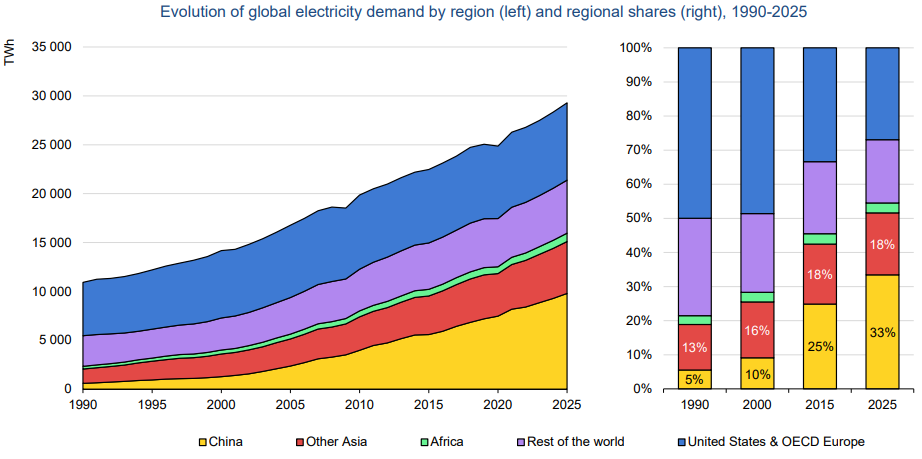

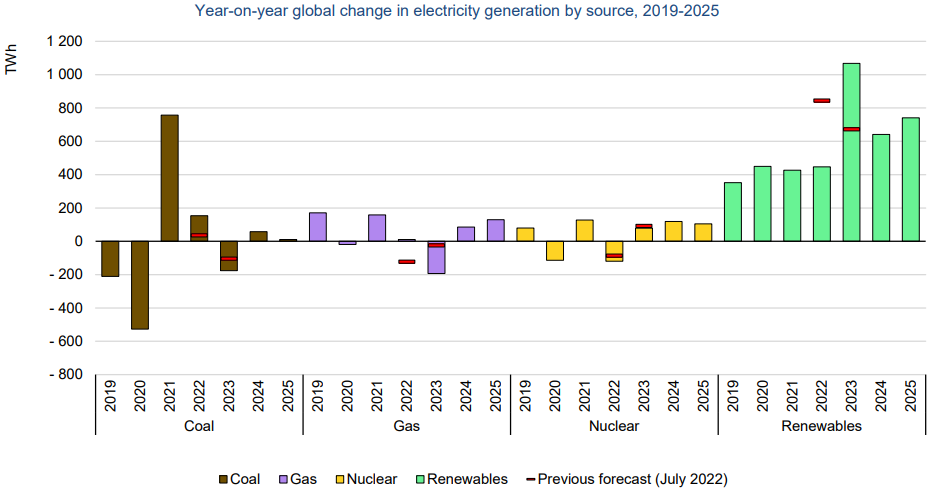

The IEA forecasts that global electricity demand is expected to rise by 3% per year over the 2023-2025 period, compared with the 2022 growth rate. Therefore, a way towards a greener world has taken the storm across the globe. Every country today is taking stiff action to cut down carbon emissions by amending renewable and alternate energy goals. It is reported that by 2024, approx. 33 percent of the world’s electricity will be produced by renewables which accounts a significant step toward the global goal of net zero by 2050. In this green revolution, solar photovoltaic (PV) is said to flaunt a handsome 60 percent (or at least 697 gigawatts) of growth, Onshore wind (309 GW), hydropower (121 GW), offshore wind (43 GW) and bioenergy follow (41 GW) according to Renewables 2019, a report from the International Energy Agency published in November 2019. Another report from Electricity Market Report 2023 predicts that renewable energy sources such as solar and wind power, together with nuclear, will on average meet more than 90% of the increase in global demand by 2025. More than 70% of this is expected to come from China, Southeast Asia and India, the report says. However, advanced economies are looking to generate more electricity, as well as reduce reliance on fossil fuels in sectors like heating and transportation.

