As the volume of variable renewable energy (VRE) sources penetrating electricity grids increases globally, so does the need to manage the increasing uncertainty and variability in electricity supply. Grids will be relying on different solutions to manage this, which could include building of overcapacity and interconnections, but also long duration energy storage (LDES) technologies. From IDTechEx’s new market report, “Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts”, the LDES market will be valued at US$223B in 2044.

How VRE penetration will influence demand for LDES

VRE penetration is expected to increase sooner in some key regions, given that governments have announced ambitious and aggressive VRE deployment targets. For instance, if California’s VRE deployment targets are met by 2035, this could see a ~280% increase in the capacity of electricity generated by VRE on a GWh basis compared to their 2023 baseline. Other key countries and US states expected to see rapid growth of VRE deployments include Germany, the UK, Italy, Australia, India, and Texas. Increased VRE penetration will result in longer periods of time when energy is unavailable from these sources, and thus, LDES technologies will be required to dispatch energy over these longer timeframes. From IDTechEx’s analysis, once a country or state’s electricity generated from VRE reaches ~45%, an average duration of storage of 6+ hours of storage will be most cost-optimal for the electricity system. On average, globally, this is not expected to occur until the late 2030s, though these other mentioned key countries and states are expected to reach such percentages of electricity generated from VRE on a GWh basis before this. As such, some deployments of early commercial-scale LDES projects can be expected before 2030 and beyond in some of these key regions.

