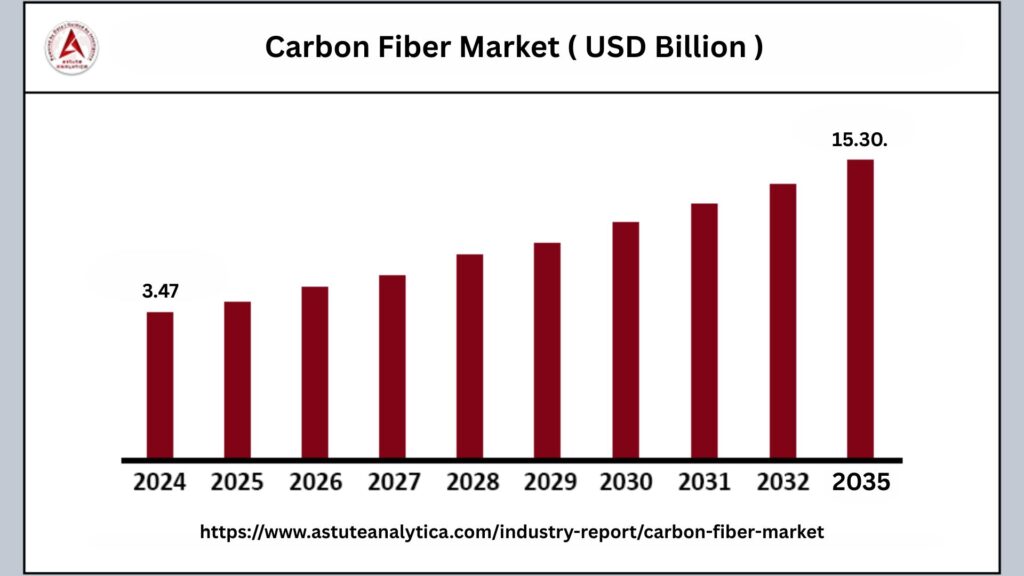

The global carbon fiber market was valued at US$ 3.47 billion in 2024 and is projected to reach US$ 15.30 billion by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 14.44% during the forecast period from 2025 to 2033.

Carbon fiber is a material composed of extremely thin, strong crystalline filaments of carbon. These filaments are often finer than a strand of human hair, measuring about 5 to 10 micrometers in diameter. The remarkable strength of carbon fiber arises when these filaments are twisted together like yarn, creating a composite that is both lightweight and incredibly durable. This unique combination of properties makes carbon fiber an ideal material for reinforcing and strengthening other materials, significantly enhancing their performance.

The carbon fiber market is experiencing significant growth driven by these expanding applications. Advances in manufacturing technologies and material science continue to improve the quality and reduce the cost of carbon fiber, making it more accessible for a broader range of uses. As industries increasingly prioritize sustainability and efficiency, carbon fiber’s role as a high-performance material is becoming even more critical, fueling ongoing innovation and market expansion.

Carbon Fiber Market Key Takeaways

- Market Share by Precursor Type, Polyacrylonitrile (PAN) type carbon fiber continues to assert its dominance in the carbon fiber market, commanding an overwhelming 73.31% market share.

- In terms of tow size, the 24-48k tow size category has emerged as the market leader, holding a commanding 70.07% market share.

- End User Dominance, the aerospace and defense sector continues to be a key end user of carbon fiber, contributing a significant 26.02% revenue share to the market.

- Within the modulus segment, the standard modulus range T300-T700 maintains its dominant position, accounting for an impressive 82.05% market share.

Regional Analysis

Asia Pacific: The Epicenter of the Carbon Fiber Market

The Asia Pacific region holds a commanding position in the global carbon fiber market, accounting for over 42% of the total market share. This dominance is underpinned by the region’s unparalleled manufacturing capabilities and deep integration of carbon fiber into various industrial sectors.

