also optimizing their financial management practices.

By Product Type

Single-use virtual cards account for 55% of the virtual card market, driven by their unmatched security and convenience. These cards are specifically designed for one-time transactions, significantly reducing the risk of data breaches that can occur with reusable cards. Consumers in the travel and hospitality sectors particularly favor single-use virtual cards, as this segment accounts for 40% of single-use card transactions. When booking flights and hotels, these cards eliminate the need to share primary card details, enhancing security and peace of mind for travelers.

By Industry

The E-commerce & Retail industry is the most dominant end user of virtual cards, driven by the need for secure and efficient payment solutions. Virtual cards are particularly effective in reducing chargeback rates by 90%, making them a preferred choice for online merchants. This significant reduction helps mitigate financial losses associated with chargebacks. The rise of subscription-based business models has further contributed to the dominance of virtual cards in the e-commerce and retail sectors, as these models often require reliable and secure payment methods.

By Payment Method

Credit-based virtual cards account for over 55% of the virtual card market, primarily due to their flexibility and rewards offerings. The rise of buy-now-pay-later (BNPL) services has significantly contributed to the popularity of credit-based virtual cards, making them an attractive option for consumers. Credit-based virtual cards are particularly popular among millennials, as they align with this demographic’s preference for digital-first financial solutions.

Recent Developments in the Virtual Cards Market

- Bankwest’s Virtual Card Feature: In April 2025, Bankwest introduced a new virtual card feature, giving its banking app users the option to make everyday payments without disclosing details of their physical debit or credit card. The ‘pay and vanish’ digital card enables customers to pay using a time-limited digital version of their debit or credit card, available as a single or multi-use option.

- Zil Money’s Launch of Virtual Card Feature: In April 2025, Zil Money, the leading financial technology company, launched the Virtual Card feature, offering a secure, customizable, and efficient solution for managing payments.

- Mastercard’s Adoption Initiative: In April 2025, Mastercard introduced a new program aimed at ramping up the adoption of virtual cards, simplifying the interaction between banks, platforms, and corporates.

- Visa’s Partnership with Extend: In March 2025, in a move to address the growing demand for secure B2B payment tools, Visa signed a referral agreement with Extend, a New York-based virtual card and spend management firm. This agreement will expand the availability of Extend’s virtual card platform, allowing middle-market companies to issue and manage digital cards for various purposes.

- Taulia and Lloyds Partnership: In March 2025, working capital management solutions provider Taulia announced its partnership with Lloyds to launch Visa-enabled Virtual Cards. Following this announcement, the partnership is set to issue Visa-enabled Virtual Cards that are embedded across a range of solutions available with the SAP Business Suite.

Top Companies in the Virtual Cards Market

- American Express Company

- Visa Inc.

- Discover Financial Services

- BTRS Holdings, Inc.

- Wise Payments Limited

- JPMorgan Chase & Co.

- Bank of America

- Citibank (Citi Virtual Cards)

- Wells Fargo

- Marqeta, Inc.

- MasterCard

- Skrill USA, Inc.

- Stripe, Inc.

- WEX, Inc.

- Adyen

- Other Prominent Players

Market Segmentation Overview:

By Card Type

- B2B Virtual Cards

- B2C Virtual Cards

- P2P Virtual Cards

By Product Type

- Single-Use Virtual Cards

- Multi-Use Virtual Cards

- Reloadable Virtual Cards

By Payment Method

- Credit-Based Virtual Cards

- Prepaid Virtual Cards

- Debit-Based Virtual Cards

By End Users

- Individuals

- Businesses

By Industry

- IT & Telecom

- Media & Entertainment

- E-commerce & Retail

- Healthcare

- Travel & Hospitality

- Government & Public Sector

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Distribution Channel

- Banking Channels

- FinTech Platforms

- Payment Gateways & Processors

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Source: https://www.astuteanalytica.com/industry-report/virtual-cards-market