On the other hand the key reasons for the growth of alternative energy have been the plunging production costs, growing concern around climate change, evolving global energy policies and increased pressure from investors on companies to adopt environmental social governance (ESG) policies are pushing renewables into the mainstream.

Reports Eyes Growth Towards the Renewable Sector

Today it is reported that the worldwide renewable power generation mix is set to witness another leap accounting for a rise from 29% to 35% by 2025. In the coming time the boom in renewables will bring the usage of conventional form of energy, i.e. coal and gas-fired generation. And so will global power-sector CO2 emissions which will stall to 2025, despite reaching an all-time high in 2022 of about 13.2Gt CO2. China will account for close to half of the additional renewable generation, followed by the European Union with 15%, the IEA says. This growth is being fuelled by increased government spending on renewables as part of economic recovery plans, the report explains. In the US, alone, the Inflation Reduction Act will provide $370 billion in clean energy investments. Nuclear output is expected to grow on average by around 3.6% a year. This will come from the anticipated recovery in nuclear generation in France, as scheduled maintenance is completed. New plants will also come online, mainly in Asia, the report says.

Carbon Pricing Mechanism

Status and trends of carbon pricing mechanisms in 2022 Carbon pricing is a key instrument to mitigate emissions, incentivise investments in low-carbon technologies and reduce demand for greenhouse gas (GHG)-intensive activities. Such policy instruments usually take the form of a carbon tax, an Emission Trading System (ETS) or a hybrid of the two. Due to the ongoing energy crisis, carbon pricing policies have entered uncharted territory, and are facing new challenges hindering their effectiveness. While the EU’s carbon price influences the variable generation cost, and hence the merit-order of the power plants, carbon pricing is currently unable to perform its traditional role of incentivising a coal-to-gas switch in electricity production given exceptionally high gas prices. Nevertheless, carbon pricing still has a crucial role to play in maintaining a long-term investment signal and making carbon-intensive fossil generation such as coal-fired electricity an economically unattractive solution. In addition, it can be a useful instrument to generate additional revenue for governments to support faster clean energy transitions, and mitigate social and competitiveness impacts. As of April 2022, 68 carbon pricing initiatives were in place worldwide, covering over 23% of GHG emissions, with the majority in the form of an ETS. Many of them saw carbon price increases compared to 2021. The price of allowances in the EU ETS, the most established ETS globally, rose from an average of USD 50/t CO2-eq to more than USD 90/t CO2-eq for January to April 2022. Prices in the UK ETS rose to more than USD 100/t CO2-eq, and doubled in the New Zealand ETS (USD 50/t CO2-eq) and in state-level systems in the United States. Allowance prices in Korea (USD 19/t CO2-eq) and China’s national ETS (USD 9/t CO2-eq) increased only slightly. Despite these increases, less than 10% of global emissions are covered by a carbon price that is higher than USD 10/t CO2-eq. In some jurisdictions in 2022, carbon pricing instruments have had difficulty incentivising a fuel switch to lower-carbon sources due to high natural gas prices. For example, EU coal-fired generation rose by 6% in 2022.

Will Asia Pacific’s Major Generation Will Remain Coal

Economic realities in the Asia-Pacific region mean that any significant reduction of coal consumption will prove challenging. Large Asian economies are experiencing a strong rise in electricity demand, which is set to continue over the coming decades to sustain economic growth. When it comes to meeting new demand, coal is still seen as the most affordable option for base-load power. At the 26th U.N. Climate Change Conference (COP26) in November 2021, China and India were the two major hold-outs on coal, agreeing only to phase down rather than phase out this fossil fuel. In China for instance, coal-fired generation will remain relatively flat and elevated this decade, although its share is set to reduce to 51% of power generation by 2030 from two-thirds today, with faster growth in renewables. In India, coal-fired generation will still expand substantially this decade to meet soaring demand. This is despite over 40 countries pledging to phase out coal at COP 26.

