As global economic slowdown and volatilities continue to cast a shadow, 2023 emerged as the year of reinforced business fundamentals and a heightened focus on efficiency for the technology industry in India. nasscom released the key findings of the Strategic Review 2024: Rewiring Growth in the Changing Tech Landscape. The report highlights the key trends that defined FY2024E for the technology industry in India and the tech industry outlook for FY2025.

FY2024 – A year of muted growth

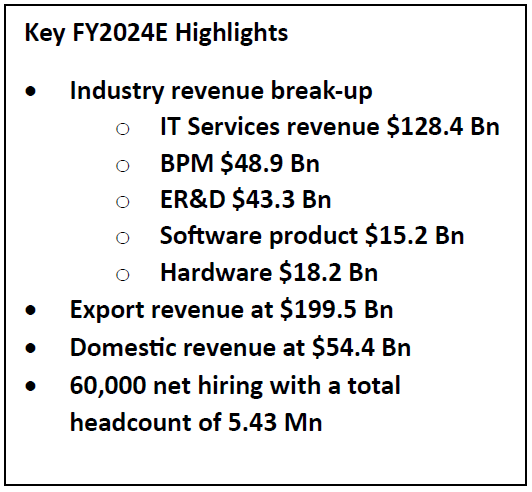

With around 50% slide in tech spending and 6% decline in tech contracts in 2023 globally, the technology industry in India, similar to global markets is currently navigating a tough terrain. Growing at 3.8% the industry added $9.3 billion incremental revenue, taking the total industry revenue to over $253.9 Billion (Including Hardware), in FY2024E (estimated).

Sub-sectors such as GCC and ER&D emerged as growth hotspots as the addressable market expanded with digital capabilities and global ER&D sourcing. Mirroring the trend, the Indian tech services export revenue (excluding hardware) is expected to touch $199 billion in reported currency, a growth of 3.3% compared to FY2023. The ER&D sector alone contributed 48% to the total export revenue addition in FY2024. Global Capability Centre or GCC continue to invest in India, expanding their service portfolios at the same time new GCCs are setting up operations. The industry saw an addition of 53 new GCCs in 2023. Moreover, driven by an uptick in clients’ technology spending, the overall deal count in 2023 marginally surpassed that of 2022, with a notable 70% increase in the signing of larger deals ($100mn+).

With continued investments by the government and enterprises in emerging technologies, India’s domestic sector emerged as the great propeller. Total domestic revenue including hardware grew 5.9% from FY2023 with a significant uptick in digital spending amongst Indian enterprises. Growing at a rate 1.8X faster than exports, the tech services domestic market grew at 7.8% compared to the previous year. Focus on application development, automation, verticalized products, SaaS, data migration for AI and cloud enterprise spending are some of the notable drivers to this growth.

Based on the cautionary demand environment, companies have been focusing on enhancing utilization and shifting to a more just-in-time hiring model. The industry added 60,000 net employees in FY2024E. However, the focus on digital skills continued to remain strong with AI, Cloud, Data and Cybersecurity emerging as top in-demand skills for the industry in 2023. The industry is committing 60-100 hours per year per employee on upskilling. With the advent of Generative AI, companies are expanding their portfolios and are redefining their service offerings to include AI-driven analytics, intelligent automation, and personalized customer interactions, thereby creating more value for their clients, and setting new industry standards. CY2023 witnessed 2.7X growth over CY2022 in AI-related activity. This has also led towards a concentrated focus on Generative AI training across the industry. Between 2023 – 2024 over 6.5 Lakh employees are already being trained in Gen AI skills.

Sharing his views, Rajesh Nambiar, Chairperson, nasscom, said, “While headwinds like global economic slowdown, Inflation, recessionary fears, and geopolitical conflicts continue to pose challenges, we are confident that the industry will bounce back. With digital tech spending expected to grow in 2024, we will also witness emergence of alternative demand source, customer retention, faster go-to-market strategies in newer markets for enterprises.”

Debjani Ghosh, President nasscom said, “We do see FY2025 as the year of Capability Building as the new normal. Navigating the current challenges will require the industry to focus on 4Rs – Reshape – Accelerate transition to AI first companies; Reskill – Make talent the biggest competitive advantage; Rewire growth and Raise IP creation and R&D investments.”

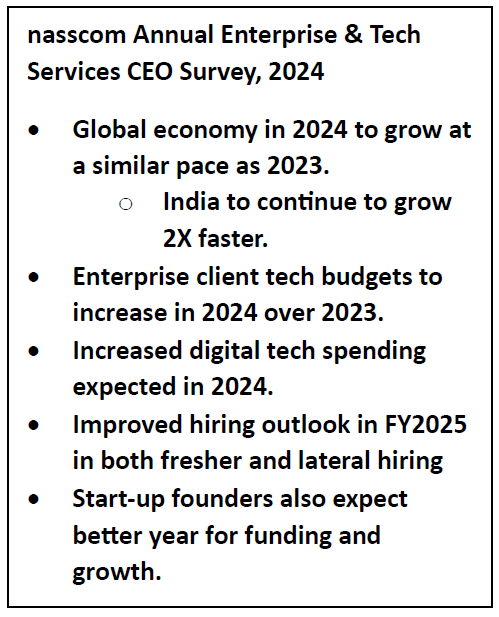

FY2025 – Insights from CEO Survey

Although global macroeconomic headwinds continue to remain constant, CEOs expect technology spending to increase in 2024. Industries such as Hi-Tech, BFSI and TMT that underperformed in 2023 will likely improve in 2024. According to nasscom Annual Enterprise & Tech Services CEO Survey, 2024, over two-third of respondents expect better revenue growth in FY 2025, driven by factors such as strong deal pipelines leading to project implementation, expansion in GCCs, AI accelerating from PoC to Production and increasing discretionary spending. CEOs also anticipate the hiring environment to normalize with the expected increase in both fresher and lateral hiring.