- Automotive Industry Driving Carbon Fiber Demand: A significant driver of carbon fiber demand in Asia Pacific is the automotive industry, particularly in the major manufacturing hubs of Japan, China, and South Korea. These countries are at the forefront of developing lighter, more fuel-efficient vehicles, where carbon fiber plays a critical role. The material’s exceptional strength-to-weight ratio allows automakers to reduce vehicle weight without compromising safety or performance, directly contributing to improved fuel efficiency and lower emissions.

- Accelerating Adoption Amid Sustainable Transportation Trends: The shift towards sustainable transportation solutions is further accelerating the adoption of carbon fiber in the Asia Pacific automotive sector. Governments across the region are implementing stringent emissions regulations and incentivizing green technologies, which are driving manufacturers to incorporate advanced lightweight materials like carbon fiber. At the same time, growing consumer awareness and demand for environmentally friendly, energy-efficient vehicles reinforce this trend.

Strong Growth Outlook for North America Carbon Fiber Market

The North America carbon fiber market is poised for significant expansion, with a robust compound annual growth rate (CAGR) expected over the forecast period. This growth is underpinned by increasing investments and technological advancements in key sectors that rely heavily on lightweight, high-performance materials.

- Rising Demand Driven by Electric Vehicles and Lightweight Transportation: A major catalyst for the North American carbon fiber market is the growing adoption of electric vehicles (EVs) and the broader push toward lightweight transportation solutions. Carbon fiber composites are essential in reducing vehicle weight, which directly translates into improved energy efficiency, longer driving ranges, and enhanced overall performance for EVs.

- Supportive Government Initiatives and Advancements in Material Science: The North American market benefits from a supportive regulatory and policy framework that promotes clean energy and green technologies. Government initiatives aimed at reducing carbon footprints and encouraging sustainable manufacturing practices enhance the appeal of carbon fiber as a material of choice. Additionally, ongoing advancements in material science are improving the cost-effectiveness, durability, and manufacturability of carbon fiber composites.

Europe’s Carbon Fiber Market Leads Globally in 2024

In 2024, the Europe carbon fiber market solidified its position as the global leader, dominating in terms of market size and influence. A combination of strong industrial demand, advanced manufacturing capabilities, and a robust innovation ecosystem drives this leadership.

- Aerospace Industry as a Key Demand Driver: A major contributor to Europe’s dominance in the carbon fiber market is its thriving aerospace industry. Prominent aircraft manufacturers based in the region, notably Airbus, play a pivotal role in driving demand for carbon fiber composites. These manufacturers require materials that combine exceptional strength with minimal weight to improve overall aircraft performance.

- Investment in Research and Development: Europe’s aerospace sector is deeply invested in research and development (R&D) efforts focused on advancing composite technologies, including carbon fiber. This commitment aims to push the boundaries of material performance and manufacturing processes to create the next generation of aircraft. R&D initiatives encompass improving fiber quality, optimizing composite structures, and developing novel fabrication techniques that reduce weight and enhance durability.

Top Trends Escalating Carbon Fiber Market

Advancements in Recycling Technologies: In 2024, significant progress in recycling technologies is driving the carbon fiber industry toward a more sustainable, circular economy. Innovative methods for reclaiming and reprocessing carbon fibers from end-of-life composites are becoming more efficient and cost-effective, reducing waste and environmental impact.

Rising Adoption of Lower-Cost Thermoplastic: The market is witnessing a growing trend toward the use of lower-cost thermoplastic carbon fiber composites, which offer unique advantages in terms of recyclability, toughness, and rapid processing capabilities. Unlike traditional thermoset composites, thermoplastic variants can be melted and reshaped, facilitating easier repair and recycling.

Developing Low-Cost Manufacturing: Efforts to develop low-cost manufacturing techniques are playing a crucial role in broadening the application base of carbon fiber composites. Innovations such as faster curing processes, automation, and alternative precursor materials are driving down production costs, making carbon fiber more accessible for mass-market products. These manufacturing advancements enable industries like automotive, construction, and consumer goods to incorporate carbon fiber components without prohibitive expense.

