Infineon will be spending several billion euros on the right takeover as it searches for new acquisitions to boost growth, as per the Chief Executive Jochen Hanebeck.

We are “on the lookout” for suitable companies, Hanebeck told Frankfurter Allgemeine Zeitung (FAZ). “I see it in the range of up to a few billion (euros).”

It comes at a time when the demand for chips is raising globally and supply chain bottlenecks lasting almost two years have constrained industries ranging from autos to healthcare and telecoms.

Infineon has said it sees growth in electromobility, autonomous driving, renewable energy, data centres, and the so-called internet of things.

The CEO said the company could expand its portfolio in several fields, including power semiconductors, sensors, software and artificial intelligence but did not name individual takeover candidates.

Infineon had bought U.S. rivals Cypress Semiconductor for $10 billion and International Rectifier for $3 billion in 2019 and 2014, respectively, to expand in next-generation automobiles and Internet technologies.

Infineon Technologies AG is increasing its target operating model and reporting its results for the fourth quarter and for the full fiscal

year, both of which ended on 30 September 2022.

“Decarbonization and digitalization are causing structurally increasing demand for semiconductors. Infineon will benefit disproportionately from this development thanks to its strategic positioning. This dynamic has further accelerated, so now is the right time for us to define an even more ambitious target operating model,”says Jochen Hanebeck, Chief Executive Officer of Infineon.

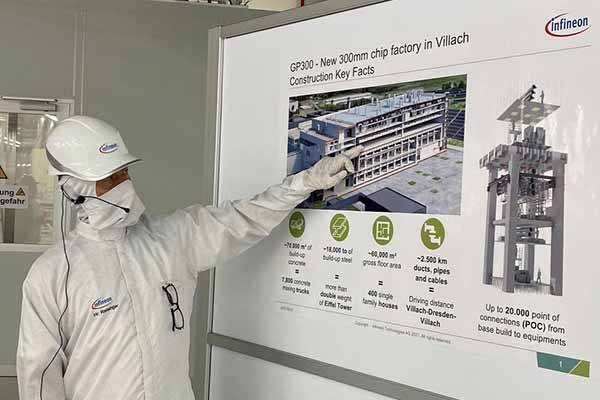

“Furthermore, by the planned investment in a new factory we are continuing the consistent execution of our strategy and are broadening the base for our accelerated profitable growth trajectory in a forward-looking way.

The main factors influencing the rise in earnings will be an increasing proportion of system solutions, a higher-value product/technology mix due to portfolio management, the expansion of costeffective 300-millimeter production, and operational expenses rising at a lower rate than revenue due to digitalization and economies of scale.