Indian Electronics Ecosystem at a Glance

Fuelled by the phenomenal GDP growth in the last few years, India is poised to become the biggest consumer markets in the world, creating demand for high technology products and specifically, electronic products. the demand for electronics hardware is projected to shoot up from USD 45 billion in 2009 to USD400 billion by 2020 while the production is estimated to reach USD 104 billion by the year 2020, leaving a huge gap of USD 296 billion in demand and production.

According to India Electronics and Semiconductor Association (IESA), the huge domestic demand is the major driving force behind the robust growth of India’s electronics industry. The growing middle class, rising disposable incomes and favorable duty structures are some of the reason why.

Citing large-scale public procurement needs that are driven by government projects like broadband connectivity to villages, rural electrification and e-governance programs as among the reasons, it said favorable ESDM policy initiatives and rising interest of MNCs and Indian enterprises in the sector have created a positive impact on the Indian ESDM value chain.

Since taking charge in 2014, the new government has been reviewing the electronics manufacturing laws and policies to capitalize on the country’s manufacturing capabilities. Bold steps such as demonetization have helped clear up many roadblocks. At first seemed like a hasty decision that would leave the economy crippled which fortunately never happened and instead, turned out to be a favorable move, luring foreign investors and global leaders to the Indian electronics sector from around the world. Furthermore, the governments timely counter measures to limit the impact and rigorous country-wide campaigning to promote practices like digital transaction, worked greatly in their favor.

To accelerate the pace of growth in the electronics industries and meeting the estimated targets within the time period, the Indian government has been constantly reviewing and forming new policies to build a more relevant and manufacturing friendly ecosystem. The recently approved ‘National Policy on Electronics’ NPE, is one such example. NPE aims to reach a turnover of about USD 400 Billion by 2020 including investment of about USD 100 Billion and employment to around 28 million by 2020.

The Policy on Electronics launched in 2012 (NPE 12) which is holistic, investor friendly and market driven towards creating a conducive environment to attract global and domestic companies to invest towards the growing Electronics System Design & Manufacturing (ESDM) sector in India. Significant progress has been made by Government of India to establish the strong foundation for the (NPE) 2012 framework which will help for value added manufacturing involving medium and high technologies.

Few highlights of the policy include:

- Modified Special Incentive Package Scheme (MSIPs) subsidy of 25% of capital expenditure (20% in SEZs) is available and all excise/CVD paid on capital equipment is reimbursed.

- Electronic Manufacturing Clusters Scheme which provides 50% of the cost for development of infrastructure and common facilities in Greenfield clusters (undeveloped or underdeveloped area from electronic manufacturing point of view) and 75% of the cost for Brownfield clusters (area where a significant number of existing EMC exists). Land can be made readily available in several of the new Electronic Manufacturing Clusters being supported by the Government of India. Currently around 30 Electronic Manufacturing clusters are notified and GoI is targeting for 200 Electronic Manufacturing clusters by 2020.

- Preference given to domestically manufactured goods in Government procurement.

- To promote greater research in electronics and IT, Government of India will fund PhD students in Universities across the country for research in industry specific needs. 3000 PhDs will be generated through this program in the area of electronics & IT/ITES.

- Providing opportunities for skill development for the private sector through Electronics. Under the scheme for providing support for skill development, Government of India provides 75% to 100% of training cost for industry specific skills for skilled and semi-skilled workers.

- Several State Governments, including Andhra Pradesh and Karnataka have already announced complementary incentives as part of their State Electronic Policies. Electronic Manufacturing Clusters have been announced by states of Madhya Pradesh, Andhra Pradesh, Punjab, and Kerala. Other states are also in process of taking similar initiatives, thereby offering a host of incentives and facilities for ESDM investors.