Increasing Demand from Aerospace: The aerospace industry remains a pivotal driver of carbon fiber demand due to its ongoing quest for lightweight yet strong materials that enhance fuel efficiency and reduce emissions. In 2024, aerospace manufacturers continue to integrate advanced carbon fiber composites into aircraft structures, including fuselage panels, wings, and interior components. The superior strength-to-weight ratio of carbon fiber enables significant weight reductions, leading to improved aircraft performance and lower operating costs.

Automotive Industry’s Push for Vehicle Lightweighting and Efficiency: The automotive sector is aggressively pursuing vehicle lightweighting strategies to meet stricter fuel economy and emissions regulations. Carbon fiber composites play a vital role in this transformation by replacing heavier metals with lighter, equally durable materials. In 2024, automakers are increasingly incorporating carbon fiber into structural components, body panels, and interior parts to enhance vehicle efficiency without sacrificing safety or performance.

Growing Adoption in the Wind Energy Sector: The wind energy sector is rapidly adopting carbon fiber composites for wind turbine blades to improve durability, reduce weight, and increase energy capture efficiency. Longer and lighter blades made from carbon fiber allow turbines to operate more effectively at lower wind speeds and withstand harsh environmental conditions. In 2024, increasing investments in renewable energy infrastructure are accelerating demand for these advanced materials.

Carbon Fiber Market Segmentation

By Precursor Type

Polyacrylonitrile (PAN) type carbon fiber maintains its dominant position in the carbon fiber market in 2024, holding an impressive 73.31% market share. This overwhelming market supremacy is the result of continuous advancements in manufacturing processes that have enhanced both the performance and cost-efficiency of PAN-based fibers. These innovations have allowed PAN carbon fibers to meet increasingly stringent requirements across a broadening range of industrial applications.

The segment’s growth trajectory is further underscored by a robust compound annual growth rate (CAGR) of 11.09%, reflecting its accelerating adoption in emerging and high-growth sectors. Notably, PAN carbon fiber is playing a critical role in cutting-edge applications such as electric vehicle (EV) battery enclosures, where its lightweight yet strong properties help enhance safety and efficiency. Similarly, the material’s use in hydrogen storage tanks is expanding rapidly, driven by the global push toward cleaner energy solutions and sustainable fuel technologies.

By Tow Size

In 2024, the 24-48k tow size category has emerged as a dominant force in the carbon fiber market, commanding a substantial 70.07% share. This commanding market presence signals a fundamental transformation in the industry, particularly in terms of manufacturing economics and the versatility of applications. The 24-48k tow size strikes an ideal balance between strength, weight, and ease of handling, making it highly adaptable to a wide range of uses from aerospace components to automotive parts and sporting equipment.

This segment is growing at a robust compound annual growth rate (CAGR) of 11.16%, underscoring its expanding importance within the carbon fiber ecosystem. A key factor driving this growth is the increasing use of automated composite manufacturing processes, which rely heavily on the 24-48k tow size for their efficiency and precision. Robotic placement systems, in particular, have revolutionized production by enabling high-speed fabrication of complex composite geometries.

By End Users

In 2024, the aerospace and defense sector commands a substantial 26.02% share of total revenue in the carbon fiber market, reflecting its critical role as a major consumer of this advanced material. This sector not only contributes a significant portion of carbon fiber sales but also serves as a key catalyst for technological innovation and stringent quality standards in the industry.

One of the main factors fueling the sector’s dominance and rapid growth is the recovery and expansion of commercial aviation following recent global disruptions. As airlines and manufacturers ramp up production to meet increasing travel demand, the adoption of carbon fiber composites has accelerated markedly. New aircraft programs now specify composite materials to constitute up to 55% of the aircraft’s weight, a notable increase from the approximate 50% composite content seen in previous aircraft generations.

By Modulus

In 2024, the standard modulus range T300-T700 continues to dominate the global carbon fiber market, commanding an impressive 82.05% share. This overwhelming market presence highlights the segment’s unmatched versatility and adaptability across a wide array of industrial applications. From aerospace components to automotive parts and sporting goods, these carbon fibers have become the preferred choice for manufacturers seeking a balance between performance and affordability.