Why solutions other than Li-ion batteries are needed

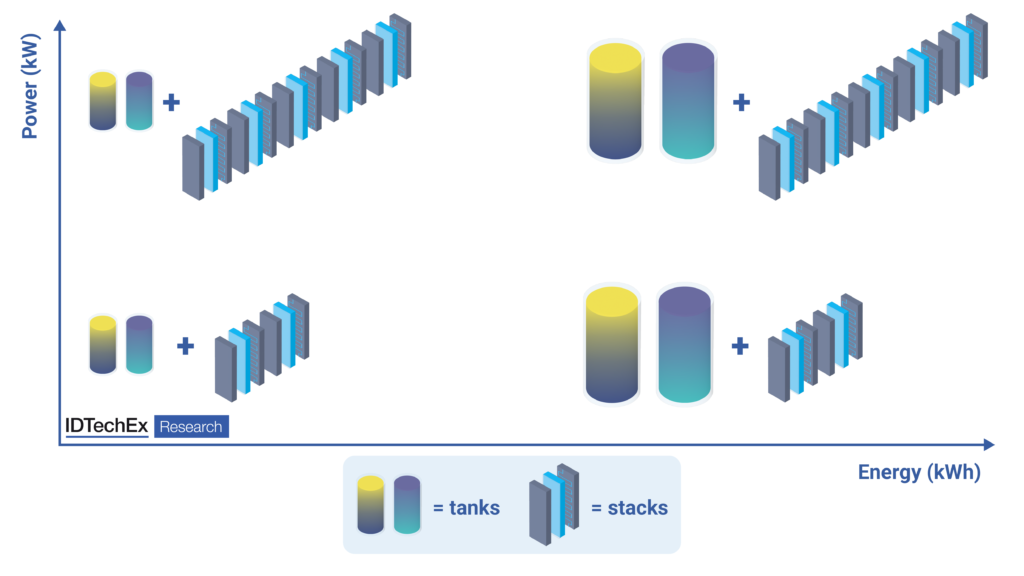

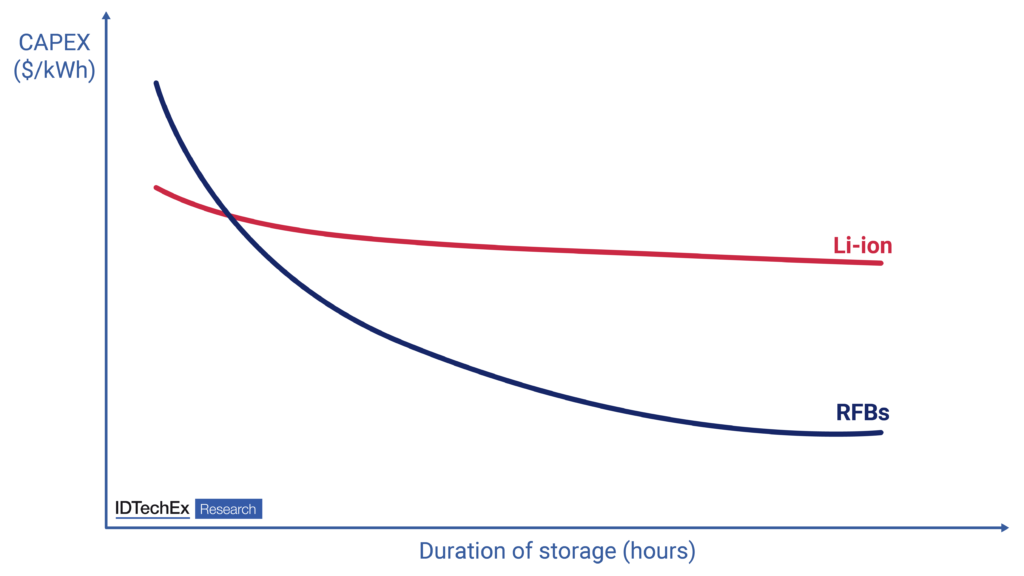

Aside from pumped hydro, while Li-ion batteries currently dominate the global stationary energy storage market, the capital cost of Li-ion is unlikely to be low enough for LDES, and instead, alternative energy storage (ES) technologies aim to offer lower costs (on a $/kWh basis). One way to achieve this is through designs that allow for energy and power decoupling. This could apply, for example, to some redox flow batteries (RFB) and liquid-air energy storage (LAES). To increase system capacity for RFBs, electrolyte volume and the size of electrolyte storage tanks can be increased, whereas changes to the cell-stack are only needed to increase power output. For LAES, the size of liquid-air storage tanks can be increased, while turbomachinery only needs to be scaled with power output. This results in faster and non-linear decreases in CAPEX (on a $/kWh basis) for many of these LDES technologies as a function of duration of storage. While there is no strict definition for LDES, IDTechEx defines this as starting at 6 hours duration of storage. This is when many of the other competing energy storage (ES) technologies start to become, or are, cheaper than Li-ion on a $/kWh basis.

As VRE penetration increases, the average duration of storage in a given country or state will need to increase to support this. Therefore, at higher penetrations of VRE, reduced system costs for many LDES technologies can be expected, highlighting their advantage over Li-ion. Moreover, suspected Li-ion material constraints coming towards the end of the decade and the safety risks of flammable electrolytes in Li-ion are expected to be other key factors driving demand for other energy storage (ES) technologies generally. A variety of LDES technologies are currently being developed and commercialized across key regions, including electrochemical, mechanical, thermal, and hydrogen storage. Ultimately, however, depending on VRE penetration, it will not be until the mid-2030s when demand for LDES technologies starts to accelerate in key regions, with wider global demand only coming after ~2040.

In their new market report, “Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts”, IDTechEx brings the reader a holistic overview of this market, including the following information:

Market Forecasts and Analysis

- Granular 20-year LDES market forecasts by region (GWh), by technology (GWh), and by value (US$B) for the 2022 – 2044 period.

LDES Market Overview and Data Analysis

- Future market landscape of long duration energy storage, including key player activity, historic smaller-scale deployments, planned future projects and announcements up to 2031, projects by scale (pilot-, demonstration-, commercial-scale), duration of storage by key projects, and funding by technology and by player.

- Market overview and data analysis on electricity generated by VRE in key countries and US states, solar and wind deployment targets by key country/state, storage requirements vs electricity generated by VRE, and analysis and commentary on market timing of LDES technologies.

- Analysis and discussion on other technologies to promote greater supply-side and demand-side grid stability and flexibility, including interconnectors market, vehicle-to-grid (V2G), electrolyzers, demand-side response, and thermal generation plus carbon capture and storage.

Applications and Revenue Streams

- Comprehensive analysis and discussion on applications, revenue streams, and electricity markets for LDES. Discussion and analysis of opportunities and challenges for revenue generation from LDES.

LDES Technologies and Key Players

- Deep dive into LDES technologies, with benchmark analysis including metrics such as CAPEX, round-trip efficiency, cycle life/lifetime, energy density, and commercial readiness levels (CRL).

- Comprehensive coverage and analysis of the following technologies for LDES, with key player activity: batteries, mechanical energy storage, thermal energy storage, and hydrogen.

- Battery chapter covers Iron-air (Fe-air), rechargeable zinc batteries (Zn-air, Zn-ion, rechargeable Zn-MnO2, Zn-Br), high-temperature / molten-salt batteries, redox flow batteries (RFBs).

- Mechanical energy storage chapter covers compressed air energy storage (CAES), liquid-air energy storage (LAES), cryogenic / liquid-CO2 energy storage (LCES), alternative and underground pumped hydro storage (APHS), and gravitational energy storage systems (GESS).

- Thermal energy storage chapter covers thermal energy storage (TES) and electro-thermal energy storage (ETES).

- Hydrogen coverage includes hydrogen storage methods, salt caverns, key projects, and applications for hydrogen in LDES.

- 20+ company profiles.