- In addition, to recognize and motivate the Micro Small and Medium Scale Enterprises (MSMEs) in the Electronic System Design & Manufacturing (ESDM) sector, the Government of India (GoI) has announced a national scheme for the sector. The Scheme aims at providing financial support to MSMEs to promote manufacturing, to build quality into Indian manufacturing & also to encourage exporters. The support under the Scheme will be provided in the form of reimbursement to the manufacturers in the MSMEs. The scheme for providing financial support as Grant in Aid is expected to benefit the manufacturers, domestic industry, exporters in the electronics sector. This will also assist to attract value added manufacturing involving medium and high technologies. The Scheme will provide GIA for the following activities:

- Reimbursement of expenses relating to compliance of electronic goods with “Indian Standards” notified by DeitY. The total GIA for one model is limited to `1 Lakh, only for 200 models (maximum).

- Reimbursement of expenses for testing and certification required for export. The total GIA under the Scheme for one model is `1.25 Lac , 800 models (maximum).

- Development of Electronic Manufacturing Clusters by MSMEs for diagnostic study, soft intervention and for preparing Detailed Project Reports, etc. The Total GIA available under this Section of the Scheme for Development of Clusters of `10 Lac /Cluster (max) would be available for setting up of 20 Clusters.

All these incentives are available for electronics design and manufacturing unit. This is also available for relocation of manufacturing plant from foreign country. Some of the sector includes Semiconductor FAB, Telecom products, LED FAB and products, automotive electronics, Semiconductor ATMPs, Consumer Electronics and Appliances, Hand-held devices including Smartphone and Tablets, Strategic Electronics, EMC, Avionics and Medical Electronics etc. The product based R&D expenditure has also been included under MSIPS.

Policy Boost: Indigenous Mobile Manufacturing Industry

Phased Manufacturing program (PMP)

Under the phased manufacturing program (PMP) developed by the Ministry of Electronics and Information Technology (MeitY), the government wants to jump start the large scale manufacturing of one the largest selling consumer goods in the country — mobile phones.

After India signed the World Trade Organisation’s ITA-1 pact, it became cheaper to import components as well as finished goods (Information Technology Agreement), under which certain inputs for IT products were exempted from duties. According to industry estimates, only about two per cent of value addition is done in India with regards to mobile phone manufacturing. Raising that figure over the next ten years is the primary aim of the PMP, which was proposed by a joint panel of the industry and the government.

“In 2016-17, total value of mobile phones to be produced in India is likely to reach Rs 90,000 core from Rs 54,000 core in 2015-16”

Highlights of Policy:

- The panel set up under the MeitY has set target of 500 million handset production by 2019 and export target of 120 million mobile phones by 2019-20, taking annual manufacturing output in the range of Rs 1.5-3 lakh crores.

- Mobile phone makers will get tax benefits and incentives to promote the sub-assembly of various mobile parts on a phased manner.

- This will include mechanics, microphone and receiver, keypad and USB cables in 2017-18; printed circuit boards, camera modules and connectors in 2018-19; and display assembly, touch panels, vibrator motor and ringer in 2019-20.

- Key parts such as printed circuit boards (PCBs) continue to be imported. PCBs are the backbone of mobile phones and covers nearly 54 percent of the total cost. With China dissuading local units from producing lower-end phones, to focus on producing premium devices, it is likely that real manufacturing would kick off in India.

- Will run alongside a major scheme supporting electronics manufacturing clusters under which 8,000 acres of land will be developed across the country over the next three years.

- The government also expects to engage with Apple under the conditions of PMP. While Apple has proposed to shift manufacturing to India, it has continued to demand a series of sops including a ten year tax holiday and duty free imports of components, among others.

With formation and implementation of manufacturing policies with similar progressive intent can help India’s as a one of the ‘biggest global consumer’ to a ‘Reliable – leading ‘global export partner’. China’s sudden retreat from the global semiconductor industry has left many Chinese business partners in a state of shock, while some businesses are already looking up at India as their next possible manufacturing destination and partner. The ideas and applauded and welcomed by country’s many leading electronics manufacturers. But in spite of the allotted budget, which is many folds higher as compared to previous budgets, it still falls short on impressing some of the market segment and one of them is Debjani Ghosh, the managing director of South Asia, Intel, and president, MAIT (Manufacturers’ Association for Information Technology).

