The most anticipated union budget of recent times i.e., the Union Budget 2021-22 was finally announced on 01 February 21. With the Union Government facing daunting challenges in the wake of COVID-19 pandemic and the emerging chaos on the geo-political as well as the local front; it was to be seen what path is adopted to steer the economy out of these doldrums.

‘Chaos is a ladder’:

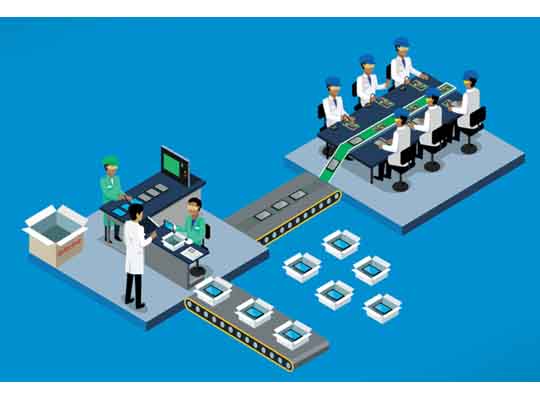

While COVID-19 induced chaos has forced the countries/corporations world over to look into re-alignment of their global supply chains, only a handful countries have been able to capitalize upon the opportunity offered by this chaos. India, seems to be one of those countries which marketed itself aggressively during the pandemic and was able to capitalize upon the opportunities that presented in some sectors namely mobile manufacturing and electronics. As a result we witnessed shifting of manufacturing/assembly related to some global premium mobile brands into the Indian mobile manufacture/assembly arena.

The Government has actively supported the mobile and electronics manufacturing industry through introduction of schemes like Production Linked Incentive (PLI) scheme wherein it is granted a benefit of 4% to 6% on incremental sales of goods manufactured in India to eligible companies, for a period of five years subsequent to the base year (FY2019-20). Further, passive support is being extended to this initiative by strategy of ‘Import Substitution’ wherein import duties on the mobiles, its spare parts and certain other electronic components are being increased gradually in a phased manner.

Firstly, there has been a steady increase in the Basic Customs Duty (BCD) rates on cellular phones imported as is, since a past few years to nudge the mobile manufacturers towards import of knocked down kits and local assembly (for e.g., BCD rates on import of ‘telephones for cellular network’ falling under Chapter heading 8517 of the Customs tariff has been increased from 10% as on 30 June 2017 to 20% currently).

Now, to consolidate its local manufacturing base and continue to build upon the success of the local manufacturing the Government, through this Budget, has introduced a slew of amendments to rationalize BCD rates chargeable on components used in manufacture of mobile phone and parts of accessories supplied along with them. The aim being making the local manufacture of components more attractive rather than importing them.

A similar strategy is being adopted/executed in other sectors as well, notable amongst them being solar energy operated equipment and its components as well as electronic toy industry. The solar industry was struggling due to skewed tariffs on solar cells and downstream distributable utilities (e.g., solar inverter). Budget 2020 contained enabling provisions for raising the tariff rates on solar cells and modules by up to 20%. Now, it was expected that duties applicable to other accessories would be rationalized. Similarly, the toy industry too was suffering from cheap price of imported goods vis-à-vis the locally manufactured ones.

The below table gives an indication of the existing custom duty rates and the proposed rates that would be chargeable on certain imports:

| HSN Code or Customs tariff chapter | Product Description | Old Rate of BCD | Proposed New rate of BCD | Increase |

| Any Chapter | Inputs or parts for manufacture of Printed Circuit Board Assembly (PCBA) of cellular mobile phone.Inputs or parts for manufacture of camera module of cellular mobile phoneInputs or raw material for manufacture of specified parts like back cover, side keys etc. of cellular mobile phone (w.e.f. 1.4.2021) | NIL | 2.5% | + 2.5% |

| Any Chapter | Inputs or raw material (other than PCBA and moulded plastics) for manufacture of charger or adapter of cellular mobile phonesInputs or parts of Printed Circuit Board Assembly of charger or adapter of cellular mobile phones | NIL | 10% | + 10% |

| 9405 50 40 | Solar lanterns or solar lamps | 5% | 15% | + 10% |

| 8504 40 | Solar inverters | 5% | 20% | + 15% |

| 9503 | Parts of electronic toys for manufacture of electronic toys | 5% | 15% | + 10% |

The data presented in the above table makes the following things very clear:

- The Government is very keen in moving towards a progressive taxation regime which aims at incentivizing local manufacture and indigenization of a supply ecosystem relating to certain products/industry.

- The manner in which the amendments are being planned and bought into effect point towards a definite vision of achieving Atmnirbharta/self-reliance in local manufacture in key sectors.

- Capitalize upon the chaos generated and consolidate position as preferred manufacturing and supply chain hub in case of some emerging as well as established sectors.

To summarize the above, the vision of Atmanirbhar Bharat is not going to be realized unless sustained efforts are made at the policy level to work on a two-pronged ‘Carrots and Sticks’ strategy i.e.,

- Creating an environment conducive to growth of local manufacture and extension of benefit under PLI schemes to other emerging sectors – The ‘carrots’ approach and

- Along with the above penalize/disincentivize imports – the ‘sticks’ approach.

The BCD rate increments highlighted above is a representative of ‘sticks approach’. Along with this, dangling carrots like PLI incentives would go a long way in attracting investment in the manufacturing sector. There may be international restrictions on ‘sticks’ approach as other countries may retaliate by levying duties on imports from India. Hence, the Government would have to do the balancing act of incentivizing local manufacturing and imposing tariff and non-tariff restrictions on imports selectively. This seems to be the direction in this Budget.