The automotive industry has not stopped evolving since the first Model T Fords rolled off production lines in 1908. The role of the automobile has changed a lot since then: from a device for simply moving people and goods from A to B, to an immersive experience focused on lifestyle and delivered through mass customization. The drivers for change are equally diverse, ranging from safety and environmental regulation to the need for brand differentiation. But it is always technology that has paved the way.

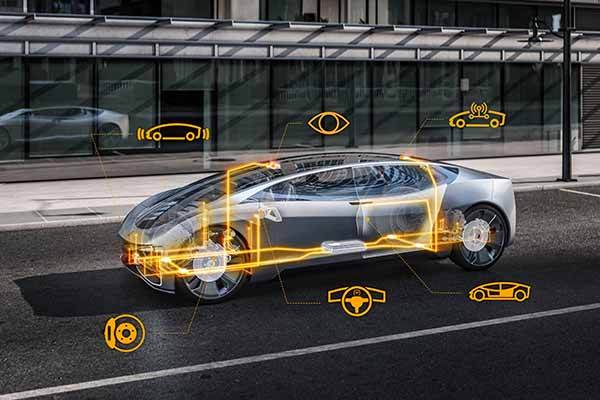

In parallel with the aviation industry, modern vehicles increasingly embrace a fly-by-wire approach. A growing dependence on software, connectivity, cloud, and edge computing capabilities makes the modern vehicle more like a mobile data center than a means of transport. Combined with the move towards electric vehicles and autonomous driving, this trend is going to have a big influence on the architecture of next-generation vehicles.

Of course, innovation is iterative, and several developments can occur simultaneously. For example, the continued adoption of in-vehicle networking has led to a zonal architecture, saving cable weight while enabling more functionality. The big question for automotive manufacturers, engineers and system architects is: what comes next?

To answer this question and gain valuable insight into the factors that will shape and influence the future direction of the industry, Molex and Mouser Electronics have combined forces to conduct a survey of more than 500 automotive industry professionals, stakeholders, and technology leaders in 30 countries. Read on to find out what the results of the Data Centre on Wheels survey reveal about the top trends, challenges and opportunities the automotive industry faces in designing and building next-generation vehicles.

New features – what and by when? The survey began by asking respondents to consider which features might be desirable in a vehicle and when they were likely to become available as standard (Figure 1).

Using a smartphone app to control the vehicle was the top choice, with 50% of respondents voting it possible within less than five years. (Some top brand platforms already offer smartphone control of selected vehicle features.) The ability for manufacturers to control access to features with a subscription model is an interesting aspect to the app control concept. While technology has the potential to make this possible, it will be interesting to see whether a subscription model gains favour with consumers.

Gaining autonomy On the topic of autonomy, the industry was a little less certain. Although highly autonomous (Level IV) and fully autonomous (Level V) vehicles have been predicted for some time, delivering the reality requires multiple capabilities and technologies to work reliably together. This requires the automotive industry to overcome a wide range of factors, including insurance, financial and social implications, as well as developing the technology. As Figure 2 illustrates, 27% of survey respondents believe half of new vehicles sold will be Level IV in 10 years, and 15% say Level V in the same period.

Technology drivers Next, respondents were asked about digital technologies: how they have shaped vehicle design over the past five years and their likely influence during the next five years. The ratification of new standards and other advances in vehicle networking have been significant in recent years. However, the emphasis on networking is shifting from in-vehicle to extra-vehicle, as Figure 3 shows. The consensus is that cloud computing, AI/machine learning and immersive UI/UX are critical enabling technologies for the future.

Bumps in the road Technology deployment is never a smooth ride. Next-generation vehicles contain multiple technical innovations in many interrelated systems, so getting them to work in harmony is a big challenge. This is reflected in Figure 4. Respondents cited double the number of challenges with software developments than with hardware.

Compatibility issues aside, respondents were asked to consider what other challenges might affect the introduction of next-generation vehicles. Among the key obstacles identified are consumer fear of autonomous vehicles, insufficient investment in roadside V2X/V2C infrastructure, and pushback from vehicle dealerships against lost revenues (Figure 5).

Supply chain issues are seen as another major hurdle to the deployment of next-generation vehicle architecture. This is perhaps unsurprising given the current semiconductor shortages across the electronics industry. What may be surprising is that, while the scarcity of semiconductors and other critical electronic components and modules rated high as a concern, the technology shortage around EV batteries and the raw materials essential to their chemistry worried our respondents the most (Figure 6).

Our final question raised some interesting cultural and relationship issues (Figure 7). The belief that hardware and software will require frequent changes—presumably to incorporate new features and enhance interoperability with popular consumer technologies—raises concern about the differences in cultures between enterprise IT vendors and the automotive industry. This includes the approach to architecting robust data privacy and security regimes, which 75% of respondents agreed need improving.

Delivering the next generation of vehicles

There is broad consensus about the opportunities associated with designing the next generation of vehicles using the ‘data centre on wheels’ approach (over 94% of respondents agreed). However, the survey results also indicate that enabling digital technologies is only part of the solution: success will equally depend on much greater cooperation between OEMs, suppliers, and sub-suppliers. Supply chain resilience and partnership working will be crucial in addressing the challenges that the automotive industry must overcome. Data security and privacy, technology replacement, and consumer confidence will also be key factors that will impact on the popularity of such vehicles in the future. You can access the complete Data Centre on Wheels report here.