Electricity demand grew by an estimated 3.3% in 2022 in the Asia Pacific region, led by a strong rise in India (8.4%) that was partially offset by subdued growth in China (2.6%) due to the slowdown in the economy stemming from its zero-Covid policy. Demand in the two countries represented about 70% of the region’s total electricity use of 13 500 TWh, which accounts for approximately 50% of global consumption. More than half of the increase in 2022 was met by renewables, of this renewable output almost 60% was from China. The majority (57%) of the region’s electricity was generated by coal in 2022, with low-carbon sources, such as nuclear and renewables, contributing to 32% of the mix. As a result of its strong reliance on coal for power, Asia Pacific has the highest electricity generation CO2 intensity of our analysed regions, at 590 g CO2/kWh in 2022, compared to a global average of 460 g CO2/kWh. Power systems in several countries came under severe pressure during 2022, due to both sharply elevated global energy prices and extreme weather events, highlighting the critical need for electricity security. China experienced its longest heatwave in decades, worsening drought conditions that left the Yangtze River at record-low water levels. South Asia was similarly affected, with heatwaves in India starting exceptionally early in the spring and the worst recorded in 122 years. These extreme weather events led to record-breaking electricity demand for cooling, which was compounded by a fall in hydropower generation and coal supply shortages. In Japan, the government issued a power shortage warning for the first time ever, calling for reduced electricity consumption as very low temperatures and a 7.4 magnitude earthquake in March 2022 put the power system at risk of not being able to meet demand. Similar calls to reduce power use amid tight supply were made in Thailand, a gas dependent country sensitive to high prices. The convergence of weather events and record-breaking gas prices led to higher coal use in electricity generation for the Asia Pacific region in 2022 (+2.5% on 2021 levels), but going forward its share in the mix will decline. Coal power is expected to fall to 52% in the electricity mix in 2025, with the share of low-carbon sources rising to 38%, driven mainly by strong y-o-y growth of almost 12% annually in renewable electricity generation, which will raise its share in the mix from 26% in 2022 to 32% in 2025. The share of gas-fired generation will decrease slightly from 10% in 2022 to reach 9% in 2025. Steady growth in electricity consumption on an average of 4.6% every year is forecast in the next three years, with renewables meeting almost two thirds of that additional demand. The higher share of renewables in the mix will help reduce the average CO2 intensity in the region to 535 g CO2/kWh in 2025. However, CO2 emissions from power generation will continue to rise by an average 1.2% per year to 2025, as coal-fired generation, despite having a diminishing share in the generation mix, remains the main fuel in the region and grows on average 1.3% per year. In 2025, the CO2 intensity of the Asia Pacific region remains the highest globally.

China And India’s Policies to Counter Carbon Emission

China has pledged to achieve peak carbon emissions by 2030 and may well meet this target earlier, given its track record of overdelivering on its five-year renewables targets. Carbon emission growth in the country has started slowing since 2012, when larger rollouts of wind and solar capacity began. The lingering impact of COVID-19, which is still leading to lockdowns in Asia, could help make targets more attainable, since energy demand is currently somewhat lower than anticipated, although coal use has also rebounded faster than expected. S&P Global Ratings believes that India, on the other hand, will likely miss its 2022 renewable energy capacity targets, and its ambitious 2030 targets would be even harder to achieve with the country set to continue increasing coal use until 2050. China’s policy approach is multi-faceted, serving to discourage coal-fired generation while encouraging renewables. With the launch of China’s carbon market in the summer of 2021, coal-fired power plants will need to comply with emissions targets. By contrast, India’s policies are aimed at making renewables and other alternatives more attractive rather than penalizing coal use. In our view, India still lacks comprehensive energy transition policies and a clear commitment to phase out coal.