Electric traction motors may have originally been developed in the 1800s, but the market continues to evolve today, with the growing electric vehicle (EV) market providing new technologies, opportunities, and demand. IDTechEx has been writing research reports about electric traction motors in electric vehicles since 2012, but each year there are new developments that continue to surprise and impress.

In recent years there has been an increased focus on the materials used for electric motors as well as the underlying topology. Some are looking to improve features such as power and torque density with acquisitions related to axial flux motors, while others are looking to become more cost-effective and sustainable by reducing or eliminating rare earths. In an ideal world, both of the above could be achieved simultaneously, but in reality, there is often a trade-off to be made. IDTechEx’s latest iteration of “Electric Motors for Electric Vehicles 2024-2034” takes a deep dive into motor technology, market adoption, material utilization, and market forecasts.

Materials and Rare-earths

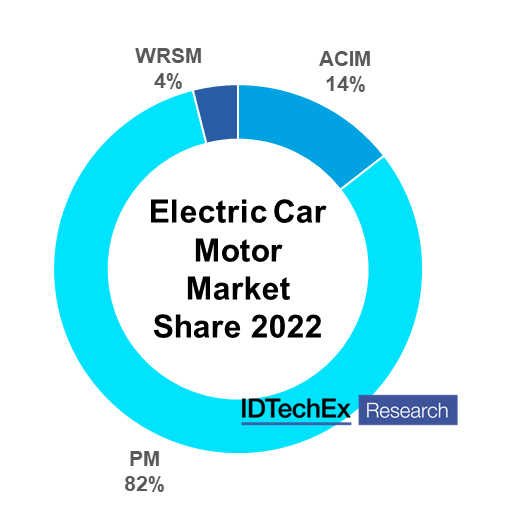

A key consideration for the EV motor market is that of magnetic materials. From 2015-2022 the share of permanent magnet (PM) motors in the electric car market remained consistently above 75%. Rare-earth magnets continue to be a concern in 2023 due to their supply chain being constrained to China and the prices starting to rise drastically again in 2021 (like they did in 2011/2012). To avoid these concerns, several European OEMs have opted for magnet free designs, including Renault and BMWs adoption of wound rotor motors and Audi’s use of induction motors. In 2023, Tesla announced its next-generation motor would be a PM machine without rare earths, further bringing the focus to alternative magnetic materials such as ferrite magnets and the challenges they pose to mass adoption.

For example, many OEMs have steadily reduced rare earth content in their PM motors through advanced material developments and optimized motor design, but to fully adopt rare earth free magnets typically requires a significant hit to performance. Without significant design changes, adopting a ferrite magnet would lead to power and torque loss of over 60%, but if various aspects of the design can be optimized, then the performance reduction from ferrite magnets could be offset. There are also players looking at newer magnetic alloys, such as Niron’s iron nitride magnets.

IDTechEx’s report provides an analysis of magnet free motor designs, routes to rare-earth reduction, and options for alternative magnetic materials. IDTechEx predicts that PM motors will remain the dominant form of motor (especially with China’s dominance in the EV market), but there will be further reductions in rare-earths per motor and alternative magnetic materials making greater progress in the market.

Axial Flux and In-wheel Motors as Emerging Options

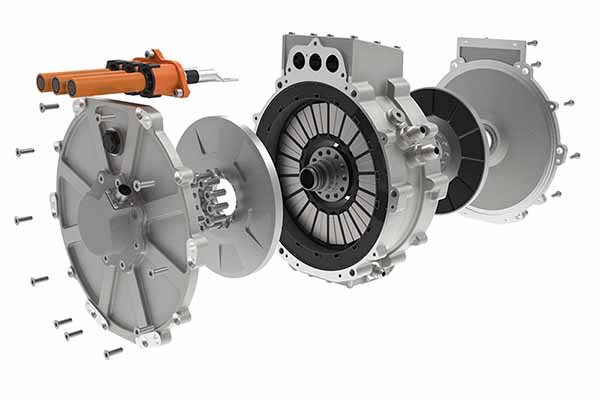

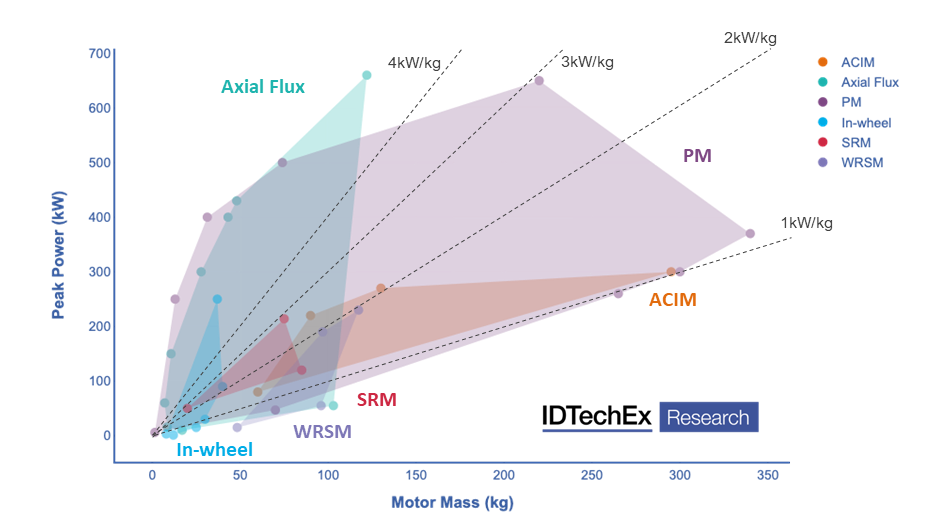

In addition to the traditional on-board radial flux motors in EVs, there are two emerging alternatives that have gained a lot of interest but are at early stages of market adoption, namely axial flux and in-wheel motors.

In axial flux motors, the magnetic flux is parallel to the axis of rotation (compared to perpendicular in radial flux machines). The benefits of axial flux motors include increased power and torque density and a pancake form factor ideal for integration in various scenarios. Despite the previous lack of adoption, the technology has evolved to market integration. Daimler acquired key players YASA to use its motors in the upcoming AMG electric platform, and Renault has partnered with WHYLOT to use axial flux motors in its hybrids starting in 2025.

In-wheel motors have made it into some on-road vehicles, such as a limited quantity of Lordstown trucks, but key progress has also been seen from Protean, where Dongfeng demonstrated the first homologated passenger car with ProteanDrive (in-wheel motor platform) in 2023 and is following this with fleet testing.

IDTechEx expects a large increase in demand for axial flux and in-wheel motors for certain vehicle categories but does not predict they will fully displace the traditional on-board radial flux machines in the near future. IDTechEx’s report, “Electric Motors for Electric Vehicles 2024-2034”, carries out performance and market analysis of emerging motor technologies with players, adoption, and 10-year market forecasts.

To find out more, including downloadable sample pages, please visit www.IDTechEx.com/motors.