The sustained success of the T300-T700 range is largely attributed to its cost-effectiveness combined with reliable performance characteristics. Recent advancements in manufacturing processes have played a pivotal role in reinforcing this position. Innovations in production technology have significantly lowered the cost of industrial-grade carbon fiber, bringing it down to approximately $7 per pound without compromising quality.

Recent Developments in the Carbon Fiber Market

Vorsteiner Launches Carbon-Fibre Aero Package for Lamborghini Revuelto: In July 2025, Vorsteiner introduced a new aftermarket carbon-fibre Aero Package tailored specifically for the Lamborghini Revuelto, Lamborghini’s hybrid supercar. This package features five distinct components designed to enhance both the vehicle’s performance and visual appeal. The parts are engineered to increase downforce, reduce overall weight, and optimize airflow around the car.

India’s First Indigenous High-Performance Carbon Fibre: Marking a historic achievement for India’s assistive technology sector, July 2025 saw the joint unveiling of the ADIDOC Foot Prosthesis by the All India Institute of Medical Sciences (AIIMS) Bibinagar and the Defence Research and Development Laboratory (DRDL) under the Defence Research and Development Organisation (DRDO). This groundbreaking innovation represents the country’s first indigenously developed high-performance carbon fibre foot designed for lower limb amputees.

Nike Air Foamposite One “Carbon Fiber” Edition: In July 2025, Nike announced a bold new iteration of the iconic Air Foamposite One sneaker with the upcoming “Carbon Fiber” edition, scheduled to launch during the Holiday 2025 season. This latest model continues to honor Penny Hardaway’s signature line while integrating modern design updates. The shoe features a striking Black Foamposite shell enhanced with carbon fiber detailing, giving it a sleek, futuristic look that pushes the boundaries of sneaker aesthetics.

Xiaomi YU7 Max Revealed as Premium Performance Variant of Upcoming Electric SUV: In June 2025, details about the Xiaomi YU7 Max, the high-performance flagship variant of Xiaomi’s soon-to-be-launched electric SUV, emerged online. The YU7 Max was spotted in what seems to be its fully equipped form, showcasing extensive use of carbon fibre elements and top-tier performance hardware.

Top Players in the Global Carbon Fiber Market

- Advanced Composites Inc.

- BASF SE

- Formosa M Co. Ltd

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber & Composites Inc.

- Nippon Graphite Fiber Co. Ltd.

- SGL Group

- Solvay

- Teijin Limited

- Toray Industries Inc

- Zoltek Corporation

- Other Prominent Players

Market Segmentation Overview:

By Precursor Type

- PAN Type Carbon Fibre

- Pitch Type Carbon Fibre

By Tow Size

- 1-12 k

- 24-48 k

- >48 k

By Modules

- Standard Modulus (T300 -T700)

- Intermediate Modulus (T800-T1100)

- High Modulus (M35-M60)

By End User

- Aerospace & Defence

- Civil wide body

- Civil narrow body

- EVtol/drones

- Military

- Other

- Automotive

- Super cars

- Premium vehicles (gasoline)

- Electric vehicles (EVs)

- Pressure vessels / Hydrogen storage

- CNG

- Hydrogen storage Automotive

- Hydrogen storage Aerospace

- Hydrogen storage Ground

- Hydrogen storage Rail

- Pressure vessels / Hydrogen storage

- CNG

- Hydrogen storage Automotive

- Hydrogen storage Aerospace

- Hydrogen storage Ground

- Hydrogen storage Rail

- Wind & Energy

- Wind on-shore

- Wind off-shore

- Tidal power

- Fuel cells

- Other

- Infrastructure/civil

- Buildings

- Concrete re-bar

- Trains

- Other

- Consumer

- Bicycles

- Marine

- Consumer goods

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

![SMART ENERGY WEEK [September] 2025 to Lead Global Renewable Energy Advancements SMART ENERGY WEEK](https://timestech.in/wp-content/uploads/2025/07/Untitled-design-2025-07-31T112230.406-218x150.jpg)