Electric light commercial vehicles (eLCVs) now make up nearly 5% of the global light commercial vehicle (LCV) market – but an overwhelming majority of these have been battery-electric (BEV). With hydrogen fuel cell vehicles yet to impact in this segment of commercial vehicles, the question has to be asked whether they will ever have a place in the future of LCVs. IDTechEx’s new “Electric Light Commercial Vehicles 2025-2045: Markets, Players, Forecasts” provides critical insights into the role of fuel cell (FCEV) vehicles in this fast-evolving industry and aims to answer this question.

How do FCEVs stack up against BEVs?

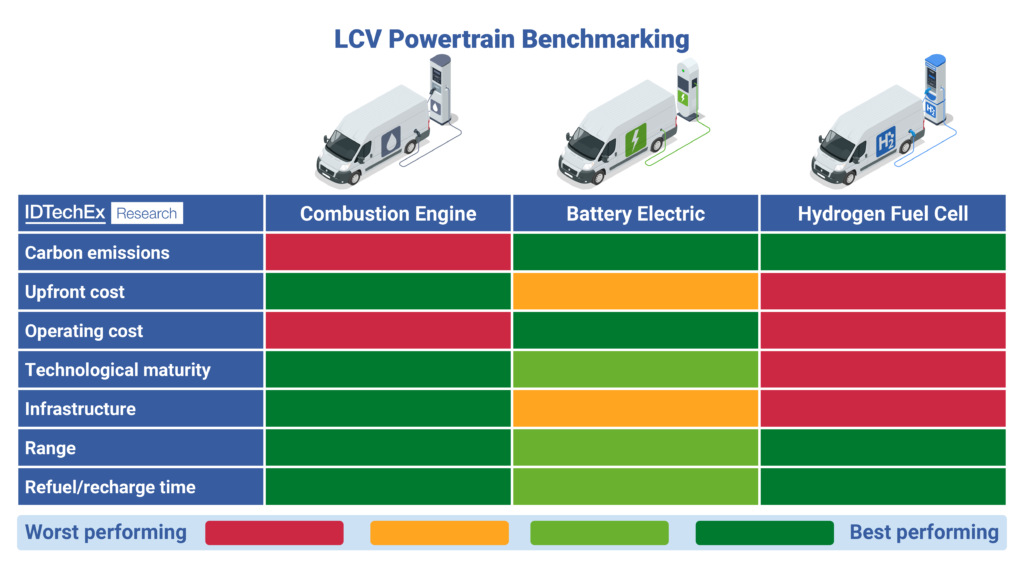

Hydrogen fuel cell LCVs provide the opportunity for zero-emission cargo transport – just as BEVs do. the real strength of FCEVs lies in how they differentiate themselves from BEVs: through extended range and fast refueling.

Hydrogen is a much higher-density energy source than Li-ion batteries, allowing FCEVs far greater runtime with just the hydrogen they can store onboard. Up-and-coming fuel cell LCVs have a typical range of 400 to 600 km, with some expected to achieve 1000 km soon! This is beyond what batteries can provide and enables much greater operational flexibility for fleets.

The same can be said about refueling times too. Current day FCEVs can refuel in 5 to 10 minutes, similar to a diesel vehicle. This is certainly faster than battery charging, which itself can vary anywhere from 30 minutes (DC fast charge) to 8 hours (overnight charge).

The upside of fuel cells over batteries in these areas is clear, but the question remains whether LCVs require such high range and fast refueling attributes for their everyday use. Most LCVs operate within cities, making their usage low-mileage by nature. The new “Electric Light Commercial Vehicles 2025-2045” report from IDTechEx finds that battery technology is already more than sufficient to satisfy an LCV’s mileage demands. An average eLCV from a major manufacturer will have batteries sized for 200 km of operation (around 2 days’ worth of mileage). Newer and higher-capacity models are also regularly exceeding this, providing plenty of operational flexibility.

It is for the same reason that LCVs and fleets don’t require fast refueling either. With the range they have today, battery-electric LCVs don’t need to fast-charge during the workday and an overnight charge will suffice.

