Yangtze Memory may be out of the 3D NAND market by 2024, following says TrendForce. From now on Yangtze is unlikely to be able to source manufacturing equipment, spare parts or technical support from the US, which means it will be unable to increase output or advance its products.

The Entity List inclusion prevents Yangtze from being supplied with equipment capable of manufacturing NAND with more than 128 layers which kills its upgrade path. Achieving commercially viable yields on its 232 layer NAND looks unlikely.

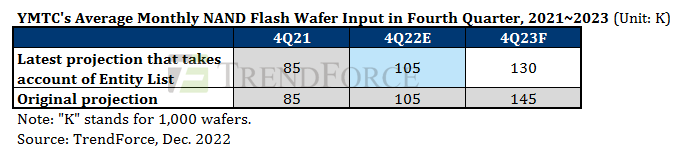

Developing the 232 layer device earlier this year had put Yangtze on the same level as the market leaders, but Entity List membership means Yangtze may never be able to produce it commercially. Yangtze’s supply bits for 2023 were initially forecasted to grow by 60% YoY. Now, the projection is for a YoY decline of 7%.

NAND Flash buyers outside of China are having reservations about using Yangtze NAND. Apple qualified the company’s parts for use in products to be sold in China but succumbed to US political pressure and said it would not order them.

It is likely that Yangtze will be limited to operating only within mainland China in the future.

By 2024, the NAND industry will be on the 2XX-L generation for their primary 3D NAND processes, and may be producing 300-layer parts. If it can’t make competitive 3D parts, Yangtze could be force into reverting to manufacturing only 2D parts.

Yangtze is reported to have had government subsidies of $24 billion and its 2022 capex budget is said to be $32.8 billion. The company has 5% of the flash market with 128-layer NAND taking 40% of its output and 64-layer representing 60%. Yangtze’s Fab1 was reported to have been running 100k wpm of NAND flash at the end of last year – at or near full capacity.

Yangtze’s Fab2, where equipment was being hooked up in the summer – is said to be capable of running 200k wpm and was intended to increase Yangtze’s market share to 10%.