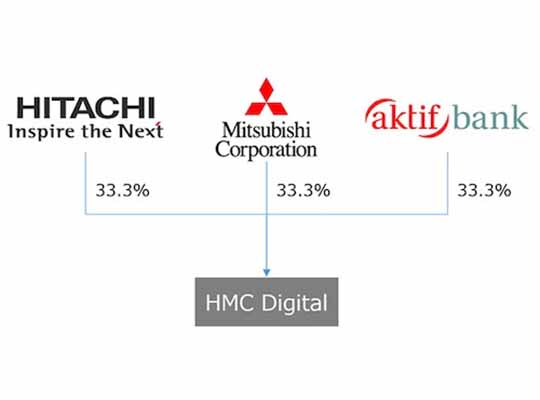

TOKYO, Oct 1, 2020 – Mitsubishi Corporation has agreed to perform a feasibility study to assess the effectiveness and potential applications of a biometric authentication platform in Turkey. Partnering MC in the study will be Hitachi Europe and Turkey’s Aktif Bank. A non-corporate entity called HMC Digital will be established to perform the study.

Biometric authentication technologies rely on our unique biological characteristics to verify our identities. They eliminate the risks of lost, stolen, or forgotten data that might be needed for traditional password-based authentication systems. Considered a safe and convenient method of identification, systems that employ fingerprint or facial recognition technologies are becoming increasingly common features in smartphones and other IT devices. The evolution of digital technologies has also thrown the spotlight on platform-type business models as a new category of social infrastructure.

This joint study will take advantage of two of Hitachi’s proprietary technologies, the finger-vein authentication system VeinID Five (VeinID) and Public Biometric Infrastructure (PBI), a type of public-key infrastructure that uses biometric data as a private key. Unlike fingerprint or facial recognition systems, this new system will identify people by way of their internal biological characteristics, thereby minimizing the risks of falsified identifications or aging-related misidentifications. The study will be conducted over a period of approximately one year, during which VeinID will be installed in services and applications used by the trial-period customers, which will include various financial institutions, government bodies, and private enterprises throughout Turkey.

Aktif Bank is a core group company of Calik Holding, a leading Turkish conglomerate with which MC has established a strategic alliance. Leveraging its proprietary financial technologies, Aktif Bank is developing money transfer, payment, and digital platform businesses in Turkey, the latter of which cover contactless transportation cards, ticketing services at sports stadiums, and other applications. The bank’s extensive network comprises more than 10 million customers.

Under its latest management plan, Midterm Corporate Strategy 2021, MC is endeavoring to strengthen its operations in downstream sectors and promote digital transformation (DX). By taking advantage of its far-reaching network, broad customer base, and business conception skills honed across numerous industries, MC is fully committed to realizing the business potential of this biometric authentication platform. The sogo shosha is keen to accelerate not only its traditional plant-and-infrastructure operations but also these kinds of platform-type infrastructure businesses that adopt digital technologies to build the foundations of next-generation societies and industries.

Once the business potential of this new service has been ascertained, the partners plan to build it into a platform capable of centralizing the management of personal information and verification of personal identities. The aims thereafter will be to connect the platform to a variety of applications and services, thereby providing customers with a highly safe and smoothly functioning biometric authentication service that will provide not only economic benefits, but societal benefits as well.

For more information, please visit at https://www.mitsubishicorp.com/jp/en/.