Debjani says, “It’s good to see continued and strong commitment towards increasing technology adoption and usage across critical sectors like education, agriculture, financial inclusion and rural and infrastructure development. That’s how we can successfully drive the digitization of India. However, the budget has fallen short of creating avenues to increase the manufacturing of the technology solutions in India beyond Smartphone’s”.

Unless an ecosystem where home grown component makers, such as PC Boards, IC’s, can flourish comes into existence, it is hard to put India on the global map in terms of a reliable manufacturer and exporter of technology.

The need to power-up ‘The Indian PCB Manufacturing Industry’

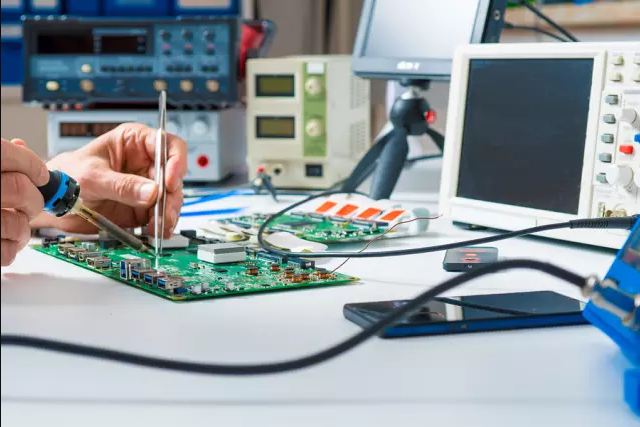

Printed Circuit Boards (PCB) being one of the most commonly available as a cornerstone technology electronics manufacturing sector, empowering almost all the electronics devices you see around you, everyday. PCB’s are used as an insulating base for conductive strips with the purpose of assembling electronic circuits. The design of the board changes with the requirement of the electric circuit design. India meets the 70 per cent of the electronic components demand via imports, mostly for sophisticated components for Indian manufacturers to build. Curbing this increasing dependency on imports for sourcing electronic components is one of the toughest challenges the Indian Government faces. In order to make a mark in the global electronics manufacturing spectrum, powering up our electronics manufacturing sector is of utmost importance with Printed Circuit Boards (PCB) on top of the priority list.

A PCB with its endless applications in all electrical and electronics devices; and thus the demand and elimination rate both remain high. According to an ELCINA study, domestic market demand for PCBs will grow at a CAGR of 20.56 per cent over the period 2015-2020, and will reach over US$ 6 billion by 2020 from the current level of US$ 2.38 billion. Currently, only 35 per cent of this demand is met by local manufacturers. And for the remaining 65 per cent, India is still dependent on imports.

The global market for flexible circuits is expected to grow much faster than that of rigid PCBs, since the former facilitates form factor reduction and eliminate connectors. However, the Indian market is slightly different from the rest of the world, as Indian PCB manufacturers are mostly focused on single-sided, double-sided and multi-layered PCBs with a layer count of four to six, in most cases. A good number of Indian manufacturers adopt the high-mix, medium-volume strategy where different types of PCBs are manufactured in low to medium volumes. There are around 200 PCB manufacturers in India out of which more than 60 per cent are very small.

Major Roadblocks Hampering Growth of the PCB Industry

- Inefficient supply chain for raw materials

- High capex requirements

- Lack of access to new technology and state-of-art manufacturing facilities

Other challenges include:

- Unfair playing field, since companies from competing countries have access to finance at much lower costs.

- Logistics inefficiencies and infrastructural bottlenecks, resulting in longer turnaround time frames and higher costs.

- Conflicting policies in operation across the various levels within the electronics industry, from the components segment to finished products.