In essence, BEVs and their flexibility are already well-suited to the LCV industry. Any additional benefits that fuel cells can provide goes beyond what is needed in most applications and will come at higher cost.

What other barriers are holding FCEVs back?

Concerns around FCEVs in general will impact their uptake in the LCV segment. For one, the technology is not nearly as mature as batteries, which means FCEVs will come at a higher cost.

Another common sticking point around FCEVs is over the type of hydrogen they will use. Over 95% of the world’s hydrogen production today is of so-called ‘grey’ hydrogen –produced through the reformation of methane in natural gas. The end result is a fuel source with just as much emissions output as diesel combustion. Grey hydrogen can not be the zero-emission solution needed for the future of mobility.

Instead, FCEVs will rely on ‘green’ hydrogen – produced through the electrolysis of water using renewable sources of electricity – to achieve their true decarbonization potential. Green hydrogen is significantly more expensive than grey hydrogen though, and its production hinges upon the rollout of more renewables and development in electrolyzer technology. For now, a general lack of green hydrogen production and transport infrastructure remains, leading to low supply and high retail prices.

All of this means the running costs for an FCEV are also likely to be higher than that of a BEV. LCV fuel cost analysis in IDTechEx’s new report suggest that green hydrogen would have to reach US$4/kg in the European market to match the cost of electricity. This figure falls even lower in other global markets – down to US$1-2/kg, which is not achievable at scale in the short- or medium-term. Instead, they represent only the most optimistic long-term scenarios for green hydrogen, so it is fair to say that it will remain a more costly energy source for some time. With both a higher upfront cost and higher operating costs, FCEVs will fall short of BEVs from a financial point of view.

The mixed fortunes of FCEVs across global markets

So far, China has been the only region where FCEVs have established a foothold in the LCV market. Thanks to government investment in hydrogen technology and lower green hydrogen prices than most of the world, FCEVs in China are even competing with plug-in hybrids in terms of sales numbers.

Contrast this to the Japanese and Korean markets, which paint a rather different picture. These markets also have governments and OEMs investing heavily in hydrogen mobility. However, neither region has been able to commercialize a fuel cell LCV. IDTechEx’s new report points out that sales of FCEVs across the mobility spectrum are diminishing in these areas, and LCV OEMs are focusing more on battery-electric development instead. This has been very successful in Korea, which now has the highest LCV electrification rate of any country in the world! Meanwhile, Japan has been slower to transition – with less than 1% of LCVs being electrified – and has some way to go to reach the same point.

The European market saw high interest in hydrogen LCVs in the late 2010s, as major OEMs attempted to commercialize fuel cell variants of their most popular diesel LCVs. However, most of these were either never fully realized or discontinued soon after launch. Companies are less active now, but certain major brands including Renault and some Stellantis Group manufacturers (e.g. Citroen, Fiat, Peugeot) are initiating new development efforts – benefitting from improvements in fuel cell technology. Europe is seeing increased investment in hydrogen infrastructure, with the EU and individual countries introducing new projects to boost hydrogen mobility in the region. This should help bring more success to newer commercialization efforts compared to their early predecessors. The IDTechEx report details the state of technology development and market timeline of such efforts.

IDTechEx Outlook

Overall, the IDTechEx report does expect FCEVs to play a role in the future of LCVs – albeit a small one. While FCEVs can boast impressive range and low downtime for a zero-emission vehicle, these strengths are better suited to other commercial vehicle classes with more intensive distance requirements; not for most city-going LCVs. The report also highlights the need for green hydrogen for truly zero-emission operation and the challenges currently faced in producing and transporting green hydrogen at scale. These challenges will have to be addressed before FCEVs can gain any popularity in the LCV market.

“Electric Light Commercial Vehicles 2025-2045: Markets, Players, Forecasts” highlights the transformation that lies in the near future for LCVs. It provides more in-depth analysis of FCEVs and other powertrain technologies – going further into sales trends, key players, and total costs of ownership too. 20-year granular forecasts broken down by region and powertrain provide critical insight into the key markets driving this change within the industry.