The increasing prevalence of sports injuries owing to higher physical activity in adults and children along with the expanding geriatric population base will accelerate the adoption of orthopedic devices. The U.S. Centers for Disease Control (CDC), estimated that nearly 30 million children and adults annually indulge in athletic activities and sports, and over 3.5 million athletes are injured per year in the country. Furthermore, the U.S. Department of Health and Human Services has estimated that the number of sports injuries will exceed 8 million every year.

This has considerably triggered the rise in the instances of musculoskeletal injuries. Hence, orthopedic devices are widely adopted in orthopedic surgeries as well as in the management of musculoskeletal disorders.

The higher application of technologically advanced devices has also paved the way for new approaches to conventional surgical limitations. These include lateral approaches in spine procedure and the anterior approach across hip replacement procedures through new procedural streamlining and instrumentation.

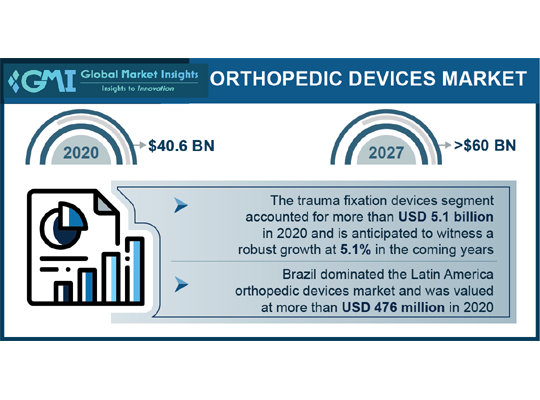

Owing to all these factors, it has been estimated that the global orthopedic devices market size will cross a valuation of USD 60 billion by 2027.

Increasing need for trauma fixation devices

Trauma fixation orthopedic devices industry share was valued at USD 5.1 billion in 2020 and will grow at a rate of more than 5.1% through the analysis timeframe. These devices are witnessing higher adoption in fixing and stabilizing severe bone dislocations given the increasing prevalence of orthopedic disorders.

Besides, the rise in the instances of road accidents and injuries has also added potential to the launch of technologically advanced devices like bioresorbable & drug-eluting implants, and nano-coated devices. The World Health Organization suggested that over 1.35 million individuals annually die due to road traffic accidents, and more than 20 to 50 million people suffer from non-fatal injuries or physical disabilities.

Brazil to see higher penetration

Brazil was the largest shareholder of the Latin American orthopedic devices market and is anticipated to expand at a rate of 7% up to 2027. The growth can be attributed to the higher disposable incomes and the proliferating medical infrastructure and healthcare expenses.

Regional research has indicated a rise in the instances of orthopedic surgeries and hospitalizations for treatments, such as lower limb surgeries in the country. The increasing awareness through government initiatives, poor diet intakes as well as lack of physical activities will further influence the demand for orthopedic disease treatment in Brazil.

Competitive and expansion strategies

Prominent suppliers of orthopedic devices are working towards inorganic strategies like mergers and acquisitions for increasing their presence across the globe. To state an instance, Zimmer Biomet, in September 2017, introduced the Persona Partial Knee System for use in joint reconstruction. The launch aided the firm in widening its product base while globally catering to a large customer base.

The ongoing COVID-19 pandemic has also positively influenced the industry outlook in terms of innovations for competitive advantages. For example, Orthofix Medical Inc., a leading orthopedic device company, in May 2021, introduced OSCAR PRO, an ultrasonic arthroplasty revision system for all the U.S. and European markets.

The influx of smart implants that are integrated with sensors has helped to offer real-time data to surgeons for enhanced post-operative assessment, positioning, as well as patient care. The increasing risks of periprosthetic infections in orthopedic surgeries are limited by these implants. The deployment of sensor-enabled technologies is also helping healthcare professionals in providing cost-effective products. Moreover, the adoption of digital systems is also giving improved access to data in order to render higher precision, predictability, and lower treatment cost. Source: https://www.gminsights.com/industry-analysis/orthopedic-devices-market